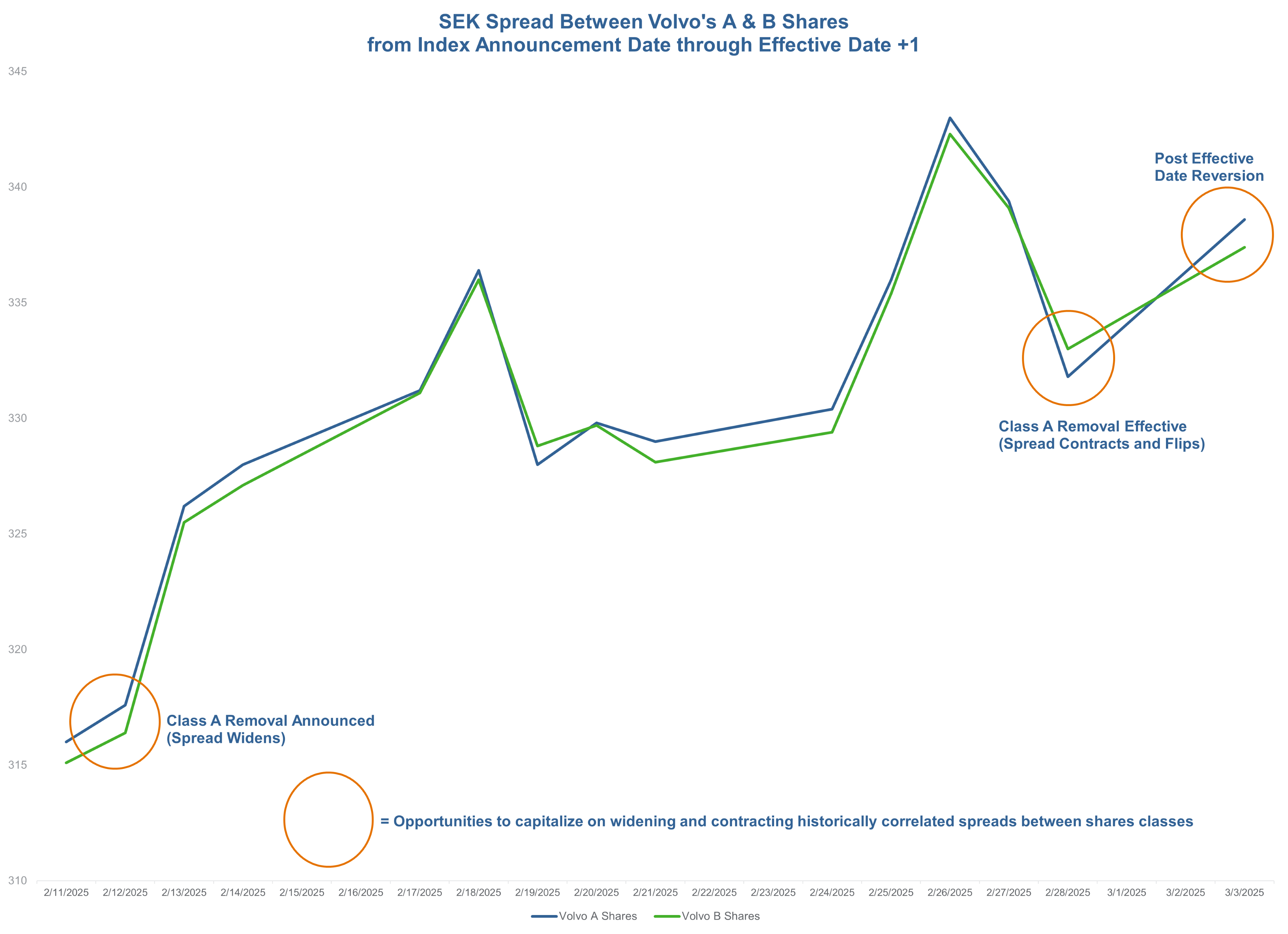

After the close on Feb. 11, 2025, MSCI announced that Volvo’s class A shares would be removed from the standard indexes at the February index review, effective at the close at month end (read more about this event in our blog here: https://bit.ly/4kg3QlQ). Volvo’s A and B shares have a historic correlation of >99.5% yet occasionally witness some short-term dislocation, often followed by reversion.

The chart below highlights the difference in spread between the two share classes from the announcement through the effective date, highlighting the expansion of the spread through the index event and then the reversion thereafter.

Investors should be aware that successfully navigating these events requires a deep understanding of the factors driving price movements and the potential for deviations from historical relationships. Understanding index events along with thoughtful implementation can help reduce costs and potentially add value.

For example, if an investor had replaced their exposure to A shares with the highly correlated B shares and exited the position on the effective date, this would have resulted in a gain of approximately 85bps at the trade level. Furthermore, anticipating reversion and adding exposure to the newly deleted A shares at the expense of the B shares would have generated approximately an additional 65bps.

While these opportunities exist, execution requires careful analysis and an appreciation of the risks involved, as market dynamics can shift unexpectedly.