Fourth Quarter 2020 ReviewFirm View

While domestic equity markets are once again near all-time highs, along with a hot housing market reminiscent of 2005, America stands at the edge of a great precipice. The global pandemic rocked global commerce, sentiment and social stability. Beyond the immeasurable human toll the virus has taken, long-lasting impacts to the psychology of individuals and businesses alike will be felt in the years to come.

Looking back to the beginning of 2019, everything was going so well, or so we thought. Stocks made record highs and the COVID-19 pandemic was barely on investors’ radars as the year began. It would take a few months’ time before investors began to understand the severity of the pandemic that was just beginning and take stock of the ramifications across society and the economy. As the virus spread quickly across the world, the unprecedented response from governments included massive lockdowns, grandiose fiscal stimulus packages, moratoriums on evictions, and other novel solutions to try to keep fragile economies from collapse. The response by central banks was swift with interest rates cut to near zero to help provide support. Meanwhile, researchers scrambled to develop a standard treatment or vaccine. During the first two quarters of 2020, the enormity of the unknowns — between the mandated lockdowns impacting businesses and consumers to the transmissibility and severity of the disease — made modeling future earnings nearly impossible.

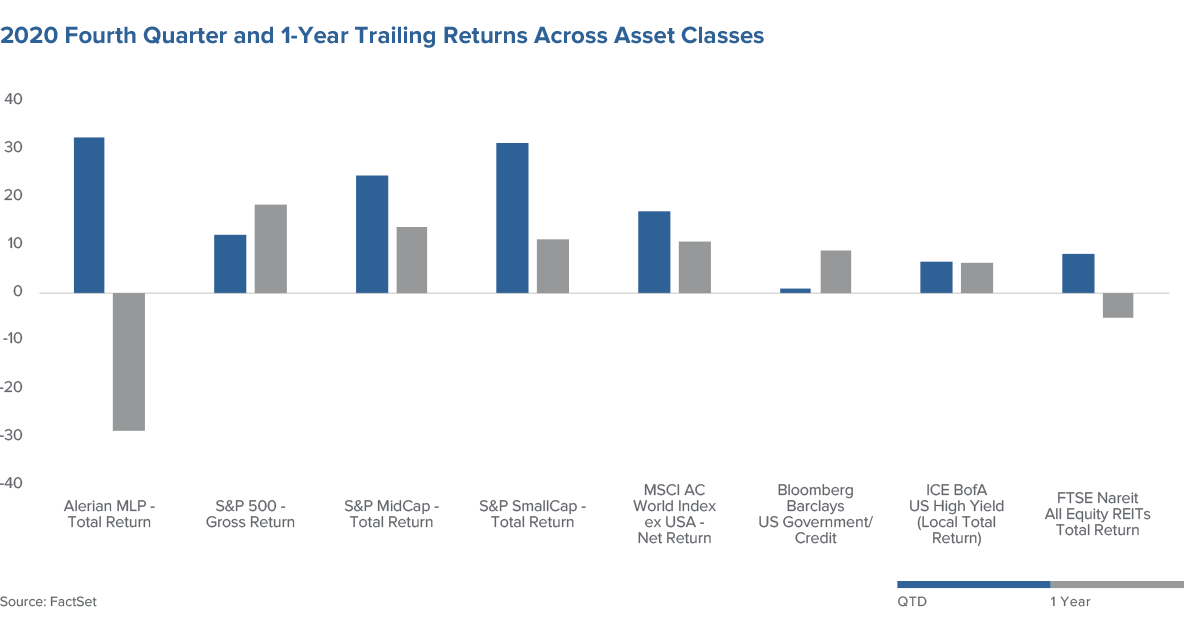

By mid-year, the S&P 500 had already suffered the worst quarter since 1928, falling 19.6% as the government-ordered shutdowns and shelter-in-place orders overwhelmed many businesses. Some simply closed and never reopened while others had to completely rethink their business model. Despite scenes of empty metropolises and highways, hope emerged as the acceleration of the digital transformation allowed for more productive online workforces and, maybe less so, digital learning for children and students. Markets have recovered far faster than the economy, which remained under pressure, with the sharp decline in equity values, GDP drawdowns and even unemployment, having appeared to be mostly transitory. Consumers were out spending money on their homes, where they suddenly found themselves spending the majority of their time. This pushed home prices to near record levels as well as pushed commodity prices for building materials higher. Improving general understanding of the virus enabled reopening to take place, causing sharp but uneven recovery in the aforementioned areas, but the strength has remained in the housing arena.

As the year came to a close, the S&P 500 went out with a bang to finish at a new all-time high, marking the 33rd of the year. In November, big news of three different vaccines showing strong efficacy helped fuel optimism that the worst may be past for the pandemic. Rates rose on the optimistic outlooks as credit spreads have tightened materially from their panic levels of the spring. Projections for earnings have risen with many companies now expecting to see greater growth in the coming year. The impact of the pandemic remains for many businesses, and while a vaccine rollout of this magnitude is equally unprecedented, the news was clearly positive. With rapid deployment of millions of doses, many experts are still pointing to late 2021 before any real semblance of normalcy may return, if not even later.

Westwood’s 2021 Outlook

As we do each year, we look forward into 2021 and set scenarios to help guide our investment outlooks and assumptions. This provides both a time for introspective analysis for what has transpired as well as what opportunities and pitfalls may await in the coming year. We start with our operative scenario, the most likely vision of the future, and then push our intellectual flexibility to alternative outcomes.

For 2021, the key themes within our operative scenario — “The Shawshank Redemption” — revolve around unleashing spending by consumers and corporations.

COVID-19 Retreats:

The vaccine deployment proceeds on-track, allowing the lockdowns to be lifted and freeing the populace from self-imprisonment to spend, spend, spend as consumers use their high levels of savings to binge on new adventures and new outfits. This helps drive corporations to invest themselves in hiring new workers as well as investments for productivity and capacity enhancements. A virtuous cycle unfolds with second quarter GDP showing the greatest rebound in growth for the year.

Stimulus Remains:

Global central banks never even consider removing the “punch bowl” and the party for risk assets continues to be fueled by extraordinary market support from historically low policy rates. Fiscal stimulus trickles in, helping replace some of the consumption gap that remains as the economy continues the healing process and employment improves. The combined impact pushes corporate profits higher, justifying current valuations and making risk assets look highly attractive.

Political Rhetoric Fades:

Trade policy returns to the spotlight with the new administration taking a more conventional approach to diplomacy. This results in lower tariffs, serving as an additional boost to profits for corporations and helping lower overall volatility in the market. This also helps offset inflation, which remains largely in check despite the unprecedented stimulus provided to the economy and consumers.

While we believe the most likely scenario is the one laid out above, there are certainly events in the foreground that could cause a “raging bull” to be unleashed. Should congressional control fall to the Democrats, large fiscal impulses without corporate tax increases could spur an acceleration in growth. Faster deployment of vaccines coupled with high-volume/fast-result testing brings confidence back for CEOs and individuals alike to get out and spend even more, driving valuation multiples higher at the same time earnings are revised upward.

In contrast, if “there will be blood,” such a retrenchment would start with a slower vaccine rollout or other safety concerns that cause reinstatement of onerous lockdowns on corporations and consumers. Rising inflation and potential for further populist policies could see volatile flareups and pressure valuation multiples as risk premiums increase.