Executive summary

- Holiday spending in 2023 was surprisingly robust, led by apparel and restaurants.

- Headwinds remain: higher inflation, higher interest rates, credit card debt, student loan debt.

- Shopping habits are changing: online grows, inperson retail slows and bargain hunting is the name of the game.

- If the Fed reduces rates, we expect to see a greater capex spend and higher tech spending by consumers.

Consumer spending was strong to close out 2023, as consumers overcame several headwinds to continue spending. Those obstacles haven’t gone away — and all eyes remain on the Federal Reserve, as interest rates could be a key factor in whether consumers continue to spend in 2024.

Spending Grows, but Slower Than in Previous Years

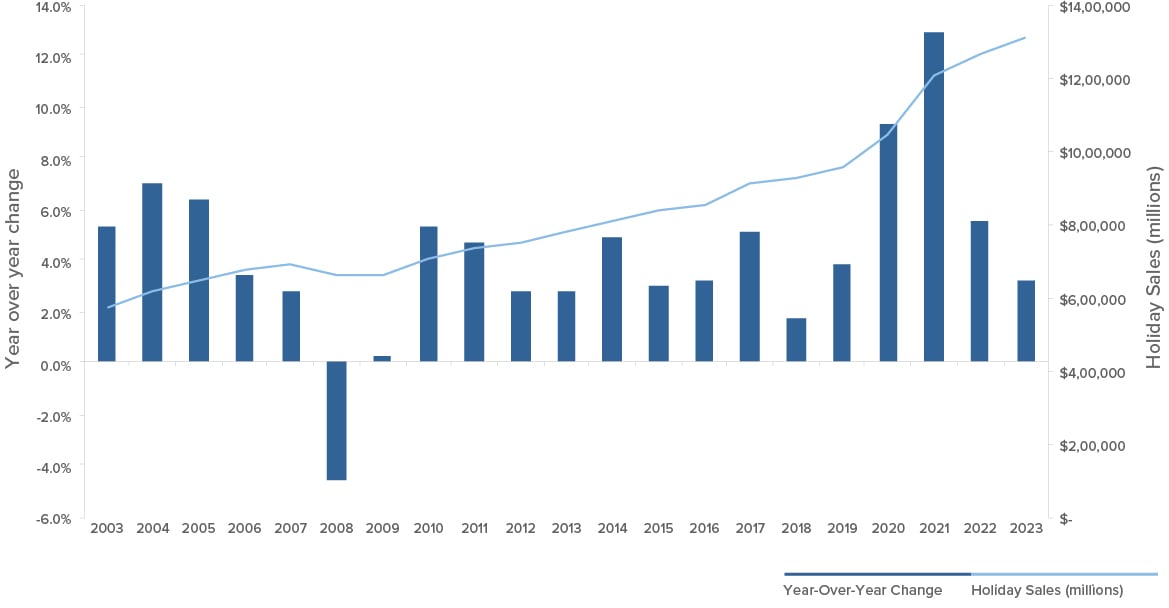

Consumer spending in the holiday season rose 3.1%, surprising analysts who expected a more modest increase after the last few years when pent-up demand sent sales soaring. Consumer spending was especially robust for food and apparel, particularly in restaurants, where spending increased by 7.8%. Sales of electronics and jewelry were slightly lower year-over-year.

While sales weren’t as strong as they were from 2020 to 2022, the gains were more in line with historical averages from 2010 to 2019. The National Retail Federation (NRF) noted that pent-up demand from the COVID-19 pandemic and excess monetary stimulus helped support spending increases, averaging over 9% for those years. “It is not surprising to see holiday sales growth returning to pre-pandemic levels,” said NRF CEO Matthew Shay in a press release. “Overall household finances remain in good shape and will continue to support the consumer’s ability to spend.”

