Seeking Quality and Value in the Housing Industry

Westwood’s Team-Based Approach

Westwood’s U.S. Value investment process is a team-based approach. Our analysts identify, analyze and recommend individual stocks for inclusion in Westwood portfolios. Research groups, based on sector coverage, review the work from each analyst, challenging assumptions and vetting the investment thesis to determine if the stock is appropriate for the U.S. Value approved list. Each strategy’s portfolio managers, while also analysts, are also tasked with building portfolios of stocks from the approved list that meet that particular strategy’s risk and return objectives. The portfolio management team bears final responsibility for building the portfolio and managing portfolio risk for an individual strategy.

The housing sector either directly or indirectly involves hundreds of companies and billions of dollars in market capitalization. The Federal Reserve’s tightening campaign, intended to tamp down inflation and tap the brakes on the economy, has exacted a severe toll this year on the sector. Through data and anecdotal information, we’ve seen a tremendous slowdown in home buying and home building.

Our investment thesis in support of the housing sector rests on three fundamental pillars: affordability, current supply and improving demographics. When each of these pillars shows a positive trend, we believe the housing sector may be an attractive investment opportunity. When one or more of the pillars is challenged, it’s a difficult sector in which to invest.

Let’s examine each of these pillars as they stand today, and more importantly, where they might be headed over the next 12 to 36 months.

Affordability

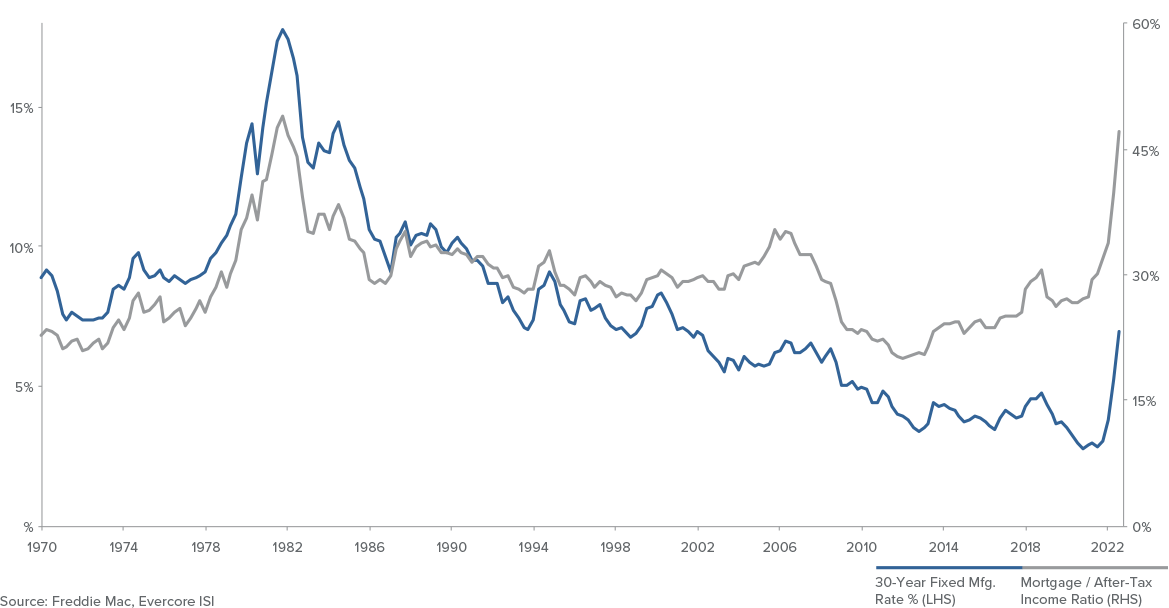

Mortgage rates have been on a consistent decline for the past 30 years, falling from double-digits in the late 1980s to the mid-3% range prior to the pandemic in 2020. The low financing allowed millions of homeowners to purchase new homes and helped current homeowners refinance existing mortgages.

