Bottom-up Multi-Asset investing can bring something very powerful and unique to a portfolio in the current environment

Many portfolios today have increasingly more exposure to top-down diversification or macro exposure as indexing has proliferated in investor portfolios. In an environment where index volatility increases across asset classes and correlations go to one, outperformance becomes a function of avoiding losses in the worst stock indices vs. adding higher quality stocks. A flexible, bottom-up multi-asset approach that can sync the asset allocation process to the stock selection process may help investors pursue equity-like returns with less risk. As investors look forward to potentially rising interest rates and a lower nominal growth environment, a winner-take-all market environment creates a favorable backdrop a for a bottom-up multi-asset approach particularly if you believe downside market volatility will increase.

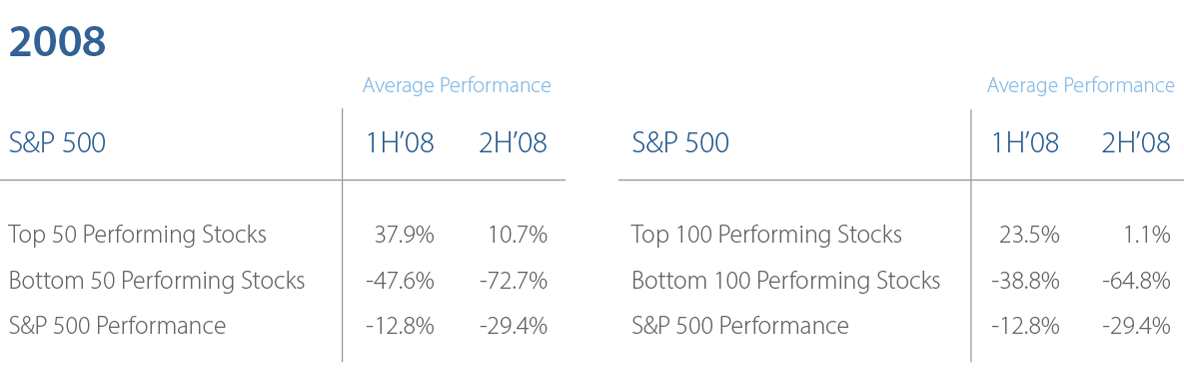

2008: Potential Inadequate Risk Diversification in Top-Down Macro-Oriented Multi-Asset Class Strategies

Why It Matters

The ability to invest with a flexible, bottom-up multi-asset strategy can help investors avoid the worst performing stocks during a market downturn. Many top-down macro-oriented multi-asset strategies tend to invest in “blunt” indexed instruments exposing investors to undue market risk that could be avoided with an active approach.

Take Action: Learn More About Our Flexible Multi-Asset Approach and Emphasis on Risk Diversification

