Someone once said, “It’s incredibly hard to become a quality company and it’s hard to ‘un-become’ a quality company.” Unfortunately, this statement doesn’t apply when investing in small cap equities. Changes can happen rapidly as less capitalized or hyperfocused business models are especially susceptible to shifts in consumer sentiments, economic health and/or competitive forces.

The dictionary definition of quality is: “a distinctive attribute or characteristic possessed by someone or something as measured against other things of a similar kind.” With the stock market sensing the economic cycle is in the later phase, many small cap investors are considering a rotation out of expensive growth into value stocks to reduce potential overexposure to high-priced volatility. Investors may also transition out of more “expensive” investments (more on this shortly), into areas of higher quality and value. And yes, quality and value both exist in the small cap universe, but can be more difficult to identify.

Morgan Stanley recently revised expectations for equities to return a sobering 4.9% per annum over the next 10 years, citing lower growth and inflation expectations. Considering investors have logged more than 300% returns in the S&P 500 since the March 2009 low, in what’s now the longest expansion in history, it’s logical to expect a rotation or “twist” from growth to value.

And while the transition seems logical, and even simple on the surface, traditional value investing can be different than “high-quality” investing and can be linked to heavily indebted, highly cyclical and unprofitable companies.

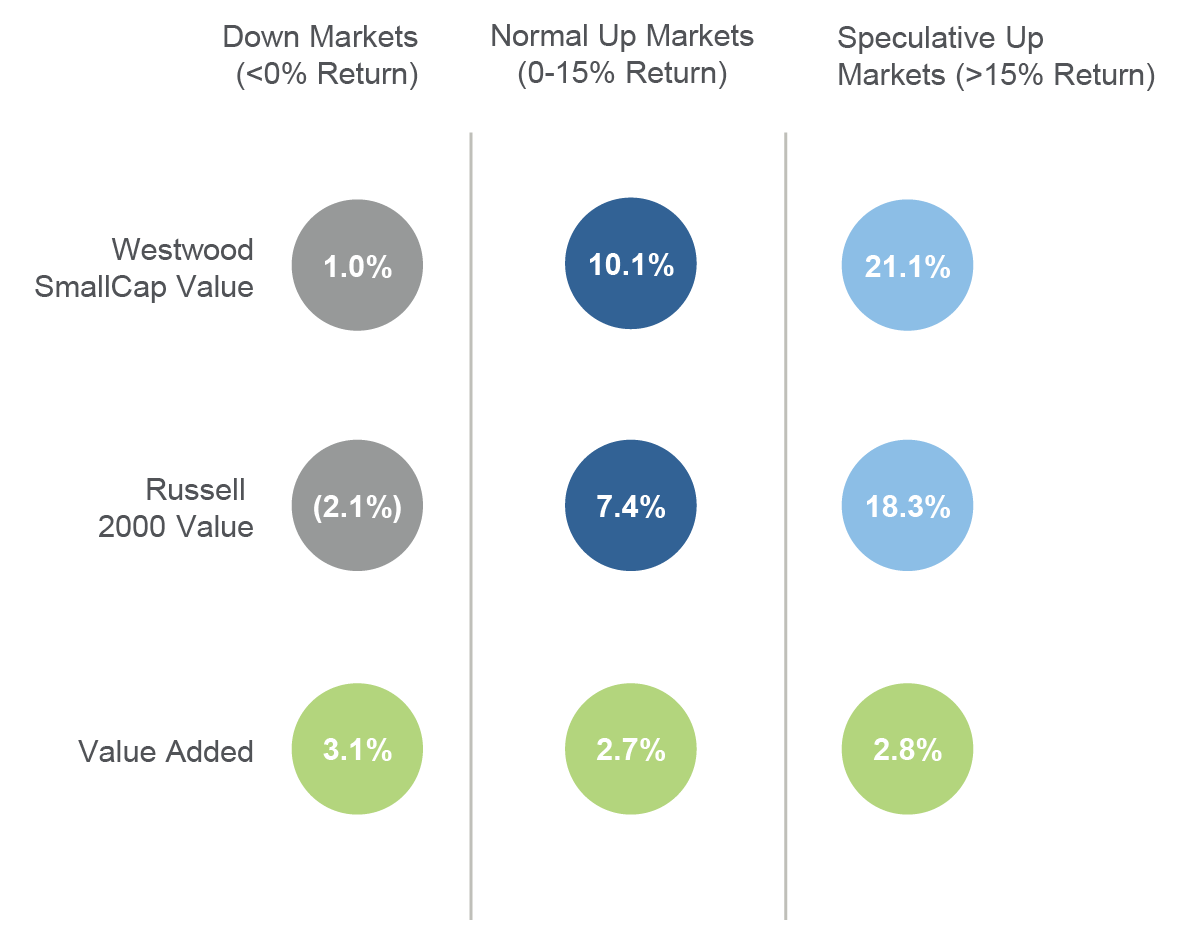

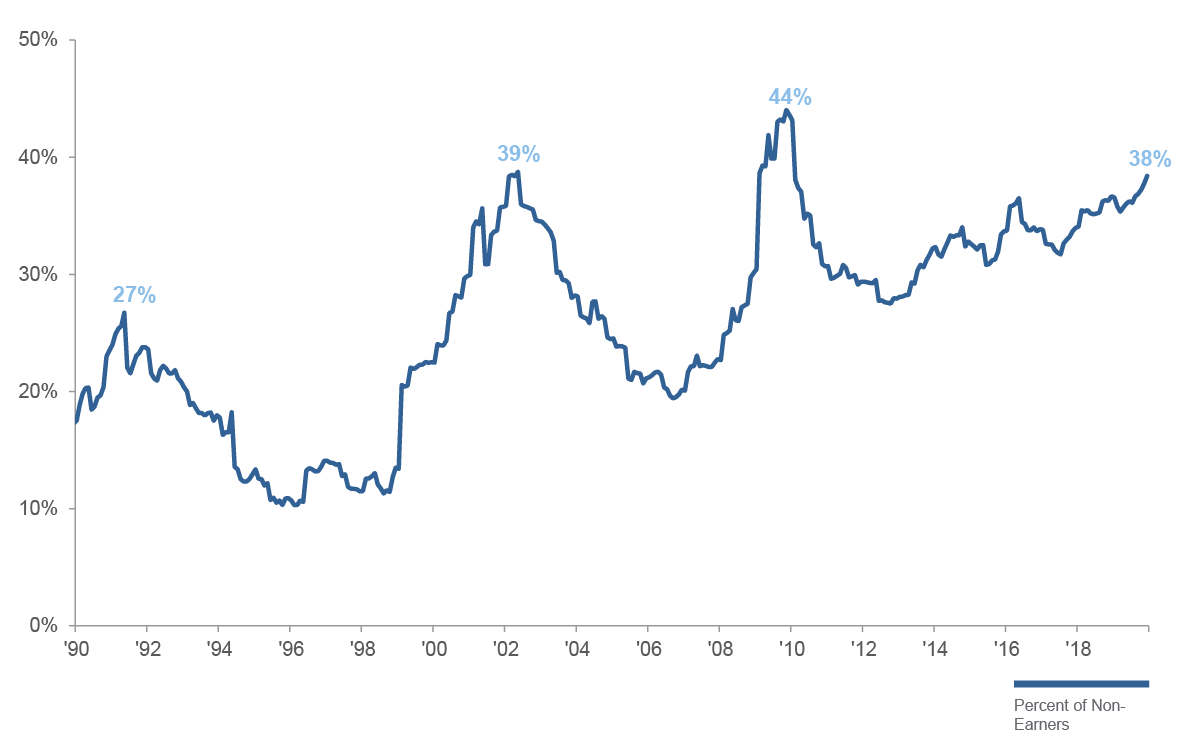

This is a critically important aspect of value that many investors tend to get wrong. In fact, with nearly 40% of small cap companies in the Russell 2000 index losing money at the peak of the cycle, quality is a distinctive investment attribute that should not be confused with traditional value investing.