| Late 2021 | Sept. 2022 | |

| Home Price | $465,000 | $465,000 |

| Down Payment | $93,000 | $93,000 |

| Loan Amount | $372,000 | $372,000 |

| Mortgage Rate | 3.2% | 7.0% |

| Monthly Payment | $1,608 | $2,474 |

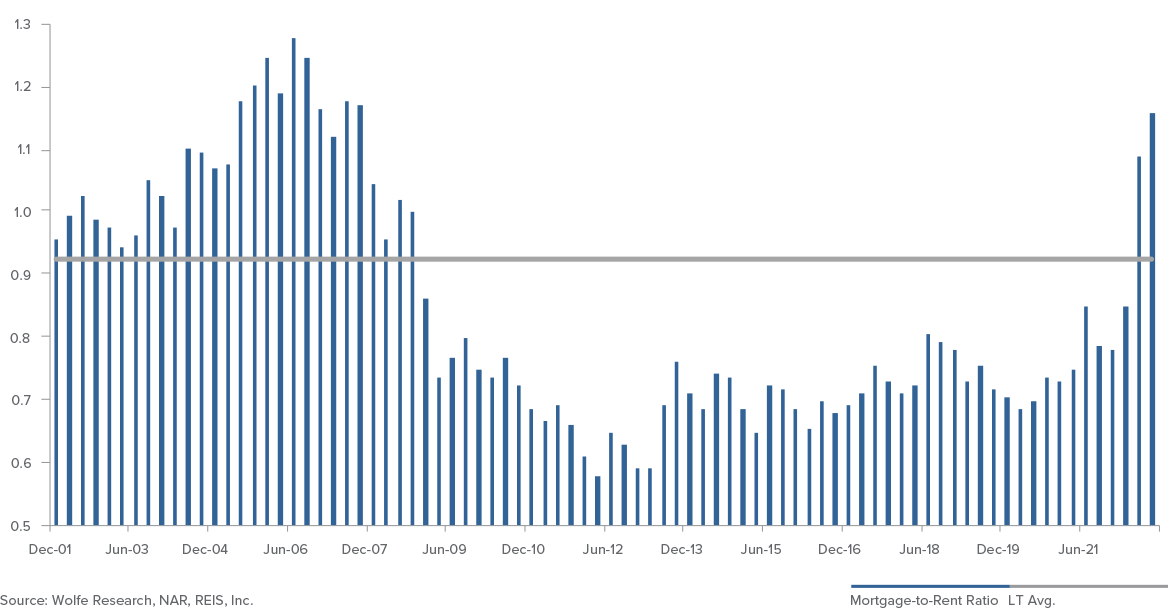

It’s not just low mortgage rates. The cost to rent skyrocketed in 2021 as well, so that the financial calculus to buy a home made more sense to first-time buyers, relative to renting.

But affordability has suffered a huge setback this year. Mortgage rates have soared as the Federal Reserve increased short-term rates; the national average for a 30-year mortgage is now over 7%. What that means is a homebuyer who originally considered a mortgage at $1,600 a month at 3.2% rate would now owe nearly $2,500 a month for the same loan, more than 50% higher.

The increase in mortgage rates will have an impact on purchasing decisions. Rental increases have not kept up with higher mortgage rates, pushing potential purchasers out of the market. Current homeowners may decide not to sell their homes, reducing the available housing supply. And many older homeowners may choose not to sell homes to move into alternative options for care, as they would receive less for their home.

