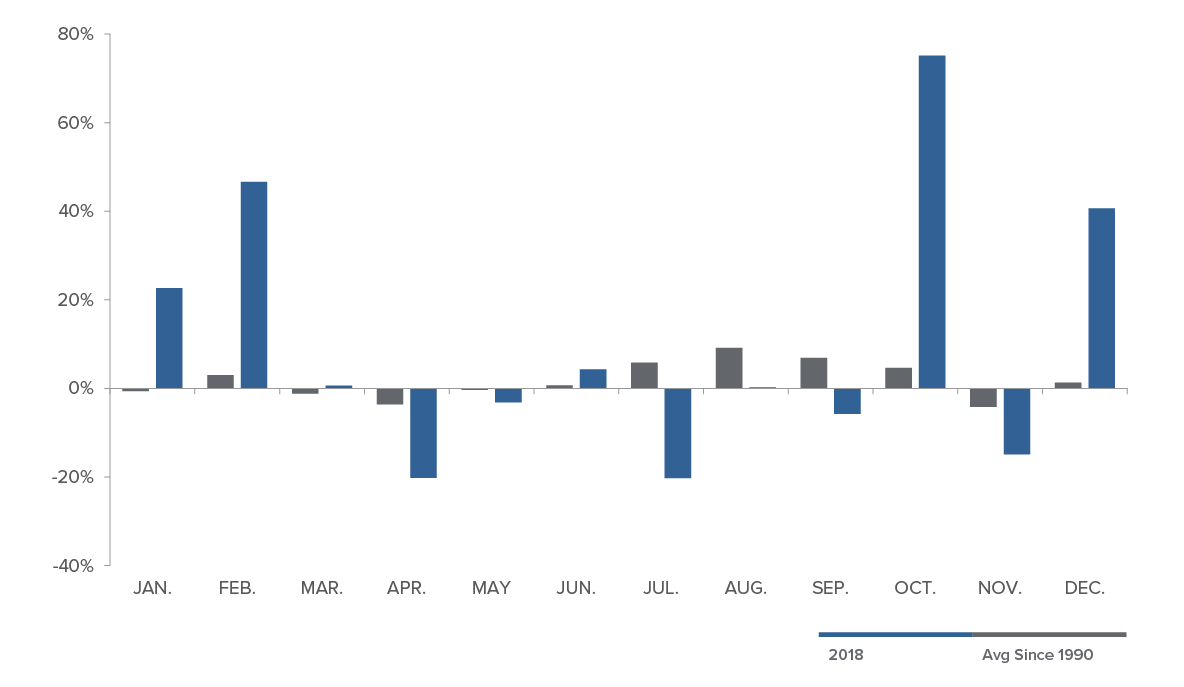

Multi-asset investing can bring something very powerful and unique to a portfolio in the current environment. The normalization in stock market volatility paired with the rise in interest rates and impact of global policy shifts may have profound implications going forward. The implications are larger than simply correlations between classes, but capital structures, geographies and security selection may be less correlated in the future. In 2018, we saw drastic changes in the monthly volatility index as interest rates rose and liquidity was slowly withdrawn from the market.