Figure 1: Percent of Non-Earners in the Russell 2000 Index

(Based on Companies With Available Data)

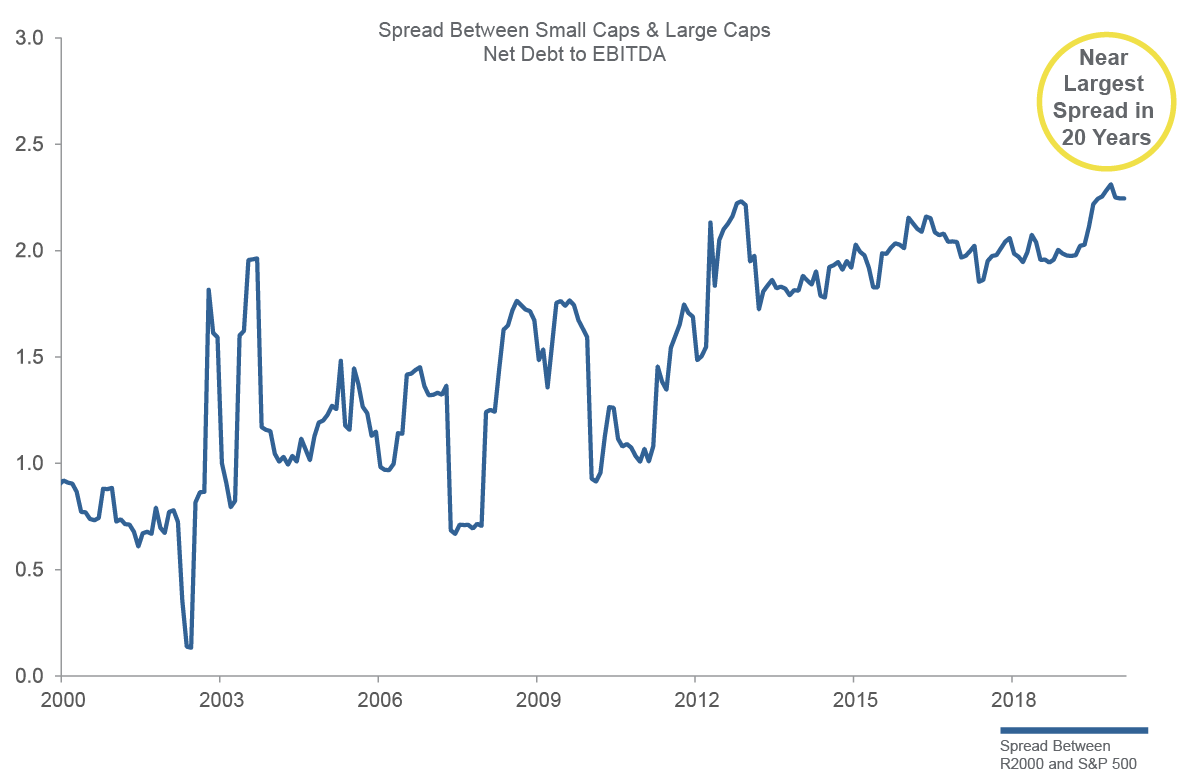

What’s more, this shift to value comes at a time when financial leverage within small cap stocks is at a multi-year peak when measured by Net Debt to EBITDA for the Russell 2000 Index (see Figure 2). This should be a red flag for investors and negates the high-quality investment thesis for more than half of the investable small cap universe despite attractive valuations.

Westwood believes there is a return premium at the intersection of quality and value resulting from “true” economic profitability, stronger balance sheets, stable business performance and lower downside risk. These same attributes are often lacking in traditional or deep value stocks. It is also often misunderstood by many investors, contributing to the secular underperformance in value as whole, and misallocation to value strategies.

Figure 2: Multi-Year Peak – High Leverage for Small Caps

What is a Quality Small Cap Company?

Quality small cap companies are generally well-managed businesses with reasonable growth outlooks and the financial strength to be investable over the intermediate term.

The following three characteristics are common with high-quality stocks that demonstrate greater consistency and lower downside risk over multiple market cycles:

Profitability

In the new economy, analyzing return on invested capital (ROIC) and cash flow generation can be a better way to value a company’s intellectual capital and ability to generate profits from assets. Consequently, GAAP earnings can distort the “true economic” profitability of a company making traditional valuation methods such as Price to Book (P/B) misleading.