Current State: Severely Challenged

Average Mortgage Rate vs. Housing Affordability Index

Housing Supply

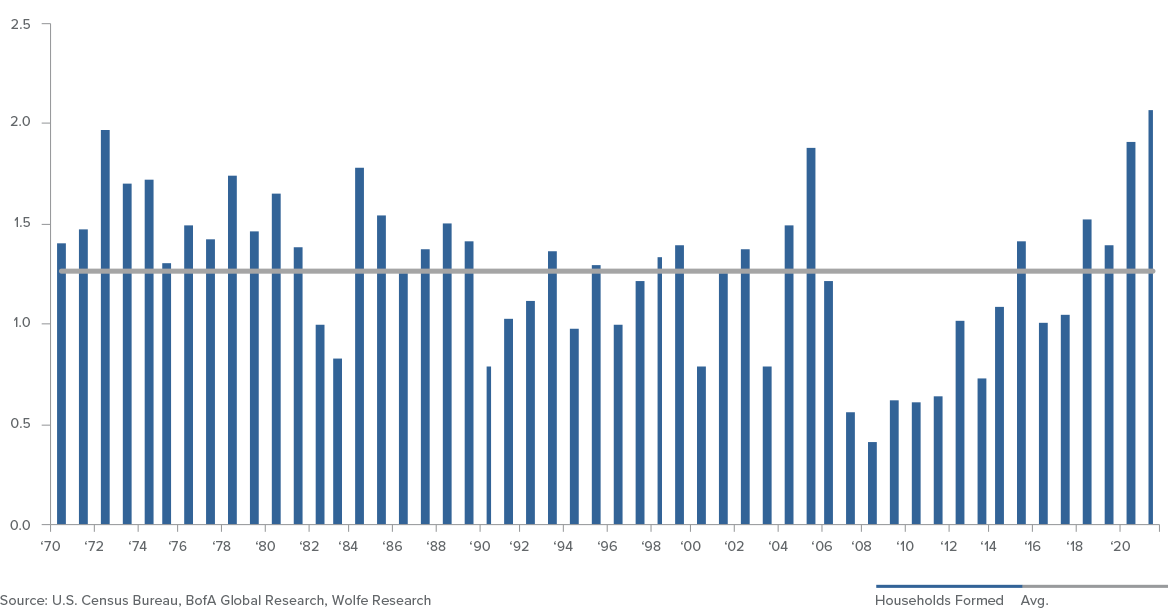

The housing supply argument rests on the belief that the housing industry is chronically underbuilt, with new housing starts trailing household formation since 2009. In addition, over 6 million homes were converted to rental units between 2005 and 2016, taking more supply out of the market for potential purchasers. With constrained or limited supply, housing prices can remain stable or rise, regardless of demand.