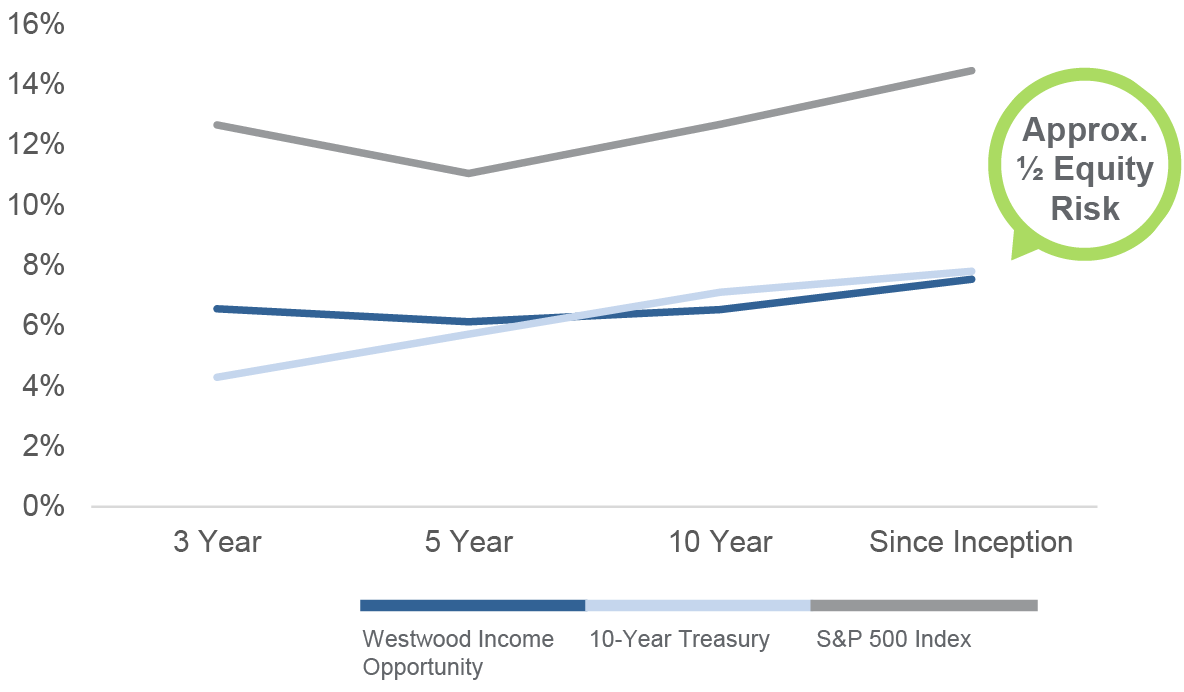

Westwood Income Opportunity | Equity-Like Returns with Less Risk Since Inception

Risk (as Measured by Annualized Standard Deviation)

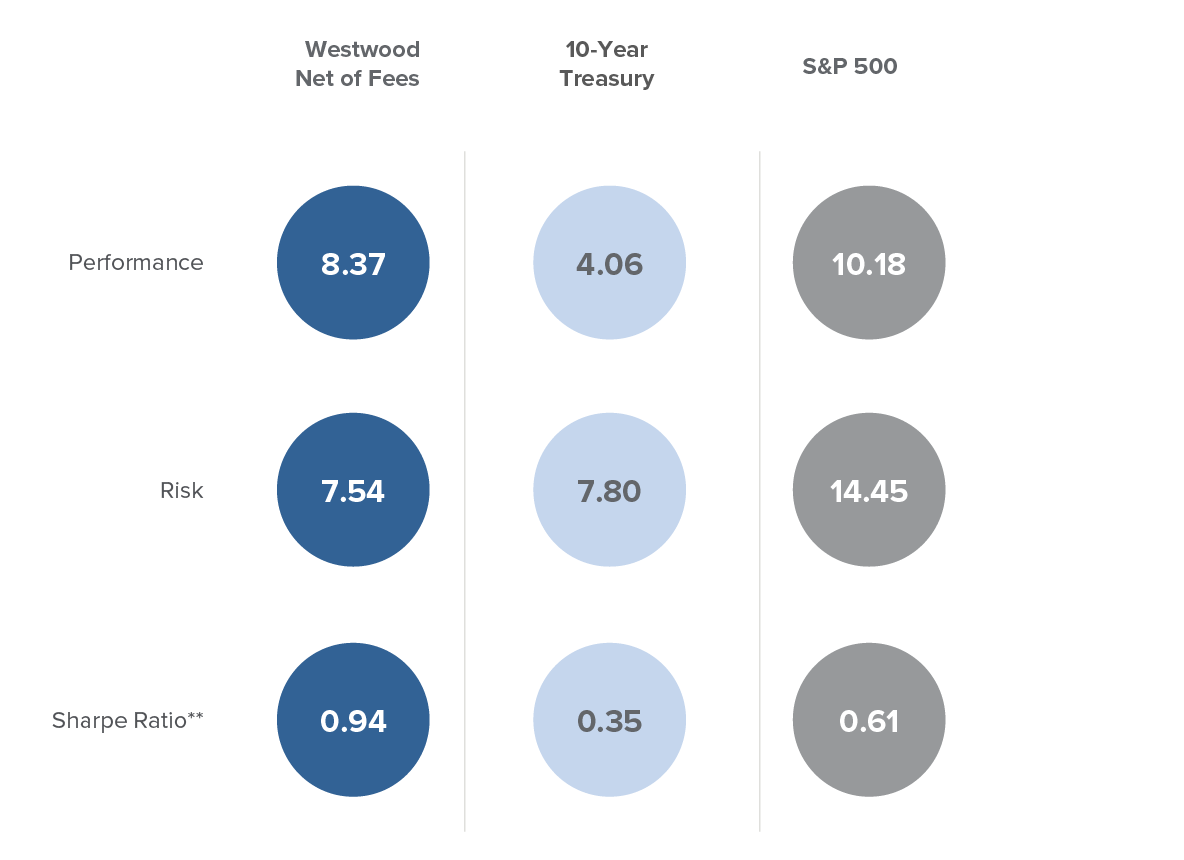

Risk and Return Comparison Since Inception*

Westwood Income Opportunity: Key Takeaways

Bottom-Up Multi-Asset Solution

Asset mix diversifies sources of return and is driven by in-depth fundamental bottom-up research

Asymmetric Return Focus

Participation in up markets with an emphasis on protecting capital in down markets

Flexible Approach

Flexibility allocates across asset classes, capital structures, sectors and market caps that display absolute value

Risk-Focused Growth & Income

Navigates changing market conditions by balancing the trade-offs between capital appreciation, yield and risk

A flexible bottom up approach to multi-asset investing could be a way for investors to diversify their equity returns with less risk.