Financial Strength

Strong balance sheets, including the appropriate leverage ratios and ability to service debt throughout the investment cycle and cyclicality of cash flows.

Understanding how management is allocating capital to expand its business, including their ability to use equity and debt, is essential.

Competitive “Moat”

A company’s ability to maintain its advantage in order to protect long-term profits and market share from competing firms is critical. This is most important for maintaining strong fundamentals related to sustainable and predictable growth, stability of cash flows, earnings and capital expenditures.

Why Invest in Quality Small Caps Today?

High-Quality Companies Have Delivered Higher Stability and Outperformance During Periods of Distress

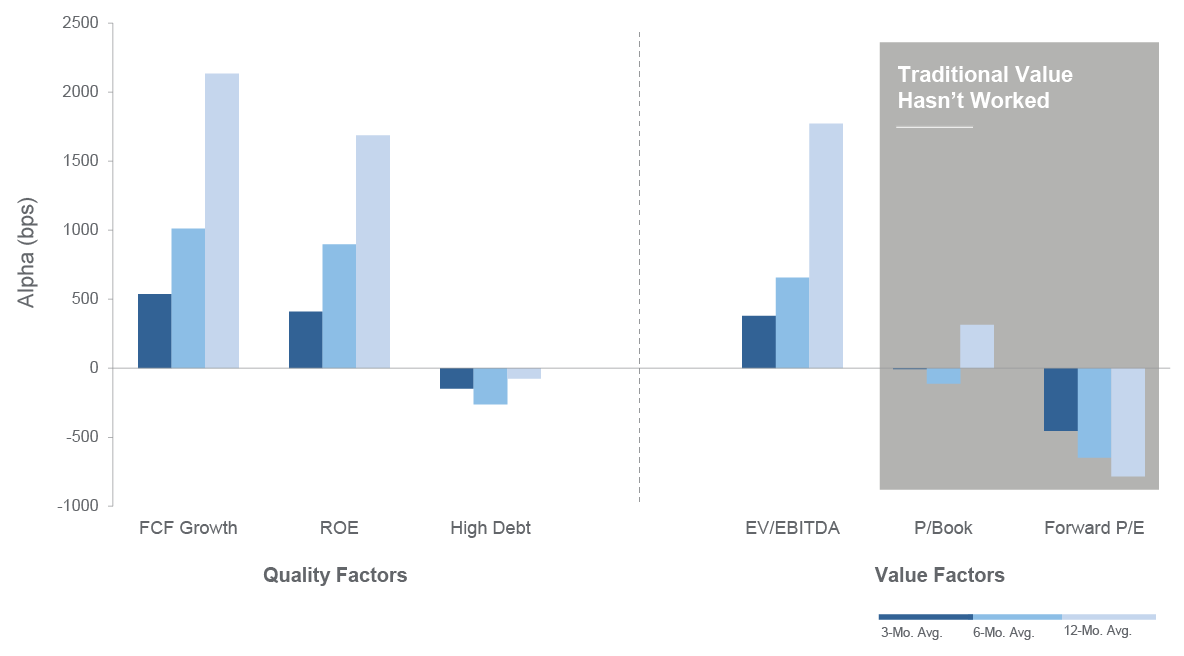

Markets place a premium on high-quality companies during economic downturns or periods of risk aversion. Figure 3 illustrates quality and value factor performance following the last three inversions of the yield curve over 3-month, 6-month and 12-month periods. What has disappointed many traditional value investors is that Price to Book (P/B) and Forward Price to Earnings (P/E) ratios failed to produce alpha while EV/EBITDA proved to be a better measure of value.

Unfortunately, changes in accounting rules and the types of assets that create value for many companies have made Price to Book a flawed metric leading to underperformance relative to the performance of “true” economic profits.

Figure 3: Factor Performance During Periods of Distress

Factor Performance Following 10-Year Treasury / 2-Year Treasury Yield Curve Inversion

(U.S. SmallCap Universe)

As you can see in Figure 3 above, quality factors such as ROE, FCF growth and financial strength were highly prized investor metrics. Furthermore, the ability to service debt and with “true” economic profits was accretive to investors during periods of distress. ROE is a critical factor because it assesses quality by rewarding high economic return companies while penalizing excessive leverage. Style box investors who build portfolios within a strict value-growth framework should take note of this evidence in the small cap asset class specifically. While in theory, the style box helps investors construct a more diversified portfolio, the lack of specificity within the allocation appears to be limiting small cap managers and hurting investment performance.