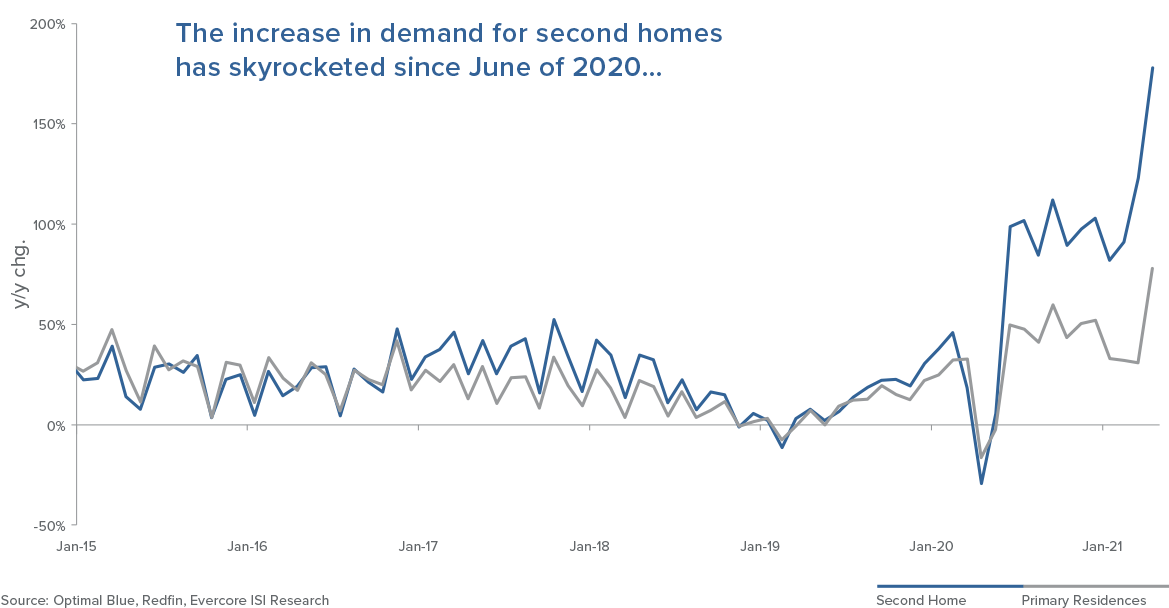

Additional forces that are limiting supply are the number of seniors in the baby boom generation that are not leaving their residences. Called “aging in place,” more seniors are opting to stay in their homes, reducing resale inventory. And the purchase of second homes for vacation or rental property has risen by more than 150% since the onset of the pandemic, further reducing supply.

There are headwinds to the supply crisis that will hold it in place, if not make the situation worse. Supply chain issues are a concern for housing – with raw materials, finished goods, and labor among them. And as mortgage rates rise, fewer homeowners are looking to sell, since they would most likely be buying into the higher rate environment.

Current State: Tight and Getting Tighter

Mortgage Rate Locks–Second Homes

Demographics

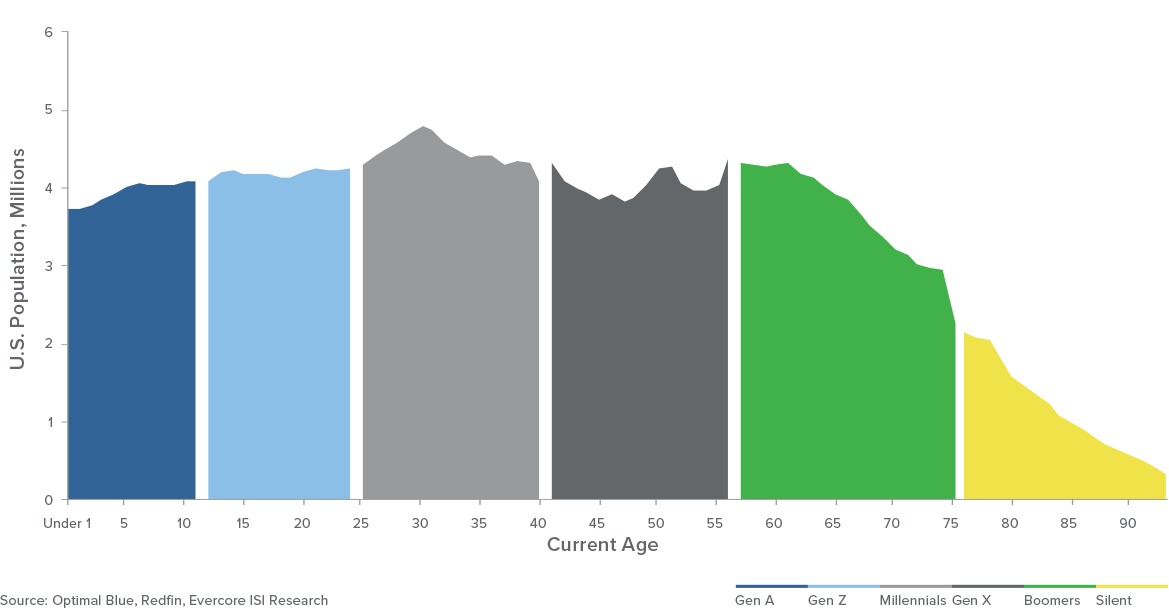

A key support for the housing industry is the impending demographic wave: millions of Millenials forming families and seeking to move from rental units into single-family housing. Household formation has grown since the depths of the Great Financial Crisis in 2009 and looks to continue its positive path.

