Inclusion of Amazon in Dow Jones Shows Impact of “Passive” Investing

The origin story of Amazon, Inc. (AMZN) is nearly a legend.

Founded in 1994 in Jeff Bezos’s garage in Bellevue, Washington, the company began as an online bookstore. Bezos saw the potential of the internet to revolutionize how consumers buy and sell goods, and the company quickly expanded its retail footprint beyond books to include other products such as electronics, clothing and various household items. Innovative strategies and an aggressive expansion plan saw the company rise from humble beginnings to become one of the largest and most influential companies in the United States.

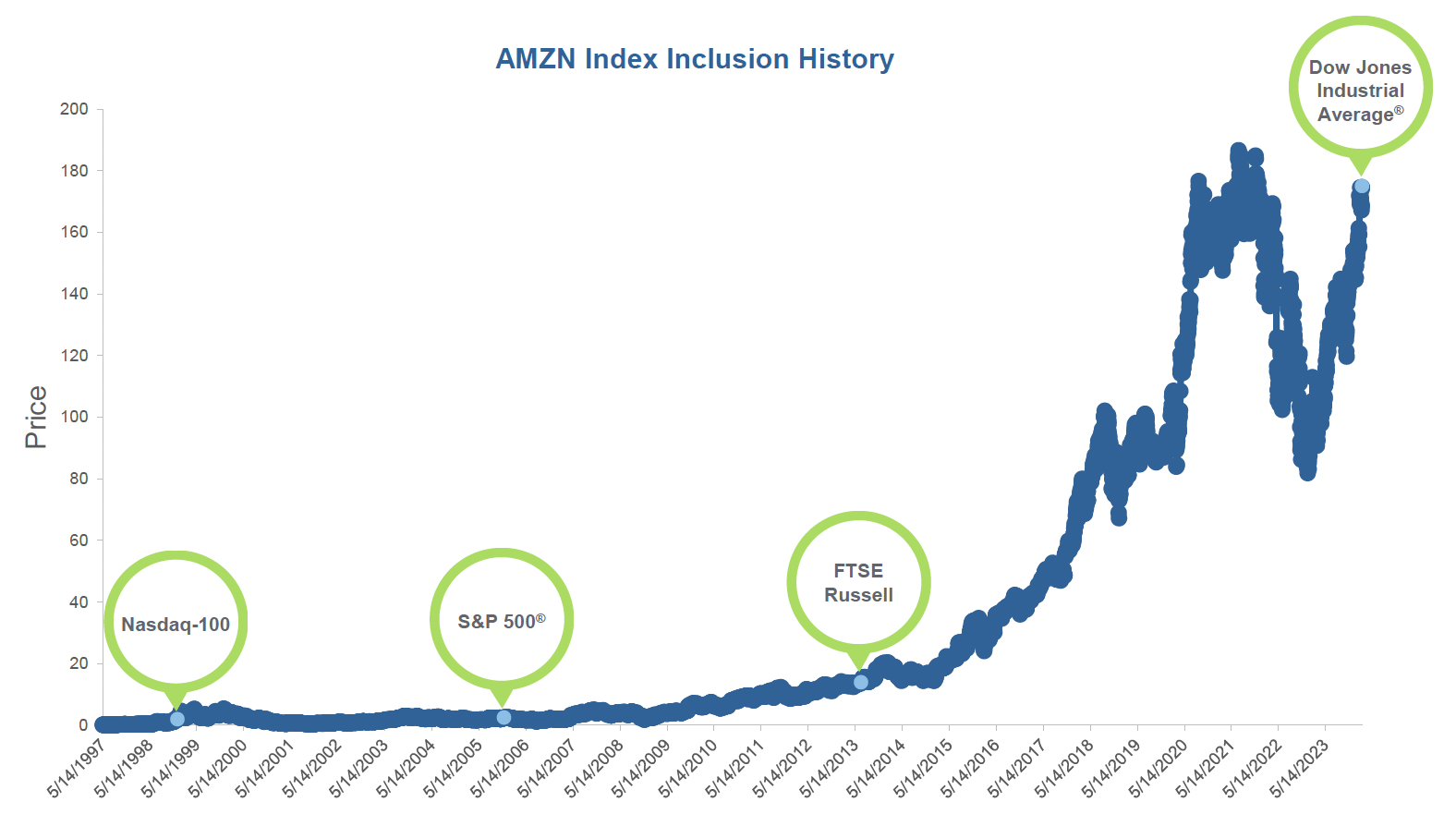

The company’s valuation and stock price have arisen from its initial public offering in 1997 to become one of the largest companies in the United States. As its market capitalization rose, it was added to equity indices such as the Russell 2000® Index, the Russell 1000® Index, the S&P 500® Index, and, in February 2024, the venerated Dow Jones Industrial Average (DJIA).

Amazon Joins Dow Jones Industrial Average in Latest “Passive” Move

At a glance, one might assume that the major U.S. equity indices are largely similar. The Russell 1000® Index and the S&P 500® Index both are considered representative of the large-cap U.S. equity market, and they are 99% correlated for the trailing 10 years.

However, over the past 36 months, the S&P 500® Index has outperformed the Russell 1000® Index by nearly 400 bps on a cumulative basis. This discrepancy, driven largely by a select few stocks in the large-cap technology sector — the so-called “Magnificent 7” — underscores the active nature of index security selection.

| 1Q 2024 | 1 Year | 3 Years (cumulative) | 3 Years (annualized) | |

|---|---|---|---|---|

| S&P 500® Index | 10.56 | 29.88 | 38.59 | 11.49 |

| Russell 1000® Index | 10.30 | 29.87 | 34.75 | 10.45 |

Source: eVestment. For illustrative purposes only. Past performance is not indicative of future results. Indexes are unmanaged, do not incur management fees, costs and expenses, and cannot be invested in directly. The index is unmanaged and is not available for direct investment.

The addition of Amazon to the DJIA highlights the dynamic nature of indexing. While most investors consider index investing to be “passive,” the process of index construction, selection and implementation entail active decision making. The variance between indexes becomes even more pronounced when considering additional factors such as market capitalization, investment style, quality, volatility or thematic methodologies.

Amazon’s stock price surged by more than 5% in the 10 days after the announcement that it would be added to the DJIA. There was similar price action in 1997 when Amazon was added to the Russell 2000® Index , when it was included in the Russell 1000® Index in June 1998, and when it joined the S&P 500® Index in November 2005.

While rules-based index methodologies dictate purchasing the stock at the most recent closing price, thoughtful implementation can mitigate the risk of wealth erosion. The selection of indexes demands the same rigorous due diligence as evaluating active management strategies, emphasizing the importance of a clear understanding of index construction and limitations.

Westwood Managed Investment Solutions

Benchmark construction and portfolio selection can be one of the most important challenges for institutional investors. Westwood’s Managed Investment Solutions team can help with both sides of that process, from creating customized benchmarks to your specifications to developing unique investment solutions using those benchmarks as a guide to implementation and performance tracking.

Contact us for more information about building customized solutions for your unique goals, beliefs and objectives.

Sources: Amazon joins Russell 2000 6/30/97, Russell 1000 6/30/98 (p. 9); Amazon to join S&P 500; https://www.nytimes.com/2005/11/15/technology/amazon-tojoin-s-p-500-index.html