Invest in Energy Infrastructure and Real Assets for Inflation Protection

By investing in midstream companies, master limited partnerships (MLPs), MLP affiliates, and other energy infrastructure companies, the strategy offers diversification to a traditional stock/bond portfolio.

An attractive source of inflation-protected income, supported with long-term contracts tied to the rate of inflation.

Energy and infrastructure assets may perform better during inflationary periods due to inflation-indexed revenue contracts that can keep up with rising prices.

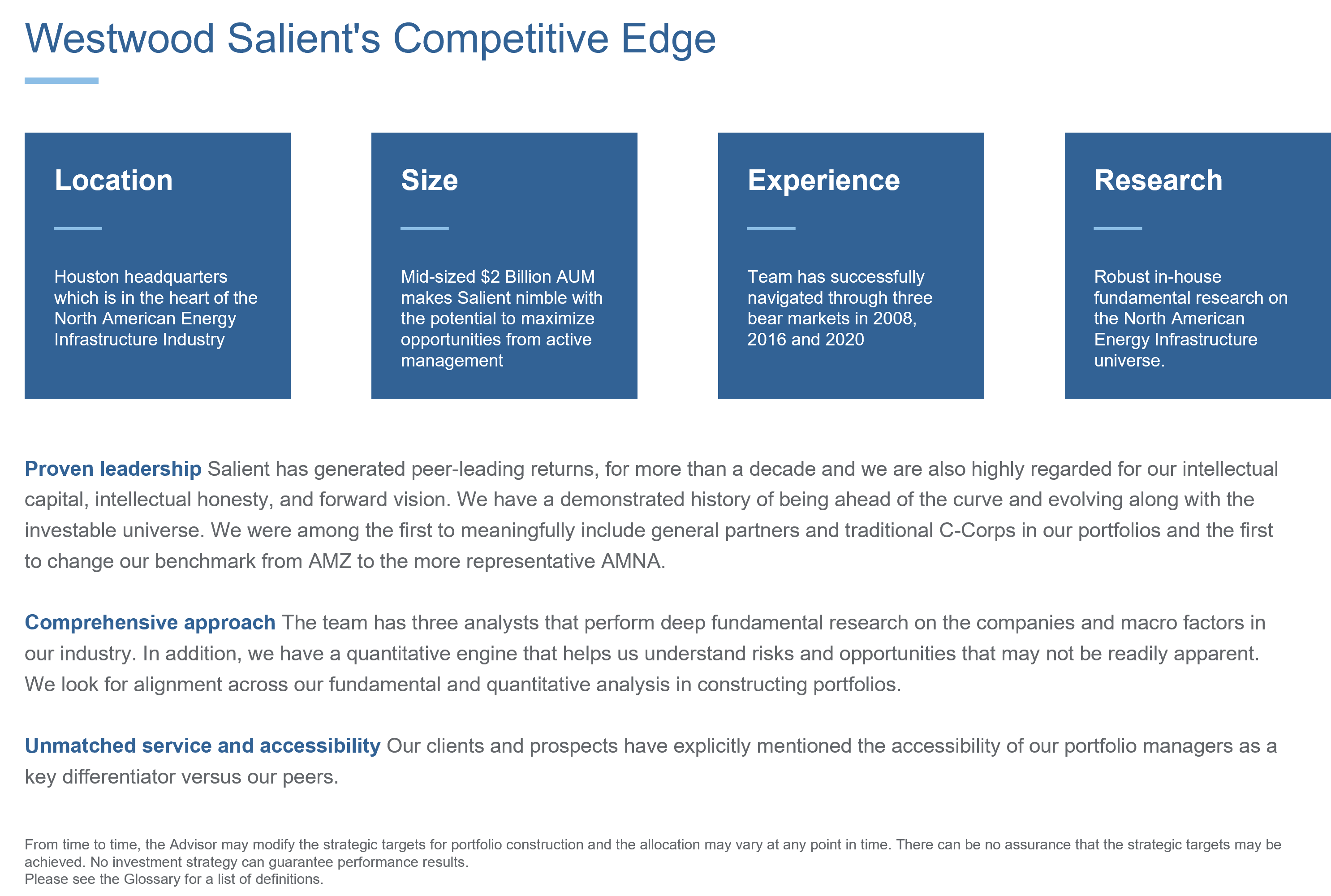

The Westwood Salient Energy Infrastructure team is based in Houston, TX, which many believe to be the energy capital of the world most active with energy related companies. The team oversees approximately $2.0B in assets across a variety of midstream energy, MLP, and real asset related products.

Market imbalances require asset allocators to consider multi-asset strategies that have a strong emphasis...

Learn moreBottom-up Multi-Asset investing can bring something very powerful and unique to a portfolio in...

Learn moreNotifications