U.S. Population by Age and Generation Cohort

With the large millennial generation moving into their prime spending age – late 20s to early 40s – the demographic story behind housing is strong. While it’s clear that millennials have in general started forming households later, postponing that initial house purchase to the mid- to late-30s, they are catching up quickly as household formation has risen over the past couple of years.

Current State: Strong and Improving

U.S. Household Formations (Millions)

Investment Thesis Revisited: Where Do We Go From Here?

As stated previously, the investment thesis for the housing sector rests on the pillars of affordability, available supply, and demographics. When all three pillars are moving in concert, the sector may be a profitable place to invest. When one or more of the pillars are challenged, investors generally use caution – making it a great time for a value-oriented manager to find quality at an attractive price. As we look at the market today, it’s clear that the affordability thesis no longer applies.

As we look at the market today, it’s clear that the affordability thesis no longer applies. As mortgage rates have risen, purchasing a home has come off the table for many households, and the own vs. rent meter seems to squarely point to renting.

Mortgage-to-Rent Ratio

However, home builders are being creative in this environment, offering incentives and other inducements to potential buyers to get them to pull the trigger. We’ve seen a pickup in adjustable rate mortgages (ARMs), which reduces the cost to potential purchasers. Some builders are using rate buydowns, knocking off 100 to 200 basis points (bps) from the interest rate, which will save a purchaser 4% to 8% off the purchase price. This may push the mortgage rate to the mid-5% range – while that’s not 3.5%, it’s still pretty attractive to first-time home buyers.

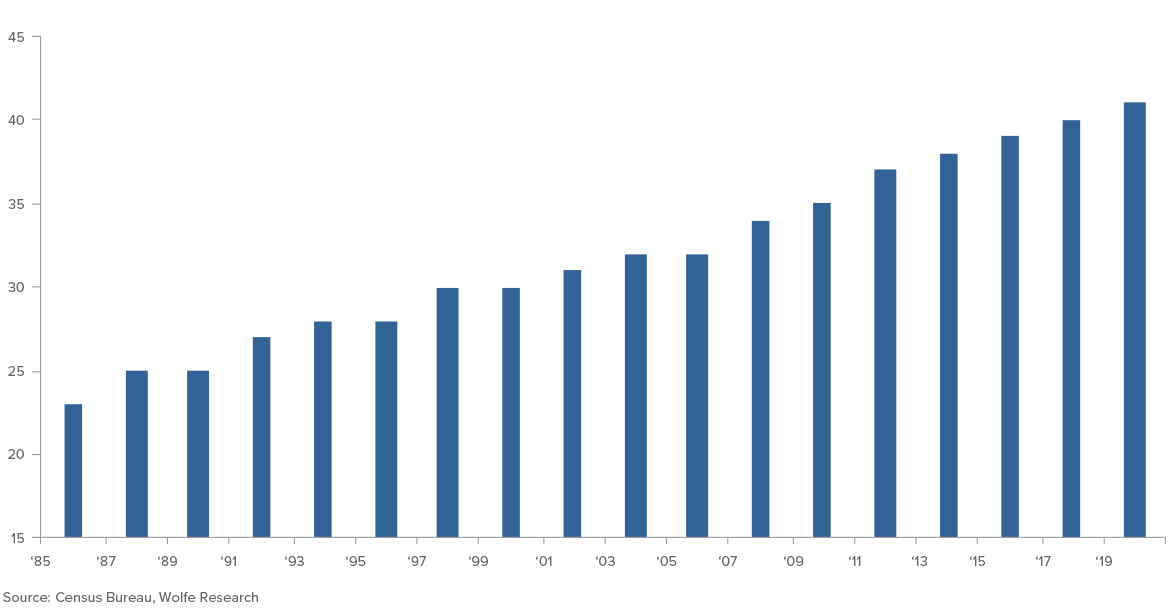

Now let’s look at supply. In general, housing supply is tight, even though new single-family housing starts have risen every year since 2011. We’ve chronically underbuilt in this country, and we remain well below the long-term historical average for annual housing starts. Moreover, our existing housing stock is aging: the median age for a house in the U.S. is over 40 years, as of 2019.