We therefore affirm that while small cap value investors have used valuation as a framework to outperform more expensive stocks, “quality” as a factor is less widely understood and can offer a compelling return profile. Data has shown that over the long term, narrowing investment candidates by the above quality characteristics has also contributed to returns in excess of the cost of capital and in turn created a wealth generation effect for investors.

Economic Profitability and Financial Strength Will Be Essential over the Next Five Years

Strong balance sheets allow a small company to control its own destiny. On the other hand, highly leveraged businesses lack the flexibility to fund their businesses and lose flexibility when the unexpected happens. The current shorter-term trends and structural debt issues in the small cap asset class are concerning. The percentage of companies with no earnings at the current level is close to past market peaks. ROE has generally been on the decline since 2011 as companies reach multi-year peaks in leverage. To make matters worse, the looming $1 trillion wall of debt for small cap companies has 58% coming due within the next two to five years. In summary, quality as a factor is quickly deteriorating across the small cap asset class and specifically the Russell 2000 Value Index, where ROEs are declining at the same time cash flow generation is in negative territory. We affirm small cap Value investors need to include quality as a new dimension that is “married” to valuation.

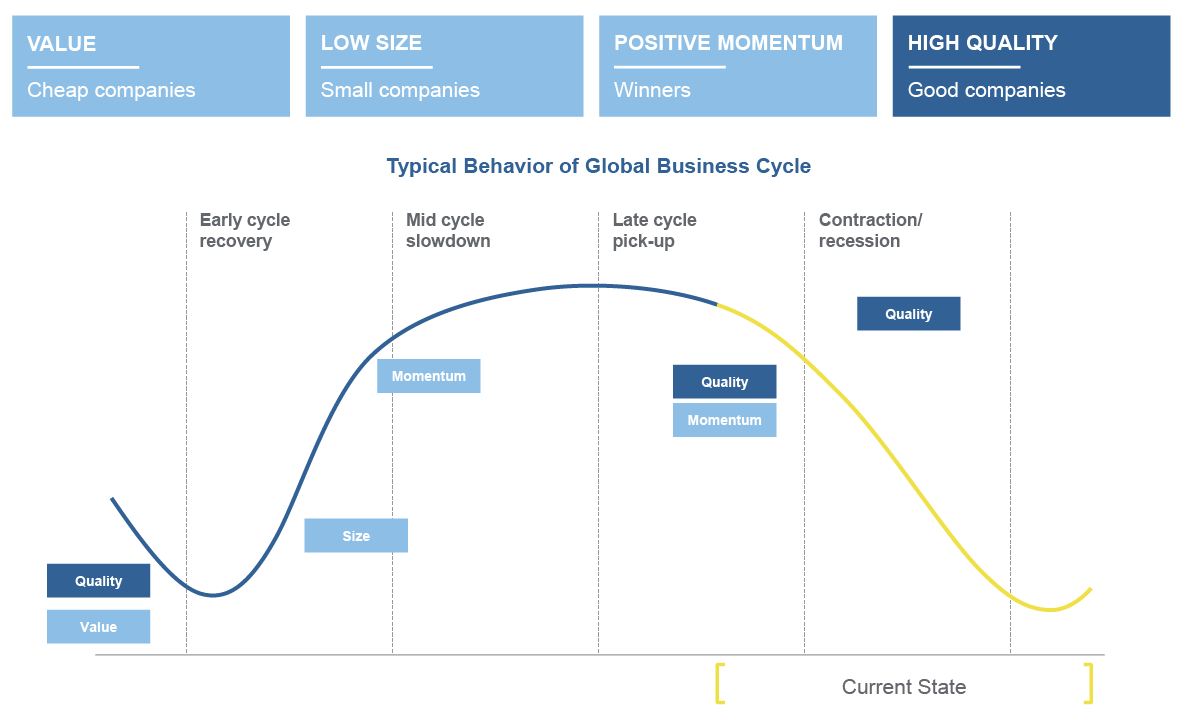

Better Consistency Across the Economic Cycle

After a decade-long bull run in small cap stocks with growth outperforming value (13.5% annualized return for the Russell 2000 Growth Index vs. 10.4% for the Russell 2000 Value Index from 2009 to 2018), investors underappreciate the value of consistent and sustainable high-quality small cap investments as we enter the later stages of the economic cycle.

