Incapacity means that you are either mentally or physically unable to take care of yourself or your day-to-day affairs. Incapacity can result from serious physical injury, mental or physical illness, advancing age, and alcohol or drug abuse.

Incapacity can strike anyone at anytime

Even with today’s medical miracles, it’s a real possibility that you or your spouse could become incapable of handling your own medical or financial affairs. A serious illness or accident can happen suddenly at any age. Advancing age can bring senility, Alzheimer’s disease, or other ailments that affect your ability to make sound decisions about your health, or to pay your bills, write checks, make deposits, sell assets, or otherwise conduct your affairs.

Planning ahead can ensure that your wishes are carried out

Designating one or more individuals to act on your behalf can help ensure that your wishes are carried out if you become incapacitated. Otherwise, a relative or friend must ask the court to appoint a guardian for you, a public procedure that can be emotionally draining, time consuming, and expensive. An attorney can help you prepare legal documents that will give individuals you trust the authority to manage your affairs.

Managing medical decisions with a living will, durable power of attorney for health care, or Do Not Resuscitate order

If you do not authorize someone to make medical decisions for you, medical care providers must prolong your life using artificial means, if necessary. With today’s modern technology, physicians can sustain you for days and weeks (if not months or even years). If you wish to avoid this, you must have an advance medical directive. You may find that one, two, or all three types of advance medical directives are necessary to carry out all of your wishes for medical treatment (make sure all documents are consistent).

A living will allows you to approve or decline certain types of medical care, even if you will die as a result of the choice. However, in most states, living wills take effect only under certain circumstances, such as terminal injury or illness. Generally, one can be used only to decline medical treatment that “serves only to postpone the moment of death.” Even in states that do not allow living wills, you might want to have one anyway to serve as evidence of your wishes.

A durable power of attorney for health care (known as a health-care proxy in some states) allows you to appoint a representative to make medical decisions for you. You decide how much power your representative will have.

A Do Not Resuscitate order (DNR) is a doctor’s order that tells all other medical personnel not to perform CPR if you go into cardiac arrest. There are two types of DNRs. One is effective only while you are hospitalized. The other is used while you are outside the hospital.

Managing your property with a living trust, durable power of attorney, or joint ownership

Consider putting in place at least one of the following options to help protect your property in the event you become incapacitated.

You can transfer ownership of your property to a revocable living trust. You name yourself as trustee and retain complete control over your affairs as long as you retain capacity. If you become incapacitated, your successor trustee (the person you named to run the trust if you can’t) automatically steps in and takes over the management of your property. A living trust can survive your death, but it can be expensive to maintain and administer.

A durable power of attorney (DPOA) allows you to authorize someone else to act on your behalf. There are two types of DPOAs: an immediate DPOA, which is effective immediately, and a springing DPOA, which is not effective until you have become incapacitated. A DPOA should be fairly simple and inexpensive to implement. It also ends at your death. A springing DPOA is not permitted in some states, so you’ll want to check with an attorney.

Another option is to hold your property in concert with others. This arrangement may allow someone else to have immediate access to the property and to use it to meet your needs. Joint ownership is simple and inexpensive to implement. However, there are some disadvantages to the joint ownership arrangement. Some examples include (1) your co-owner has immediate access to your property, (2) you lack the ability to direct the co-owner to use the property for your benefit, (3) naming someone who is not your spouse as co-owner may trigger gift tax consequences, and (4) if you die before the other joint owner(s), your property interests will pass to the other owner(s) without regard to your own intentions, which may be different.