Median Age of the Housing Stock

If you’re looking for a bright spot, know that building trends and supply issues tend to be more regional and vary city by city. Some markets in the west, such as Phoenix, Boise and Southern California, have seen significant price declines in this market, while other markets in the Southeast and Sun Belt, such as Dallas, Nashville and Charleston, seem to be in better shape. Migration patterns are also part of the picture, as people move from states such as New York, California and Illinois, to states such as Florida, Tennessee and Texas.

Finally, the demographic picture is attractive, and getting better. According to the Census Bureau, we’re starting to see an uptick in household formation in 2022, a recovery from pandemic lows. Moreover, we’re seeing a particular increase in older new households, started by those ages 30-34 and 35-44, in particular. These older first-time home buyers will be looking for entry-level homes, but also seem to place a higher emphasis on a high-quality build and certain amenities that make work-from-home or a home-based business possible.

In addition, new households need all sorts of things in their new home – furniture, kitchen appliances, televisions, patio furniture and electronics. They also need custom items like wireless internet, upgraded doors and windows, soundproofing in the walls and other amenities. The follow-on effects from household formation increase the investment opportunity in the space.

Quality and Value – and Timing

Timing plays a significant part when considering investment opportunities in the housing sector. The sector, and home builders in particular, has historically bottomed when interest rates and mortgage rates peak. Further, the group tends to be one of the leaders in a market correction, falling well before some other sectors decline.

Thus far in 2022, as the broad equity market has declined, homebuilders and other industries connected to housing have followed the historical pattern. However, they look attractive from a valuation standpoint, particularly some of the homebuilders who are trading at 60% to 70% of book value. In addition, publicly traded homebuilders have gained market share, which gives them greater access to labor, materials and land, and allows them to manage costs better because of their scale.

Homebuilder Group ROA vs. BV Multiples–Ex NVR

Finally, there are some additional areas of the housing sector that are attractive – the home improvement group, for example, as homeowners use DIY projects to improve the value of their homes. Certain groups such as building materials are attractive, as homeowners repair and remodel rather than trade up; we have found a few quality companies here, with attractive valuations and strong market position.

Conclusion

The Westwood approach emphasizes quality and value, focusing on companies that are profitable and show financial strength, and also trade at an attractive price relative to earnings, book value and competitors. Within the housing sector, it’s often hard to find both of these qualities at the same time – when a company starts to show financial strength, it can quickly become overvalued, or a company can be such a great value largely because all other fundamental metrics have deteriorated.

Our investment thesis in housing can help us identify potential winners in the sector, as well as point to a proper entry point. We look for companies that can help buyers purchase a house, either through incentives or attractive pricing. We look for companies that have the financial strength to build in challenging times, maintaining earnings growth potential even in a downturn. And finally, we seek companies that are serving attractive demographics, either first-time buyers entering the market, or long-time homeowners repairing and upgrading their homes. Using our quality value process, we continue to uncover attractive names in the sector that meet our criteria for investment.

Mr. Rodgers joined Westwood in 2019 as a Senior Vice President, Senior Research Analyst, specializing in industrials and materials. Prior to joining Westwood, he was a portfolio manager at BP Capital Fund Advisors. Prior to that, Mr. Rodgers was at Carlson Capital for 10 years, as an industrials/materials portfolio manager within the Relative Value team. Prior to Carlson, he spent nine years in sell-side equity research, with five of those years at UBS as an Institutional Investor ranked analyst. At UBS, Mr. Rodgers followed industrial, building materials and housing-related equities. He holds the CFA charter and graduated from Cornell University in 1995 with a Bachelor of Science in economics.