As expected, the Federal Reserve (Fed) decided to increase Fed Fund rates by 25 bps to 5.25-5.5%. This will bring the rate to the highest level in more than 22 years. Chairman Powell also left the door open for further rate hikes and said that they would continue to be data dependent. He said that the committee welcomed the better-than-expected inflation data in June but indicated the group still believes that there is still a long way to get to Fed’s target of 2% inflation.

U.S. Gross Domestic Product (GDP) data was released this week. The U.S. economy picked up last quarter and remained well clear of a recession despite the Fed pushing rates higher. During the second quarter, U.S. GDP grew at 2.4% picking up slightly from the first quarter GDP of 2%, driven by strength in business investments and consumer spending. Economists were expecting a growth of 1.8%.

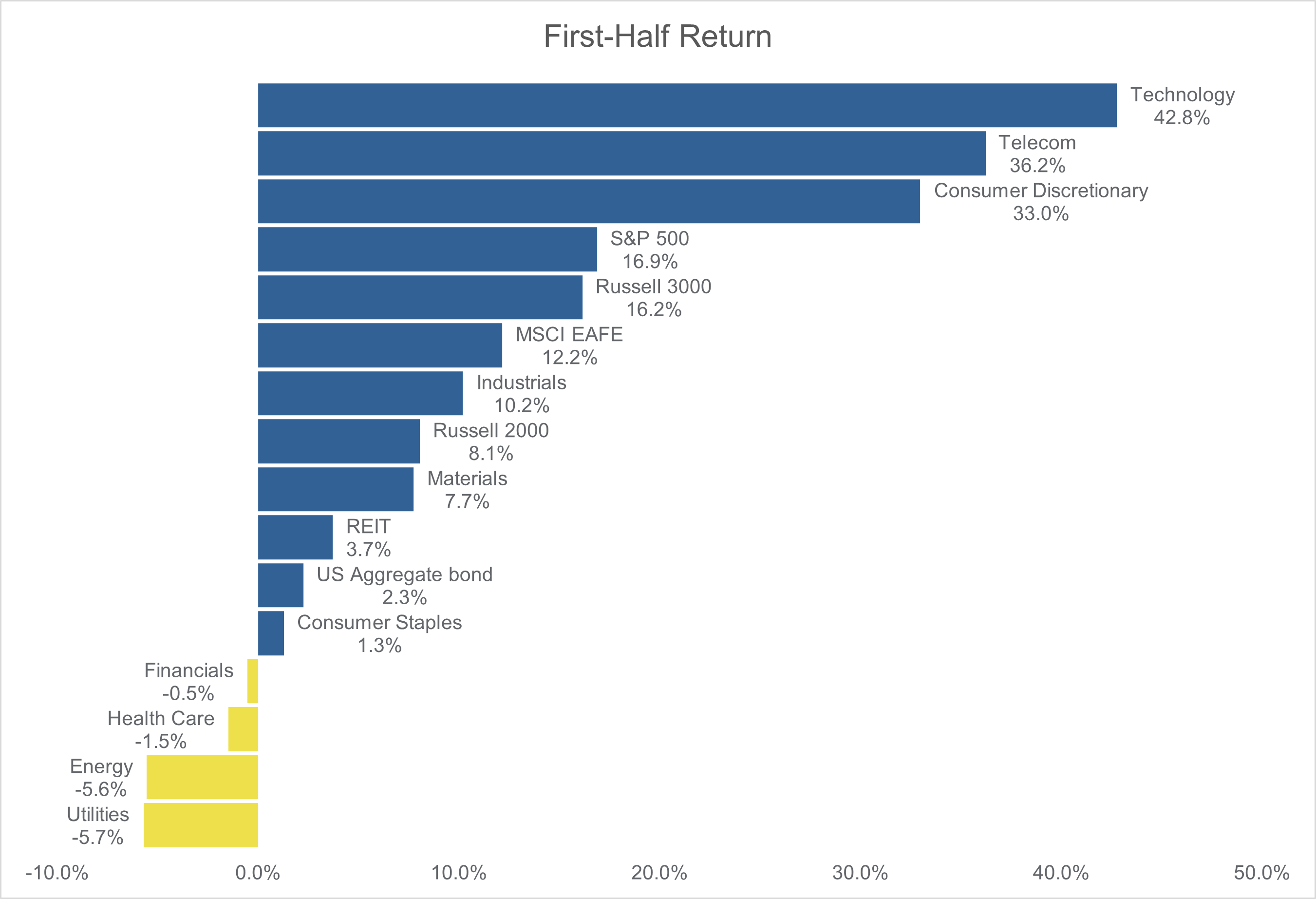

Equity markets have rallied this year with the S&P 500 index up 20.6%, the tech-heavy Nasdaq returning 37% and Dow Jones Industrial Average (DJIA) adding 8.5% to returns. The first half of the year was dominated by technology stocks. We started the year with fears of recession and investors flying to safety by investing in big technology companies like Microsoft, Apple and Alphabet. These companies tend to be recession-resistant given their strong balance sheets and cash positions. The tech stocks got a further boost in the second quarter on Artificial Intelligence (AI) boom after Nvidia, a leader in AI chips, reported a spectacular quarter and raised its guidance. In fact, the tech rally had been so strong in the first five months of the year that while the S&P 500 index returned almost 10%, the equal-weighted SPW index declined 0.7%. During the first half, the top seven stocks (Apple, Microsoft, Nvidia, Amazon, Meta, Tesla and Alphabet) contributed to 73% of the total S&P 500 index return.