Historically, investors become myopic during extended periods of bullishness, chasing performance in the highest-performing strategies believing that recent observations will persist long into the future. After a long-secular rise in small cap growth stocks, strategic investors need to consider the importance of both performance, absolute downside risk and the consistency of returns, which tend to be underappreciated at this stage in the cycle. Given the consensus view that we are in the later stages of the economic cycle, we believe slower growth, lower quality and higher volatility will lead to lower returns for traditional value/deep value companies. See Figure 4 below.

Figure 4: Sample Factor Performance Across the Economic Cycle

Investing in higher-quality fundamentals with attractive valuations in the small cap asset class has historically performed better than traditional value or momentum styles at the peak of the cycle. Traditional Value or deep Value stocks tend to perform better during the early cycle recovery since many are sensitive to economic growth. Investing in high quality means avoiding cheap companies with potentially broken business models that may be “cheap” for a reason, while targeting good companies at attractive values.

The Intersection of Quality and Value

Westwood’s philosophy and our approach to small cap investing is focused on identifying companies that maintain both specific high-quality attributes along with attractive valuations to exploit a potential return premium. Our team-based investment process is multi-faceted and tailored to specific industries including cyclical companies that play an important role in the Russell 2000 Index. Our focus on downside risk in absolute terms as it relates to the permanent loss of capital is critical to investing in companies with stable fundamentals that can perform across a broad range of market environments. In other words, we look at worst case scenarios first before moving on to an upside thesis. High active share is an intentional output of our investment process in order to express our best ideas at the intersection of quality and value.

