In 1986, U.S. newscaster Dan Rather was attacked in New York City, with the assailants repeatedly asking, “Kenneth, what’s the frequency?” This question became a topic of speculation and was later popularized by R.E.M.’s 1994 hit song, What’s the Frequency, Kenneth?, which debuted at number 1 on the Billboard Modern Rock Tracks chart.

A couple of years prior, in 1984, the Russell U.S. Index series was introduced to represent the U.S. economy by including the top 3,000 U.S. stocks, divided into two groups: the Russell 1000 and 2000. Initially rebalanced quarterly, the methodology shifted to semi-annual rebalancing in 1987 and then moved to an annual reconstitution in June starting in 1989.

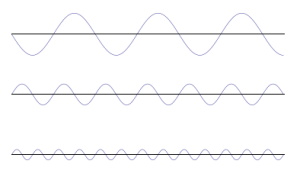

Recently, the frequency of the Russell U.S. Index reconstitution has been reassessed. Following market consultation, the Russell U.S. Indexes will move back to a semi-annual reconstitution cycle starting November 2026. The goal is to improve the accuracy of economic representation and enhance the usability of the indexes as performance benchmarks.

Currently, the Russell reconstitution occurs annually in June, with participants preparing as early as January. The process consists of three stages: the pre-announcement period (January-May), the announcement-to-effective period (May-June) and the effective date and post-rebalance period (the fourth Friday in June). With over $10 trillion benchmarked to Russell Indexes, the reconstitution has grown into a significant market event. Since 2019, the Russell reconstitution trade has exceeded $100 billion in notional value. The increase in trade size and market volatility supports the shift to a semi-annual cycle to reduce risk concentration. Index fund managers will benefit from the added frequency, allowing better risk management and more timely membership updates.

More frequent rebalancing also presents opportunities to exploit inefficiencies during index events, offering a predictable framework for preemptive adjustments and alpha generation.

Custom indexing allows asset owners to design indexes that align with specific goals like rebalancing frequency, capitalization, liquidity and profitability. Unlike traditional indexing, it combines active design with passive management, providing more tailored solutions. Instead of settling for an existing index, custom indexing enables asset owners to create a methodology that better addresses their needs, including determining rebalancing frequency (annual, quarterly, etc.).

What’s the frequency, investor?