Spotify has more than 600 million customers on its music, podcasting and audiobook platform. It’s one of the 200 most valuable stocks in the U.S.

But despite its size and familiarity, Spotify and its $90+ billion market cap has been absent from the flagship global index series of one of the most prominent global index providers.

The reason for this peculiarity is based on the MSCI index inclusion rules. Spotify is a Swedish company, but its primary listing is in the U.S. The company’s float-adjusted market cap should get it included in the index series that tracks the broad U.S. market, but their Swedish headquarters prevents it from being eligible.

According to their index rules, MSCI does not include foreign-listed stocks in their country-level indexes unless they meet specific criteria. Historically, Spotify didn’t qualify for inclusion in the country-level MSCI Sweden Index, and thus Spotify was also not included in the widely tracked MSCI EAFE index.

Earlier this year, MSCI announced that foreign listings will become eligible for the MSCI Sweden Indices beginning at the November 2024 Review. This came as Sweden met the Foreign Listing Materiality Requirement at the May 2024 Index Review.

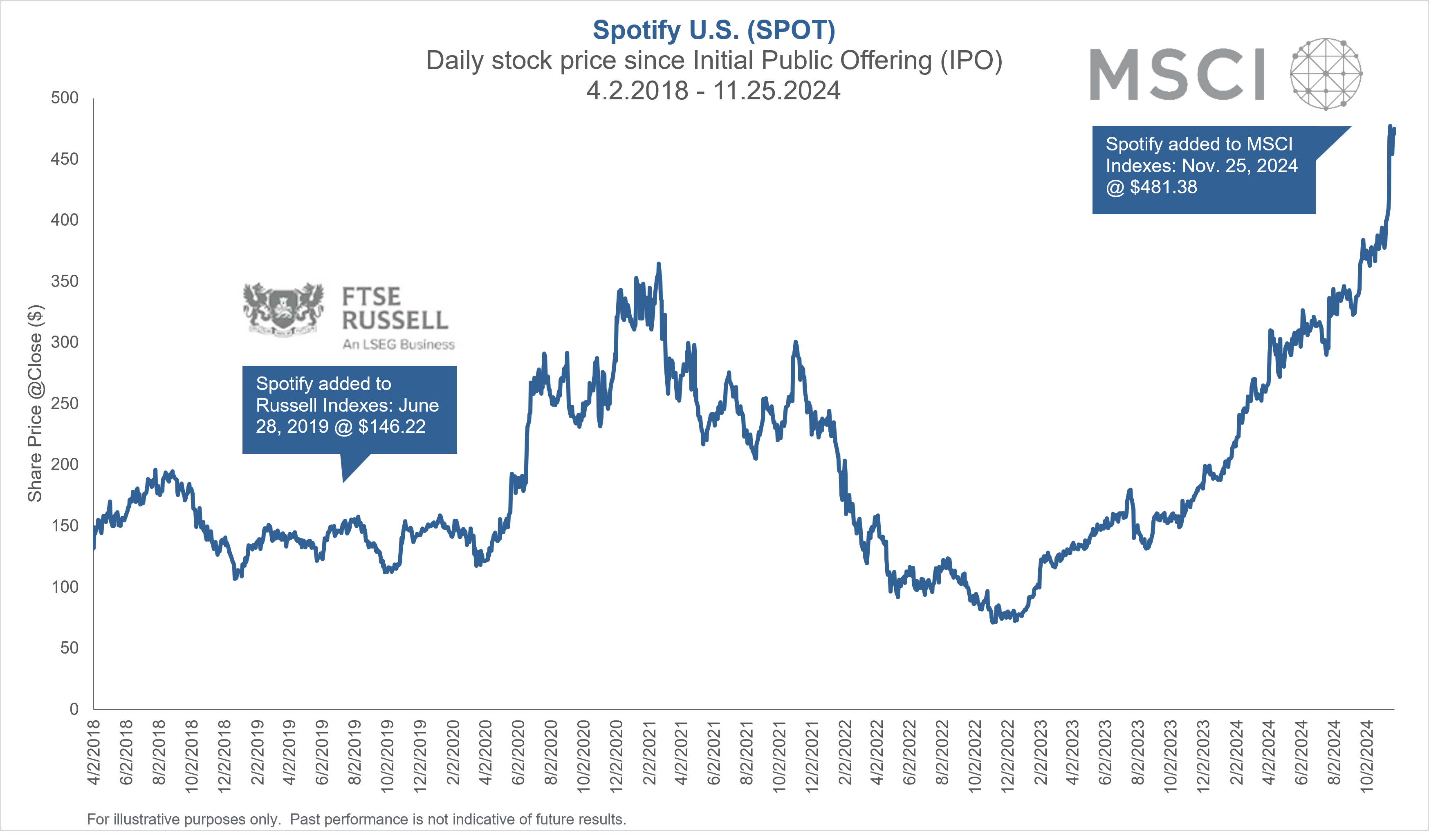

As a result, MSCI added Spotify during their quarterly Index Review this month. Large investors, including asset managers and institutional investors, will have to purchase a substantial amount of Spotify stock to track the MSCI benchmark accordingly. The index implementation point is the closing price on the primary exchange, and more than $8.2 billion of Spotify’s stock was traded on November 25, 2024, at $481.38 per share, the all time high for the stock.

Index providers operate under rules-based methodologies, and although they may seem similar from afar, they are often quite nuanced and specific.

For example, FTSE Russell, which oversees the Russell family of indexes, treats foreign listings differently. The London-based index provider uses a simple test to determine where to include a company: If the country of incorporation, stated headquarters and trading exchange are the same, that’s where the stock will be included. If any of these are different, Russell looks closer at trading volume, as well as corporate assets and revenue.

In the case of Spotify, the company is incorporated and headquartered in Sweden, but the primary shares are listed and traded on a U.S. exchange so Russell included the company with their U.S.-based indexes. Spotify was added to the Russell 1000 Index in June 2019, a little more than a year after its IPO.

The practical impact to investors is that those using Russell indexes have seen gains of over 200% with Spotify, while MSCI-benchmarked investors are just now adding the company. In this case, design matters and can make a big impact on index returns.

Westwood Managed Investment Solutions

Benchmark construction and portfolio selection can be one of the most important challenges for institutional investors. Westwood’s Managed Investment Solutions team can help with both sides of that process, from creating customized benchmarks to your specifications to developing unique investment solutions using those benchmarks as a guide to implementation and performance tracking.

Contact us for more information about building customized solutions for your unique goals, beliefs and objectives.