Usually when the markets are this narrow, one of two themes play out:

1) the market is about to correct; or

2) the market is about to broaden out and allow for greater participation.

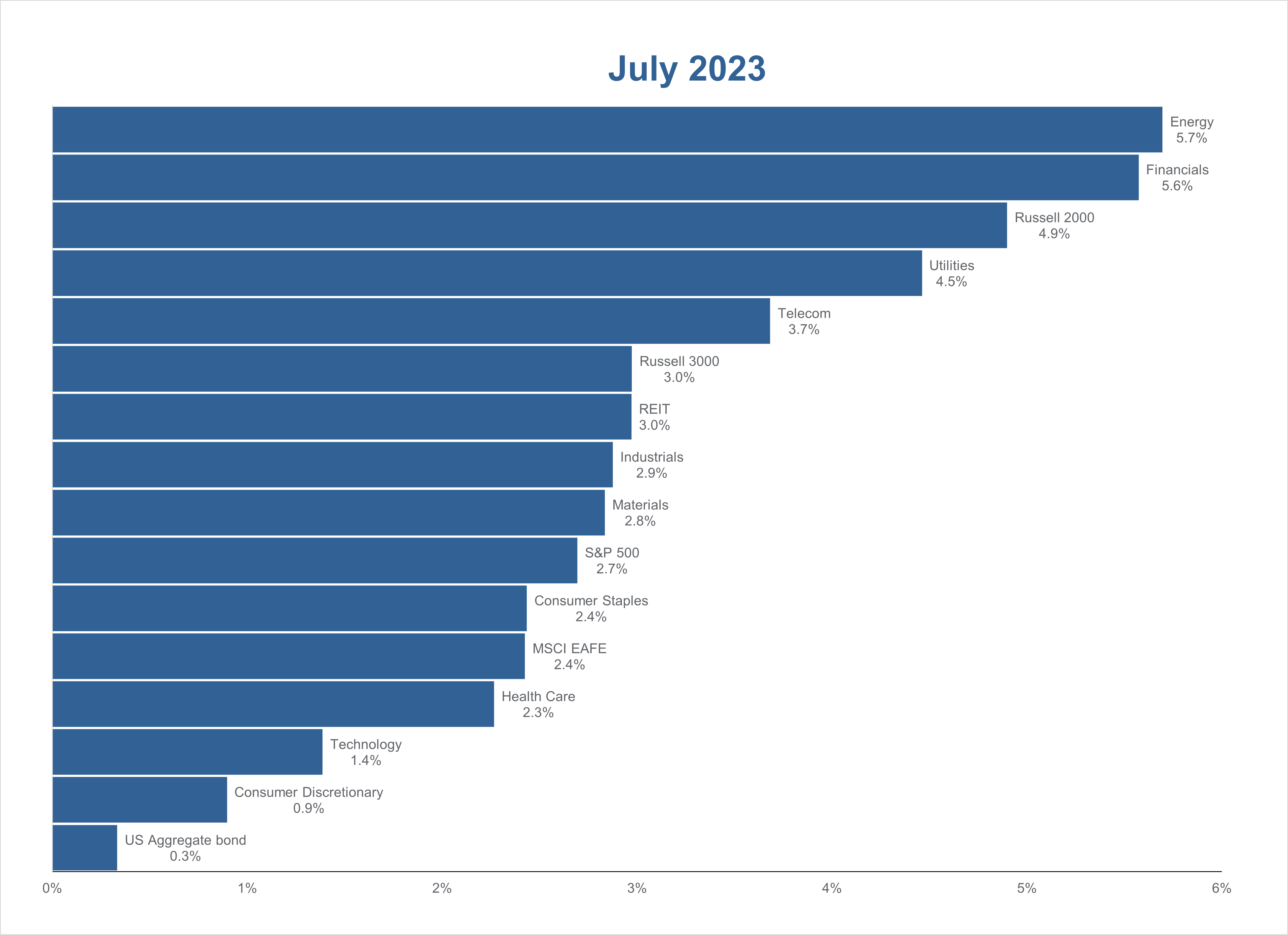

We believe that market breadth widening is a likely scenario this time. Inflation has continued to ease and we are likely very close to peak rates. At the same time, the U.S. economy has remained resilient as evidenced by today’s GDP data and strong labor market. At this point, the likelihood of a soft landing, where inflation slows down without the U.S. economy going into a recession, is becoming more likely. Even if we enter a recession next year as indicated by the deeply inverted yield curve and weaker PMI readings, this provides a good setup for cyclical and value-oriented stocks near term. Since the end of June, we have begun to see signs of market breadth widening as shown in the chart below. Cyclical sectors like Financials and Energy, as well as Small Cap stocks are beginning to outperform. The DJIA, which tends to be value oriented also logged in its 13th consecutive green day on July 26, 2023 – the longest winning streak since 1987.

Select Equity is a diversified portfolio and invests in both growth and value-oriented stocks. It is designed with risk management at its core. We utilize risk metrices (such as maximum sector limits of 16% and industry limits of 6%), primarily invest in high-quality companies with improving cash flows and stable balance sheets, constructing a portfolio of stocks which have low correlations with each other. All these factors help reduce portfolio volatility and provide good downside protection. We believe that we are very well positioned to benefit not only from market breadth widening but also from any potential uncertainty rising from disappointing economic data.

Please feel free to reach out to your Private Wealth Advisor if you have any questions.