2023 Holiday Spending Increased, but Slows

Household Headwinds Include Inflation, Rates and Debt

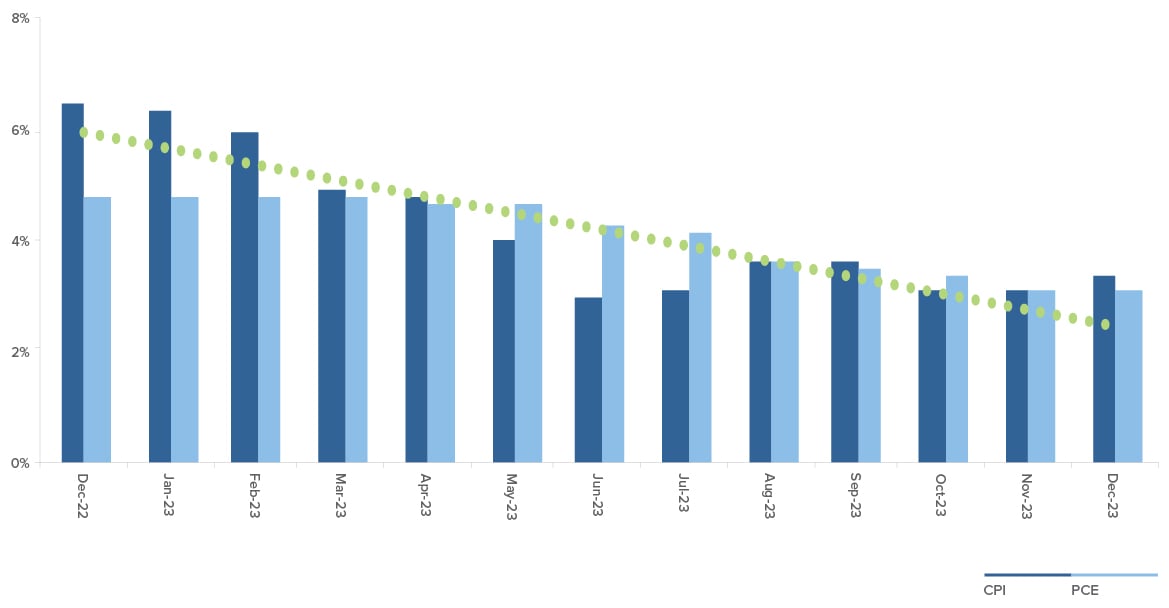

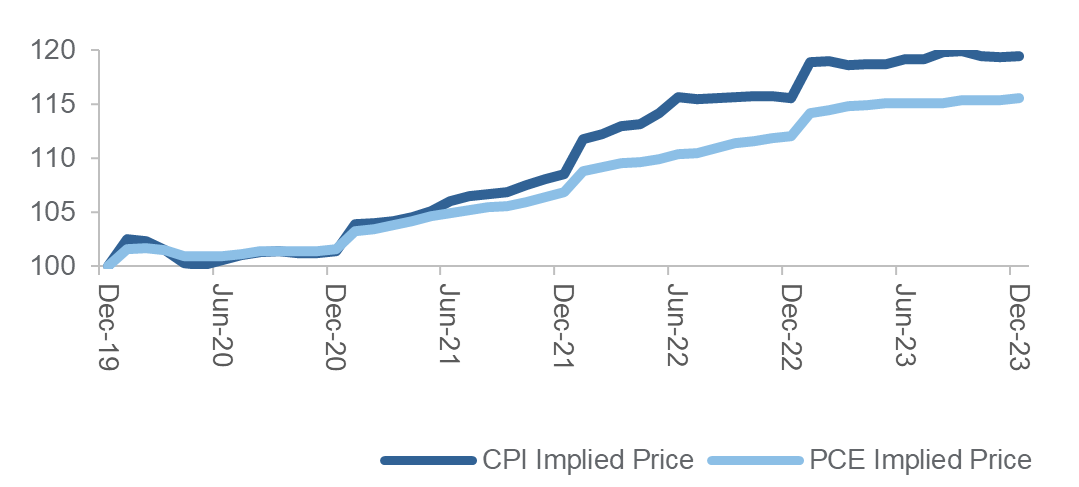

But are household finances truly in “good shape?” The headwinds that face consumers today may not have slowed spending this year, but they could have an impact through 2024. For one, inflation remains an issue – though the rate of increase is lower than it was in the summer of 2022, we’re still north of a 3% annualized CPI, above the Fed’s “acceptable” target of 2%. The longer-term impact of inflation means that an item that cost $100 in December 2020 now costs $118, and that’s a challenge.

U.S. Inflation ‒ YoY (%)

Moreover, as the Federal Reserve has increased interest rates, credit card interest rates have risen as well, causing more pain for consumers, who already have to cope with higher credit card debt levels. On top of this, student loan payments have restarted, adding more weight to the consumer debt load. Given that consumer spending is typically considered to be two-thirds of GDP, these headwinds could combine to push the U.S. economy into recession.

Price Indexed (Dec-19 = 100)

Online Shopping Grows, but In-Person Remains Attractive

One thing that was clear from holiday spending is that the shift to online is accelerating. Online spending growth outpaced brick-and-mortar sales, as web-based sales grew 6.3%, compared to in-store sales, which grew just 2.2%.

Online sales growth is driven by many factors, including convenience and choice. Some shoppers use in-store displays to try-before-you-buy, before going online and selecting the brand and style they need. Other online trends include bargain shopping, looking for the best price among dozens of retailers rather than just the one or two you would find in the mall, and spearfishing, shopping to quickly buy only the items on your shopping list.

But in-person shopping remains an integral part of the retail mix. According to a study from Total Retail, stores that develop compelling, engaging in-person shopping experiences can win over harried consumers. More than 80% of shoppers say they would return, and 64% will spend more in a store if they have a positive in-store shopping experience.

Mastercard SpendingPulse ™

U.S. Holiday Retail Sales

November 1 – December 24

| 2023 vs. 2022 | |

| Total Retail (ex. auto)

In-Store Online |

+3.1%

+2.2% +6.3% |

| Apparel

Electronics Grocery Jewelry Restaurents |

+2.4%

-0.4% +2.1% -2.0% +7.8% |

Lower Rates Could Spur Consumer and Corporate Capex

So where does consumer spending go from here? Employment is probably the most important factor as we enter 2024. As long as consumers continue to work, and wages continue to rise, they should continue to spend.

Interest rates are another factor. The Federal Reserve holds the key to the level and direction of interest rates. If the Fed begins to cut rates — as nearly everyone believes, though the timing is up in the air — that should stand to benefit borrowers, particularly those in the market for large purchases such as houses, automobiles and appliances.

Moreover, lower rates could lead to a pickup of capital expenditure investment by businesses, to grow product lines, increase production capacity or expand into new markets. The technology sector would likely lead any growth in capex spending, as many firms see broad opportunities to invest in new products that incorporate artificial intelligence.

Optimistic, but Cautious

Inflation remains a factor, and job growth has recently surprised to the upside, so the timing of the Fed’s next move is still up in the air. Interest rates are but one factor in consumer spending, impacting the housing market, sales of big-ticket items, as well as things like credit card debt and loan repayments. While spending seems to be slowing, it remains to be seen whether we’re in for a “soft landing,” or whether consumers will fold their pocketbooks and go home.

We will continue to monitor the retail landscape to understand what consumers are thinking, where they intend to spend and whether their habits are changing. At Westwood, our fundamental, bottom-up research on individual companies will always guide our decisions on security selection and portfolio allocation, as we carefully invest in quality companies that trade at attractive prices.