Average VIX Performance Since 1990 vs. YTD 2018

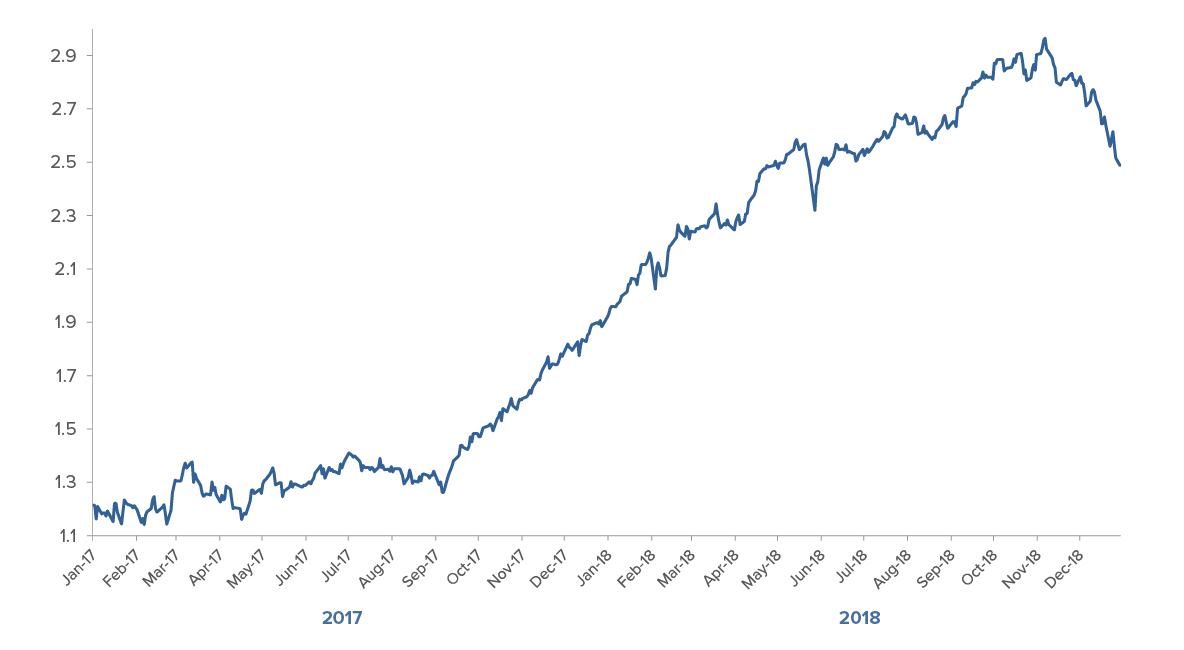

U.S. 2-Year Treasury Yield

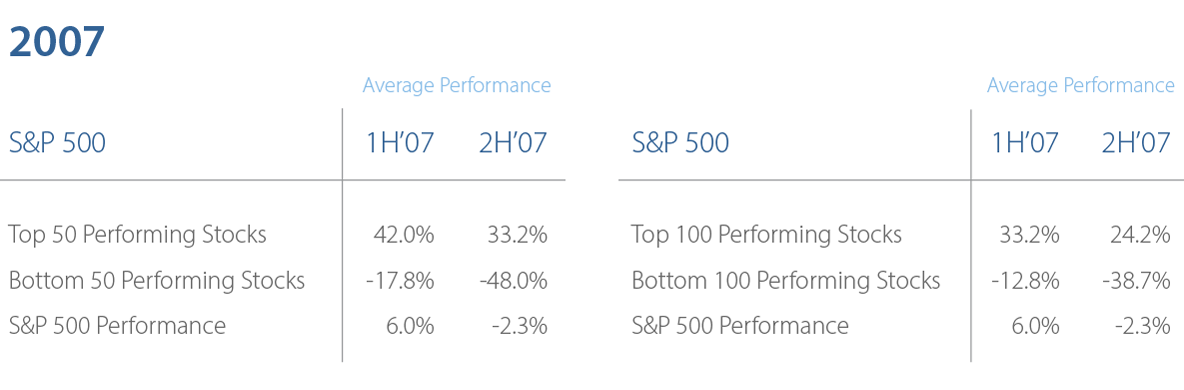

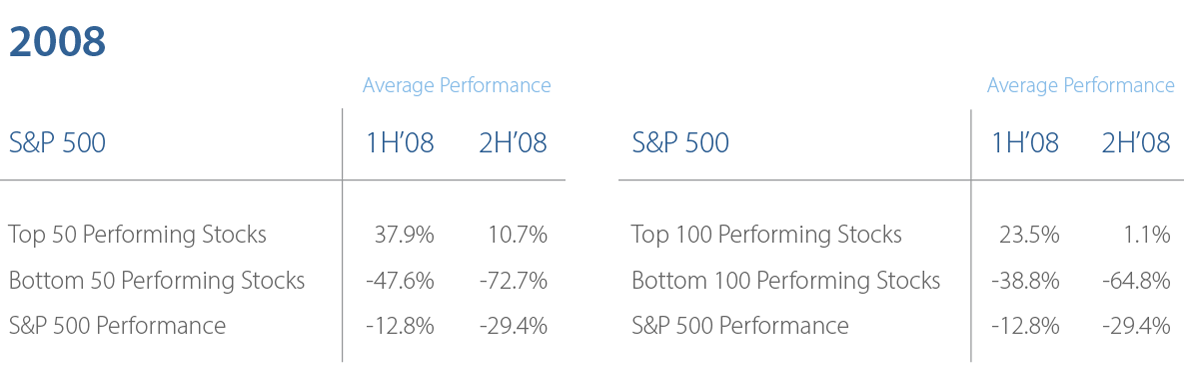

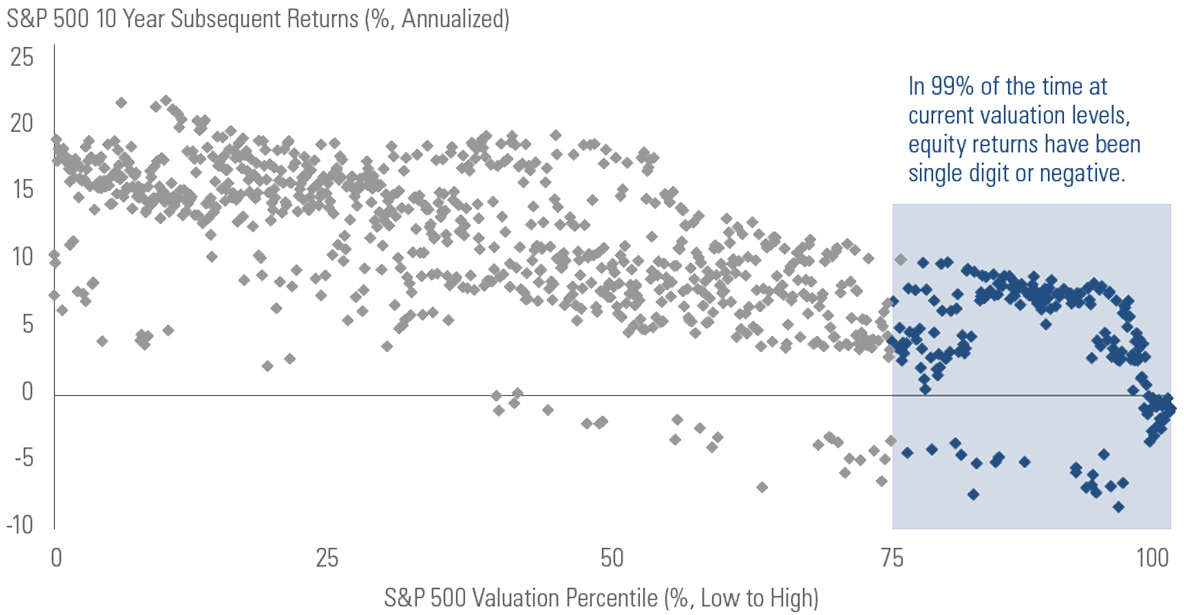

For asset allocators who have increasingly more exposure to passive indexes, the challenge is even greater. The massive shift to passive indexing and lower return environment may force asset allocators to consider new ways to manage tail risk while incorporating alpha into their investment framework. When correlations go to one, alpha potentially becomes a function of avoiding losses in the worst stocks vs. non-commoditized beta and alpha in higher quality stocks.

In the current context of the changes in volatility, we want to provide food for thought around risk diversification and tail risk management across the multi-asset complex.

- Risk parity: Multi-asset strategies that are predominately focused on traditional markets for their performance, but which use leverage to make more use of lower-returning betas, such as exposure to interest rates/duration and inflation (typically, via inflation linked bonds), in order to create a risk balanced portfolio. Tail risk management is largely a function of the integrated risk-balancing techniques of risk parity in an attempt to protect the portfolio at times of economic crisis. This could prove difficult in an inflationary environment where the portfolio has leveraged exposure to bonds.

- Top-down macro: Multi-asset strategies reliant on market returns to achieve the majority of their growth, making them suitable for investors that need a low-governance, all-in-one solution. Tail risk management is largely a function of diversification and mean-variance optimization techniques in an attempt to protect the portfolio at times of economic crisis. Due to a high level of index exposure and tactical allocation techniques, a traditional top-down approach where the asset allocation process is out of sync with the security selection may experience more downside risk in a failing market.

- Idiosyncratic: Multi-asset strategies that place a significant emphasis on tactical asset allocation and/or specific trade ideas to create a portfolio less reliant on traditional market returns, but still typically long-bias.

In a rising rate environment, risk parity and top-down macro strategies could possibly struggle with managing tail risks relative to a bottom-up approach. Knowing what you own is critical in down markets where all stocks are not created equal. The same thinking applies for building multi-asset class structures where each structure is not created equal.