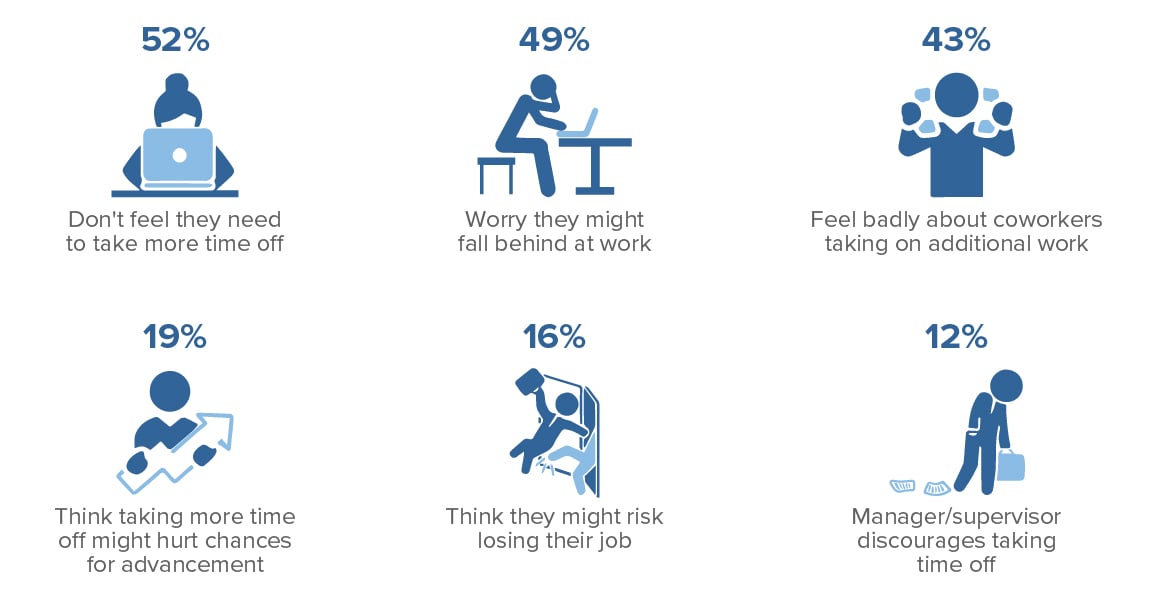

Why Do Workers Take Less Paid Time Off Than They Can?

In a 2023 survey, nearly nine out of 10 workers said it was extremely or very important to have a job that offers paid time off (PTO) for vacations, doctor appointments, and minor illnesses. Yet almost half said they take less time off than their employers allow. Here are the top reasons they gave for not using all their PTO.

How a Family Limited Partnership Can Power an Estate Plan

One challenge faced by family-run businesses involves transitioning both the ownership and operations from one generation to the next. A family limited partnership (FLP) is a legal agreement that enables business owners and their heirs to address succession, estate, and tax planning needs all at once.

Business owners who want family members to inherit their businesses in the future could use FLPs to transfer assets out of their taxable estates during their lifetimes. And to do so, the owners of a valuable business might begin this process many years before they intend to give up operational control.

Estate tax threat

The IRS calculates the estate tax due on an individual’s gross taxable estate by adding the value of all owned assets, including a home and a business, and subtracting any applicable exemptions. Even if the taxable estate falls below the current generous federal estate tax exemption level ($13.61 million or $27.22 million for a married couple in 2024), the family might not be entirely out of the woods, especially if they live in a state that has an estate tax or an inheritance tax with a lower exemption amount. Perhaps more concerning, the federal estate tax exemption is scheduled to revert to lower, inflation-adjusted 2017 levels in 2026.

When business owners fail to consider that federal and state estate taxes could be due upon their passing, the funds needed to pay the taxes may not be available, and their heirs may be forced to borrow the money or liquidate the business.

Family discount

With an FLP, general partners run the business. Limited partners (such as the children of general partners) have no vote and no say about day-to-day operations, and they are not liable for the debts of the FLP.

A general partner (or a corporation or limited liability company controlled by the general partner) can gift ownership shares to limited partners in installments that conform to the annual gift tax exclusion of $18,000 per recipient (in 2024). Because limited partners have restricted rights, these annual gifts may be valued at a discount — typically 30% or more — from fair market value. For example, more than $25,000 worth of property or business shares (currently valued at $18,000 for gift tax purposes) could potentially be transferred to each limited partner without triggering gift taxes. Of course, every family’s situation is different, and actual results will vary.

Setting up a family limited partnership can involve complex tax rules and regulations, and there are up-front costs as well as ongoing fees and operating expenses to consider. Be sure to consult with your tax and estate planning professionals.