Third Quarter 2021 Review

If the word of 2020 was “unprecedented,” the word for 2021 would be “transitory” so far. From the initial transitory logistic challenges that were overcome, to transitory inflationary pressures that appear to be abating somewhat, markets have had to adapt to a dynamic set of challenges and opportunities. One other feature that has been transitory — any market weakness from uncertainty or other sources.

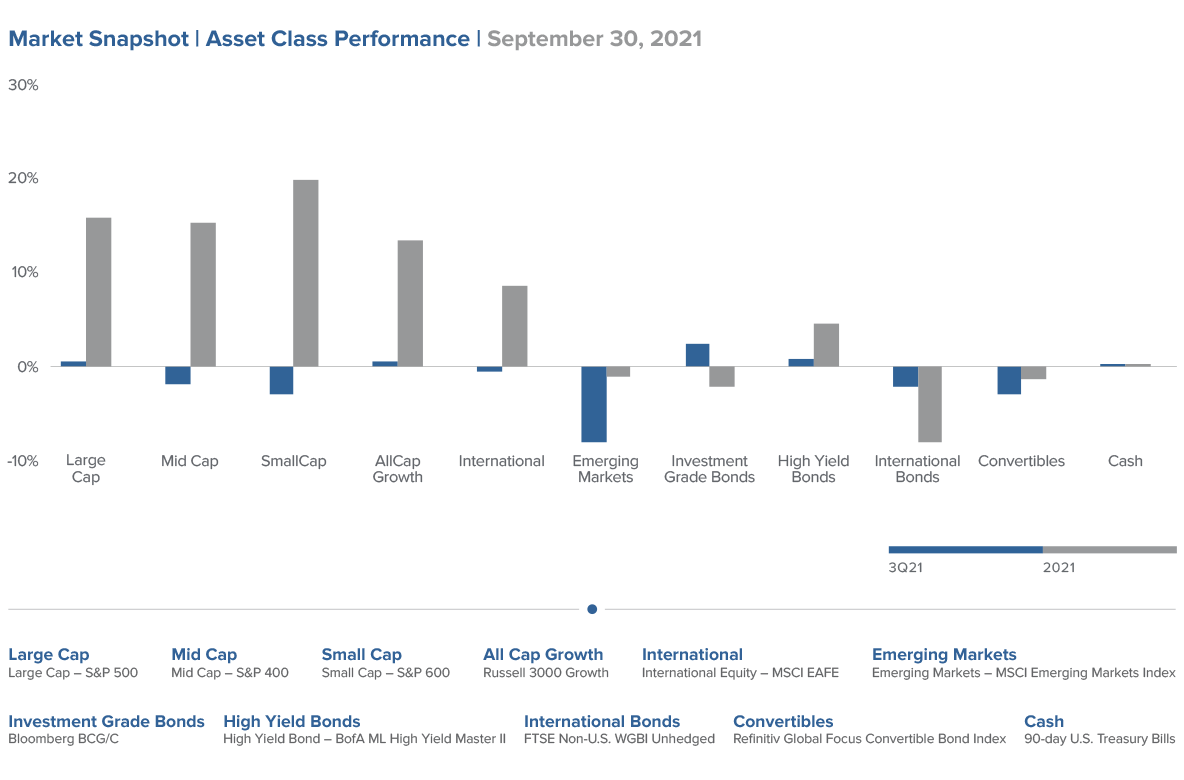

Markets have remained strong, buoyed by the recovery from the worst impacts of the pandemic in tandem with strong stimulus efforts from monetary and fiscal sources. In fact, the S&P 500 has made 73 new all-time closing highs since February 2020 with new highs seen every month since November 2020 when the vaccine trial results were announced. September saw some volatility return to the markets, but largely, market optimism has remained strong that the transitory impacts from the pandemic are fading and the recovery of the global economy and businesses alike will continue to move forward.

However, this optimism has brought with it elevated valuations for stocks and bonds alike. Equities are now trading near peak historical levels, creating concerns that this may cause future returns to fall toward more typical ranges. Credit spreads, a bond valuation metric for the amount of additional income compensation over an equivalent-maturity U.S. Treasury, have tightened significantly. Current spreads now fall in the 10th percentile for the trailing 25 years for both investment-grade and high-yield, limiting the appeal particularly if interest rates were to rise. Interest rates have risen meaningfully from the summertime lows, with the yield on the 10-year U.S. Treasury bond moving up to 1.49%. Still lower than in early spring, when it approached 1.80%, this remains extremely low in historical context. And further, this puts the pressure on companies to perform — returns will be driven by earnings and cashflows going forward — and adds further to investor sentiment that returns for equities and bonds may moderate from recent elevated levels as economic growth may be peaking here.

