...and how they can impact wealth

More and more people are purchasing art. In fact, sales through dealers grew an astounding 20 percent from 2015 to 2016. Mind boggling art sales have occurred in recent years, including two remarkable sales in 2017, Leonardo da Vinci’s Salvator Mundi, which sold for just over $450 million and Roy Lichtenstein’s Masterpiece, which sold for $165 million. Of course, these are special cases, but art sales seem to be on the rise globally and here in the Americas. In 2016, art sales through dealers and auctions in the Americas totaled $14.5 billion. And it’s not just the uber-wealthy who are buying art today. In fact, digital growth is strong, and about 25 percent of sales online are at a price point below $1,000.

Trend 1: Going private

Today, many private collections contend with, and sometimes surpass, public collections. This is particularly evident at the auction houses. A generation ago, art went from the auction house to museums in New York or London. Now, pieces are equally as likely to wind up in a private collection in one of those cities instead.

Trend 2: Digital drives immersion

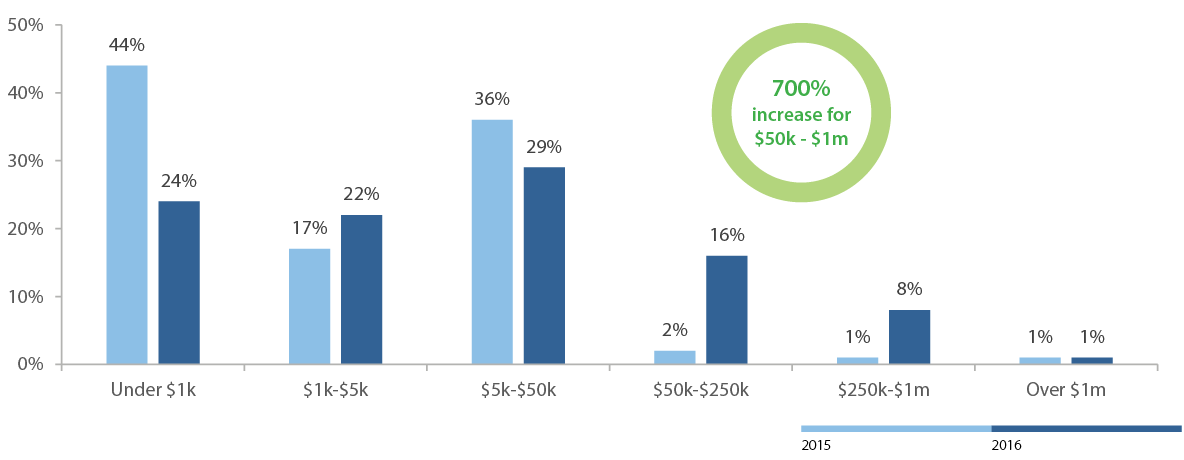

The continually-evolving digital world impacts art and artists in many ways, beyond the visual. The business of art is exploding online as more and more people have access to pieces that they love and the artists who create them. Instagram enables art enthusiasts to explore art from the comfort of their home. They can get to know the artists they follow in a whole new way. Volume of sales of online companies was significantly higher in 2016 for the $50k-$1 million price levels compared to 2015. Online art sales in 2017 were an estimated $5.4 billion according to Clare McAndrew of Arts Economics, and Saatchi Art predicts that will rise to over $9 billion by 2021.

Volume of Sales of Online Companies by Price Level

Connected to the digital growth, immersive art is a trend. According to Karen and Michael Bivins, owners of Bivins Gallery in Dallas, immersive art is taking the art world by storm. From immersive art shows at major metropolitan museums to pop-up immersion shows like Psychedelic Robot, social media is driving the public to engage with artists at events and to connect to the art itself. Gallerists and artists alike are certainly happy that one of the outcomes is a greater awareness of the art world and the potential to send art into more homes.

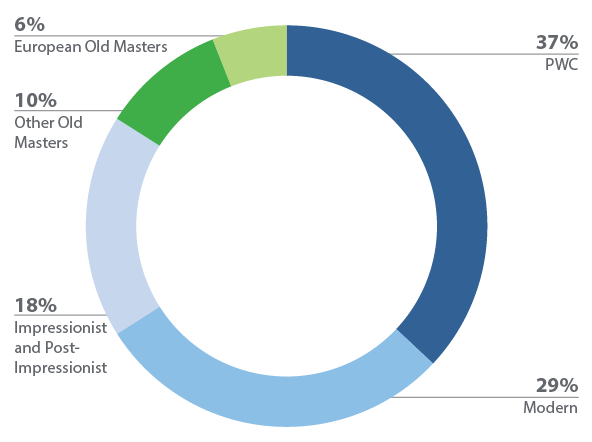

Trend 3: Modern art moves

Contemporary art is ever-more popular. Contemporary works have yielded higher prices at auction in recent years with a marked jump of nearly 30 percent between 2011 and 2015. What’s more, there is a trend of street art — bubble lettering, known as graffiti lettering, paired with stencils, statements and even stickers — migrating into the fine art space. Over the years, many graffiti artists have made the jump into the mainstream. Most recently, the French artist, JR, has caught attention with his outsized installations in communities around the world. LeCash is an LA-based artist who grew up in east Los Angeles and has similar roots. He will have his art on display at the Psychedelic Robot art exhibit in Dallas, Texas.

Market Share by Sector of the Fine Art Auction Market in 2016

(By Volume of Sales)

How do these trends affect wealth?

Certainly, if you own expensive art, it’s important to consider the estate planning impacts of your assets. Do you want to leave the art as part of your private legacy? Is it better to leave the art itself to a loved one or should you sell the piece and share the proceeds with your heirs? Would you rather share your collection with the public by donating it or parts of it?

With more people purchasing art today, there is the possibility that today’s emerging artists will create items that will have significant future value, which means that people who might not otherwise have had to tackle these types of questions will need to navigate them in the future. “One thing I love about art,” said Bivins, “is that it’s an asset you can appreciate while it is appreciating.”

“One thing I love about art, is that it’s an asset you can appreciate while it is appreciating.”

– Michael Bivins, Bivins Gallery

When it comes to investing, art is one place where you can and should let your emotions come into play. Instead of the usual advice around holding on to investments, weathering volatility and staying focused on the investment outcomes, investing in art is about embracing your emotions and finding something that you love.