The current change in the markets forces asset allocators to evaluate sources of return and tail risk management techniques. Ensure that you have the right multi-asset approach.

All Stocks Are Not Created Equal in Down Markets

Why It Matters

Bottom-up multi-asset class investing has the potential to better align the asset allocation process to the security selection process in the current market environment. This is in relative context to pure risk parity and top-down macro asset allocation strategies. While it’s an ongoing debate, the best long-term multi-asset class approach, a “winner-take-all environment” creates a favorable backdrop if correlations go to one and you believe downside volatility will increase.

“A flexible, bottom-up multi-asset approach that can sync the asset allocation process to the security selection process may be underappreciated in the current construct of institutional portfolios.”

In a second scenario, if expected returns for stocks and bonds stay low in a more inflationary type environment, global, regional and pare-wise correlations may decrease over time requiring a more bottom-up active approach that emphasizes security selection. Recognizing each multi-asset approach has value over various periods of time, a flexible, bottom-up approach that can sync the asset allocation process to the security selection process may be underappreciated in the current construct of institutional portfolios.

Key Benefits of a Bottom-Up Multi-Asset Approach

![]()

Increased Risk Diversification

The point of having a bottom-up multi-asset class allocation is not to maximize returns, but to maximize the opportunities across a more diversified opportunity set while managing downside risk. Therein lies one of the key benefits versus more traditional top-down macro strategies and asset allocation programs with heavy allocations to passive indexing.

![]()

Potential for Higher Alpha in a Low Return Environment

Many top-down, macro-oriented multi-asset strategies tend to invest in “commoditized” beta instruments exposing institutional investors to undue market risk. A flexible, bottom-up multi-asset strategy also can provide non-commoditized beta and potentially higher alpha in a low return environment while managing tail risk. The ability to incorporate a bottom-up multi-asset approach with plan assets that are overallocated to passive may appear more attractive going forward as volatility normalizes and risk premia increases in stocks.

![]()

Increased Time Diversification

Incorporating a mutually exclusive bottom-up multi-asset class strategy that has lower correlation to risk parity and macro strategies could improve time diversification across your multi-asset class complex of managers.

Learn more about our bottom-up, multi-asset approach.