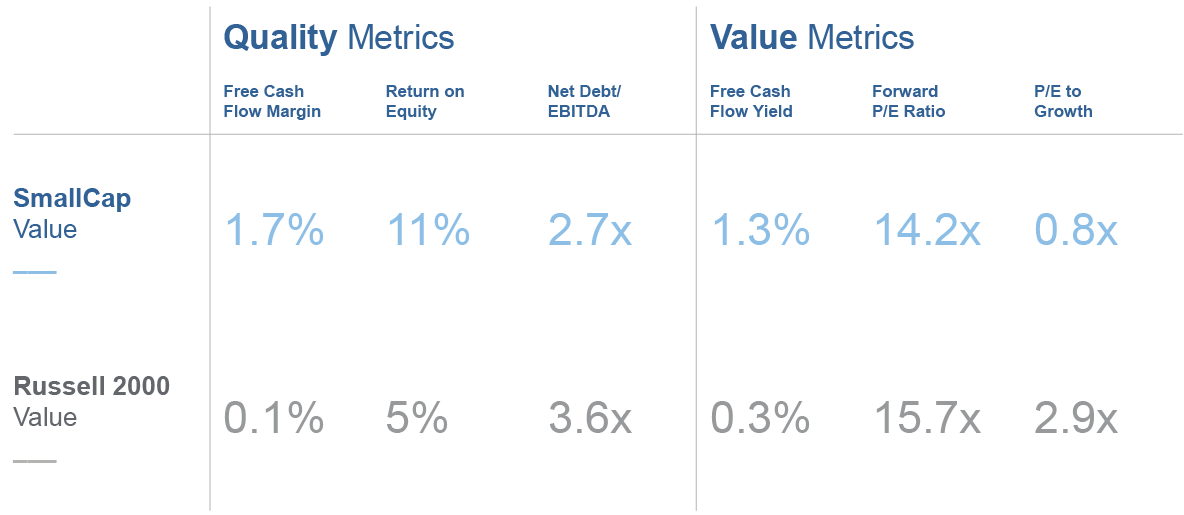

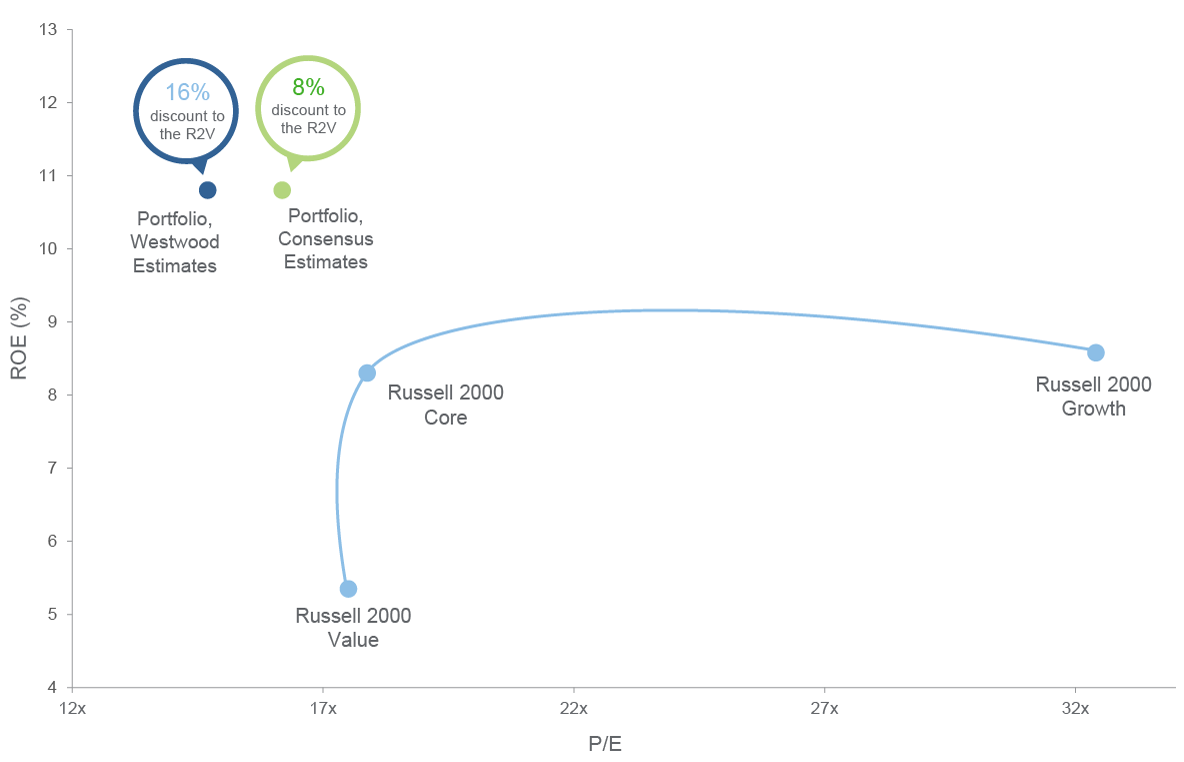

Figure 5 below highlights key characteristics and the overall profile of companies at the intersection. The Westwood SmallCap Value strategy has stronger quality metrics with better free cash flow, significantly higher ROE and less leverage than the Russell 2000 Value benchmark. Furthermore, our portfolio is typically constructed with lower valuation metrics when evaluating forward P/E ratios and lower PEG ratios.

Figure 5: What the Intersection Looks Like as of Q4 2019

Getting Valuation Right is Key to Unlocking the Return Premium

Valuing a small cap company is a complex process. Gathering and assessing the quality of metrics is just as important as the data itself. The small cap space transcends style boxes which are not unique to any asset classes and maintain both unstable memberships and relationships to value. Our valuation techniques focus on cash flow and earnings rather than price-to-book (P/B). This has been critical to identifying high-quality companies trading at discounts to their intrinsic value. Today, our portfolios exhibit both higher-quality attributes with better earnings prospects while trading at a discount to the benchmark. As you see in Figure 6, the Westwood SmallCap Value strategy has a higher ROE and lower P/E ratio vs. the Russell 2000 Value.

