In October, FTSE Russell announced a couple of possible changes to their country classifications that will affect investors tracking some major global indexes. This announcement showcases not only the differences between index methodologies but also the influence that index providers can have on equities listed within specific countries.

Pending a review period in March of next year, FTSE will promote Vietnam from Frontier to Emerging status (Secondary Emerging to be precise), and Greece will be promoted to Developed market status from Advanced Emerging. This announcement provides a good opportunity to highlight a couple of interesting details about index investing.

The Fate of Nations:

The major index providers play a crucial role in determining what classifications countries are assigned. Given the substantial amount of assets that now track indexes, these classifications can result in billions of dollars being invested in a national stock market (or not). There are three widely accepted status levels that a country can be classified as: Developed, Emerging and Frontier. However, there are no definitive criteria for these classifications, so each index provider creates their own rules and requirements for inclusion. Other index providers often follow the classification rules of the two largest index companies: FTSE and MSCI.

Which Won is Right?

The largest discrepancy between FTSE and MSCI in terms of country classification is South Korea. FTSE considers South Korea a Developed market and includes it with other significant global markets alongside the US, UK, Canada, Japan and Germany, etc. MSCI still classifies South Korea as an Emerging market with China, Brazil, India and much smaller markets like Hungary and Kuwait. Poland is another example of this bifurcation — like South Korea, Poland is an Emerging market according to MSCI, while FTSE considers the birthplace of Marie Curie and Chopin as Developed.

Each index provider has their own requirements for country classification. Economic criteria such as per capita income are often used as an initial filter, while details around market development and accessibility provide more nuance. Capital controls, FX repatriation constraints, operational (in)efficiency, physical infrastructure stability, foreign investor access and market depth and liquidity are all considerations that lead index providers to grant a country inclusion into their index series.

Given the amount of assets globally that are invested into funds tracking these indices, this inclusion can be the difference between vast sums of capital entering a country’s economy and not.

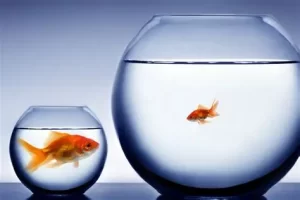

Examining the discrepancies that South Korea and Poland present between FTSE and MCSI highlights the difference between being a larger weight in a smaller index or a smaller weighting in a larger index.

South Korea, classified as an Emerging market by MSCI, holds a ~12% weighting in the MSCI Emerging Markets Index. FTSE, however, classifies South Korea as a Developed market and therefore applies a ~1.6% weight in the FTSE Developed Market Index.

The potential promotion from Emerging to Developed status for Greece results in an effective “two-way” trade for the market. Funds that track the FTSE Emerging Market Index will need to sell, while funds that track the FTSE Developed Market Index will need to buy. Estimating the value of this trade relies on the accuracy of the assets invested in funds tracking each index. There are substantially more assets that are invested in Developed versus Emerging markets, and one reasonable projection sees this potential trade as a relatively flat transaction: ~$1.4B worth of Athens listed equities needs to be purchased, while ~$1.2B needs to be sold as Greece moves from a >60bps weight with less assets tracking to a <10bps weight in a larger investment pool.

The step up for Vietnam is more pronounced as the nation graduates from Frontier to Emerging. Since the amount of assets invested in Frontier markets is a small fraction of what is invested in Emerging, the projected value of the trade could mean more than ~$1B invested into Vietnamese equities, which represents a significant uptick in the average daily value traded on the Ho Chi Minh or Hanoi stock exchanges.

Interestingly, Vietnam is being considered for promotion despite it being a country ruled by the Community Party of Vietnam and having a record of very restricted freedom of expression, religion and civil society activism. Per Freedom House, ‘the authorities have increasingly cracked down on citizens’ use of social media and the internet to voice dissent and share uncensored information,’ and scores Vietnam a “NOT FREE” 20/100 — a rating lower than those of Haiti and Iraq.

If promoted, investors in FTSE Emerging (and Global) market funds will be investors in the Vietnamese market and subject to exposure to another non-democratic nation.

Please read our perspective on the risks that authoritarian markets can pose to equity portfolios.