Forecasts for economic growth have varied widely through the course of the year, with initial estimates undershooting the potential recovery unleashed by multiple, effective vaccines. The following months saw meaningful revisions higher to expected gross domestic product (GDP) growth, only to hit the wall as issues with supply chains appear to have capped the potential growth for the year. Supply chains, having been lengthened and driven to be just-in-time with little room for error, have been severely taxed by the combination of pandemic-related disruptions and the inability to fill open positions. Many supply chains originate outside of the U.S., and different countries’ approaches to COVID-19 have dramatically impacted availability of various parts and components for everything from automobiles to sporting goods to furniture. Employees have been quitting their jobs at a record pace, further exacerbating the situation and limiting firms’ ability to properly staff their facilities to make the goods in demand. But balanced by strong consumer sentiment and continued propensity to spend, the economic outlook remains positive in aggregate. These challenges may themselves prove transitory, but as vaccine deployment continues more aggressively outside of the U.S., further recovery tailwinds may be on the horizon.

Westwood's Outlook

Throughout the year, we set scenarios to help guide our investment outlooks and assumptions. This provides both a time for introspective analysis for what has transpired as well as what opportunities and pitfalls may await in the coming periods. We start with our operative scenario, the most likely vision of the future, and then push our intellectual flexibility to alternative outcomes.

As the year has progressed, our thinking has evolved and now stands among potential peaks: Peak Growth, Peak Exuberance or Twin Peaks. Our operative scenario is titled “Peak Growth” in reference to the strong but peaking growth expected for the domestic economy.

Peak Growth is not necessarily the beginning of the end as it might sound, but rather the acknowledgement that the extraordinary stimulus that pushed the recovery to deliver the strongest growth since the 1980s is not likely to be sustainable at these levels. Our expectations remain that growth will persist above pre-pandemic trends and provide a strong and supportive environment for investments broadly, but favoring riskier areas such as equities on the margin. Improving vaccination rates globally provides incremental reopening tailwinds that flow through not only those regions, but also the broader world, as consumption resumes. Global central banks are forced to keep rates low, further supporting the markets, while growth recovering creates inflationary pressures and unemployment falls. Supplemented by additional fiscal spending and pent-up consumer demand, corporate profits remain strong, pushing returns higher.

When considering alternative scenarios, three key factors play an important role in thinking through potential outcomes:

| Peak Growth | Peak Exuberance | Twin Peaks | |

Capital Gains |

Moderating from highs, GDP growth remains strong and above recent years as supply chain issues linger. Pent-up demand helps sustain growth, albeit at a lower level, into the coming year. | GDP growth remains elevated into the coming year as supply chain issues abate sufficiently for a strong holiday season to cap the year. As clarity emerges, pent-up spending accelerates growth further. | Growth moderates dramatically from the higher level of early this year as supply chain issues wreak havoc on holiday spending. |

Inflation Pressures |

Inflation picks up, given the strength in the economy, but remains overall manageable. Companies with pricing power are able to raise prices sufficiently to maintain their margins and consumers flush with cash see little demand destruction from it. | Supply chain issues ease, limiting the need for price hikes to offset price increases. Instead, companies can price as markets allow to maintain or expand their margins. Inflation proves to be transitory, as the Federal Reserve (Fed) measures it, allowing for interest rates to also remain lower for longer. | Inflationary pressures surge, led by a rising dollar, commodity prices and continued supply chain issues. This forces the Fed’s hand to act sooner, raising interest rates and disrupting the equity market as a virtuous cycle turns vicious. |

COVID-19 and Variants |

Vaccines are joined by therapeutics in fighting to help control the spread of the virus. No new variant emerges to disrupt the improving consumer confidence as vaccines and treatments become more readily available. Confidence translates to additional consumption, supporting further economic growth. | Global vaccination rates rise sharply, as new vaccines emerge that prove effective for new variants, including Delta. Availability of vaccines and therapeutics improve outside of the U.S., allowing for a quicker than anticipated reopening and recovery to unfold. | Vaccine rollouts are delayed, as new complications emerge. Variants also begin to show resistance, requiring additional reworking and boosters to maintain effectiveness. These impact efforts to restart global economic growth as countries are forced to reinstate restrictive measures. |