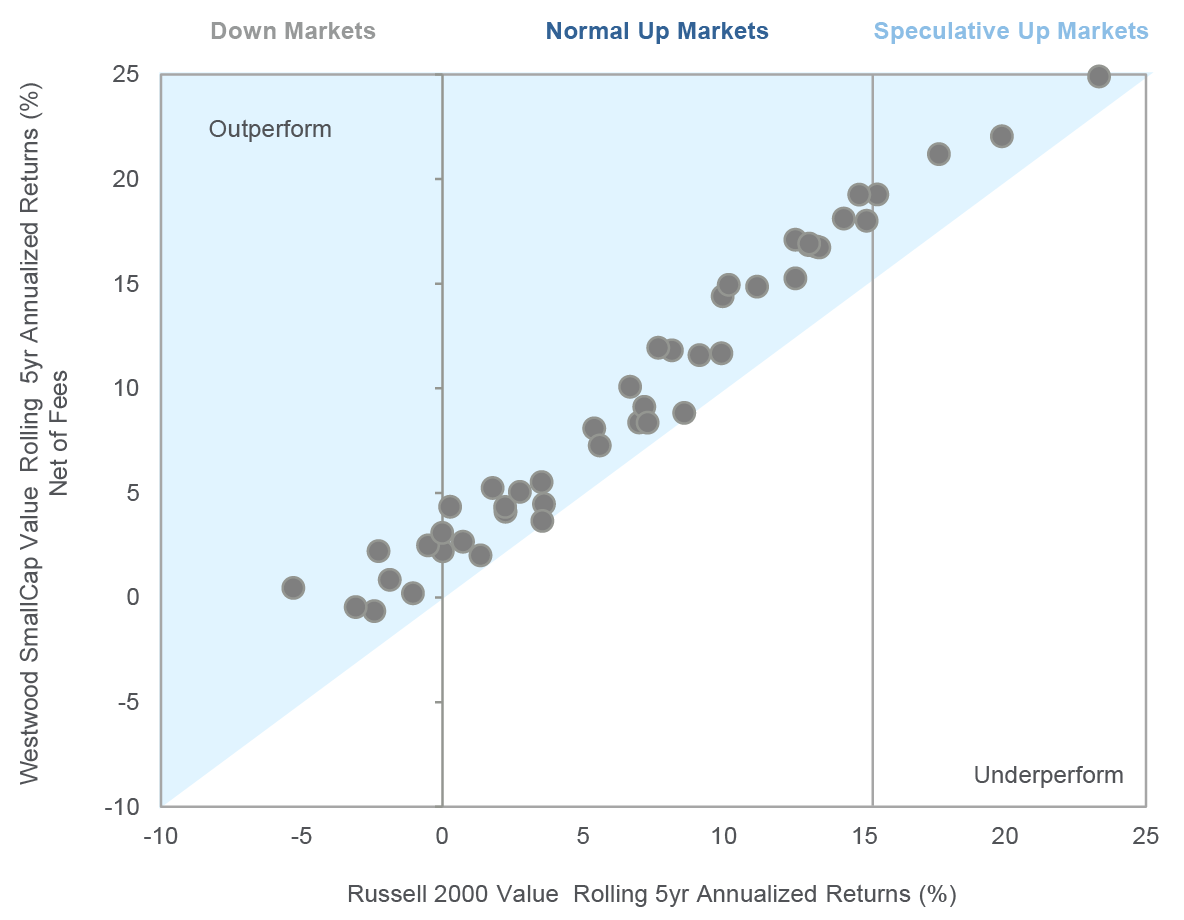

In summary, investing in great businesses across different industries trading at attractive valuations can result in more consistent performance through the investment cycle. See Figure 7. Westwood’s unique SmallCap Value strategy can be a critical building block for Value investors or as a diversifier to Value strategy that is focused on rewarding investors over time with more consistency and fewer favorable events.

Figure 6: Westwood SmallCap Value – Investing at the Intersection of Quality and Value

Forward P/E vs. ROE

5-Year Average as of December 31, 2019

Figure 7: Delivering Consistency Across a Wide Array of Market Environments

Annualized Rolling 5-Year Returns Net of Fees Since Inception

Westwood SmallCap Value vs. Russell 2000 Value Index

*Overall Batting Average: 100%

Market Environment