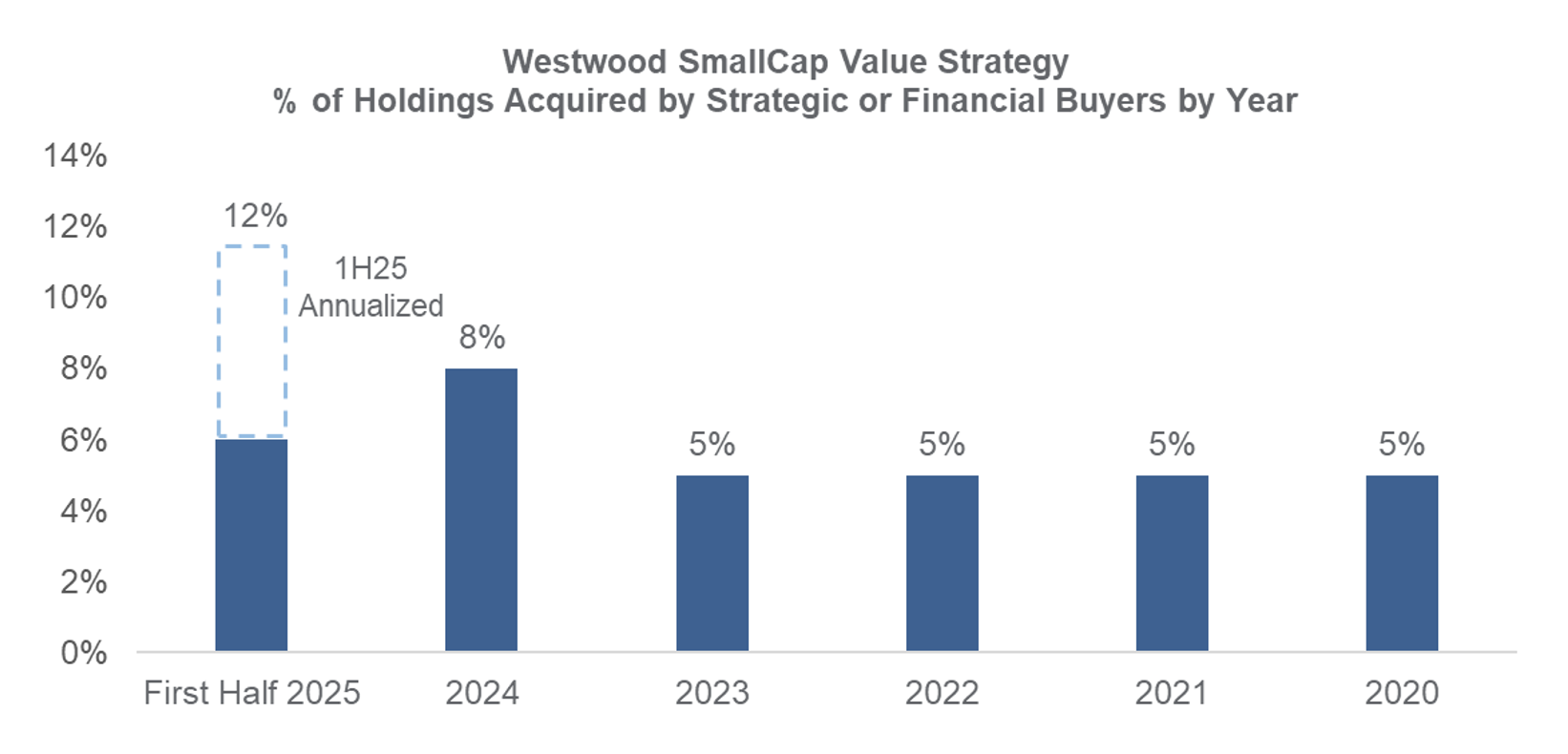

We’re seeing an acceleration of M&A activity in the broader market for small caps, as well as within our portfolio. In our opinion, the small-cap market is attractively valued, particularly in the higher quality end of the spectrum.

We look for companies that generate strong free cash flow, have high returns on invested capital and low levels of debt. These are attractive characteristics to strategic and financial buyers, even more so if companies that demonstrate these quality characteristics are trading at a discount relative to the market or their peers.

Should M&A activity continue to accelerate, it could represent a helpful tailwind to returns for our clients.

Source: Westwood analysis. Data as of 6/30/2025.

See important disclosures below.