First Quarter Review

As 2021 drew to a close, Santa Claus seemed poised to gift investors with a continued boom in equities, only to have his intentions doused by widespread, sticky high inflation, warnings of future earnings growth and an unprovoked conflict that has further disrupted already struggling global supply chains. What’s more, the Russia-Ukraine war could upend the way the world conducts its trade, logistics and commerce — leading to more “on-shoring” and other trends that could have both positive and negative impacts domestically (more on that later). And while pandemic troubles have been aggressively addressed (at least superficially) by unprecedented global stimulus and the rapid deployment of vaccines, those actions also have consequences. At just about every level, the monetary, fiscal and policy “cures” have triggered another set of risks that threaten to remove a good portion of fanfare away from the world’s “reopening.”

Assumptions — End 2022

| Real GDP | +3.5% vs. 3.4% consensus |

| Core Inflation | 4.5% vs. 4.4% consensus |

| Fed Funds Rate | 2.0%-2.25% (7 hikes) |

| Oil (WTI) | $80/bl 2022e |

| Unemployment Rate | 3.6% vs. 3.6% consensus |

| S&P 1y Fwd P/E Ratio | 20.0x |

The high-water mark for stocks in the S&P 500 came just after the New Year on Jan. 4, followed by an almost immediate 11% correction that shook the already fragile foundations of investor confidence. As fourth quarter results flowed in, the “risk-on” mentality that dominated much of 2021 shifted to a more cautious tone from executives, analysts and pundits alike. The final quarter of 2021 revealed relatively strong earnings for the S&P 500, but failed to impress, as market participants pondered the rising prices of just about everything, a quicker than expected rate hike pace and growing geopolitical tensions. These factors were unfortunately enough to quell a rebound in equities in early February.

Ironically, even though big-tech earnings carried the S&P in the first quarter, tech names like Meta (Facebook), Netflix, AMD, Tesla and many others were given major “haircuts” as investors grew concerned about everything from supply chain issues and higher interest rates, to consumer spending and even the potential for recession. Simply put, 2022 will not be a tide that lifts all ships — high-flying names with ultra-rich valuations heavily dependent on growth will face much higher scrutiny both in their reported results and forward guidance.

That said, we do see continued opportunities in value and alternative income type investments, along with select emerging markets and some key areas that thrive in higher interest rate and inflationary environments. Some key tech names do continue to flourish, especially those with focus on remote work and cybersecurity; some best-in-breed names like Alphabet and Apple have also rebounded with vigor. For now, the labor market remains extremely tight and consumers, though more cautious, continue to spend.

The Impact of the Russia-Ukraine War

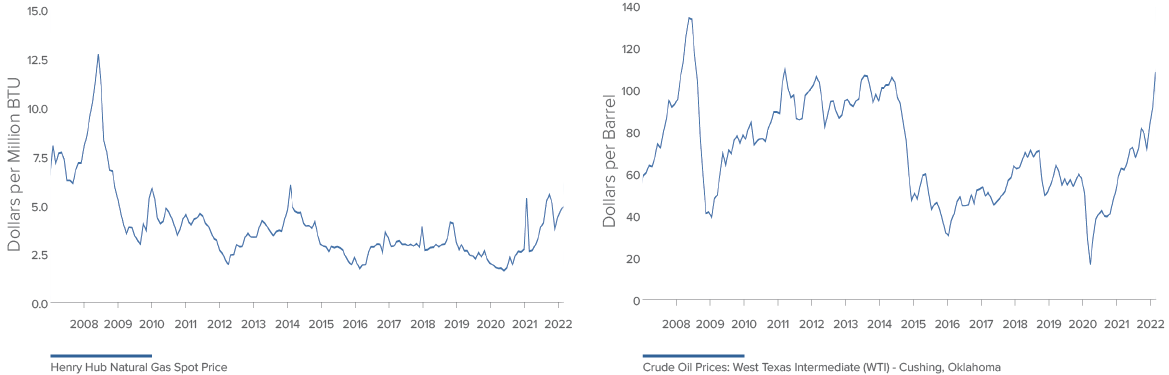

While the outcome of this conflict remains unknown, its effects are likely to reverberate for some time. Food, energy and global trade confidence are all at stake. Much of the runup in commodity prices, specifically oil and natural gas, had been driven largely by supply-side issues (pandemic-related shutdowns, military actions, domestic rig reductions and so on) as demand steadily came back online during the last year. But the most recent catalyst for energy and food inflation has been Russia’s invasion of Ukraine, which has forced the world to rethink energy consumption, distribution and obviously triggered even potential deeper supply-side challenges that will impact trade agreements outside the war-affected region.

Russia is a significant exporter of all sorts of commodities, accounting for 13% of global crude oil production, 17% of natural gas production and is the largest exporter of wheat (followed by Canada and the United States). The conflict has kept Brent oil (the European benchmark) hovering around and above the $100 per barrel mark, while natural gas prices have skyrocketed to near 12-year highs.

Unfortunately, these prices are unlikely to subside in the near term as western allies pile on sanctions and enact policies to largely remove Russia as an energy supplier. To help fill the void, America is now exporting more liquefied natural gas (LNG) overseas than at any moment in time, draining our country’s inventories, applying even more upward pricing pressure. Natural gas prices had risen 43% from January to late March, and are more than double where they were a year ago. And since we are now likely to remain a primary supplier for Europe for the foreseeable future, the restocking of supplies during the spring and summer is unlikely to happen. This could prove to be an extended drag on consumers.

With Russia and Ukraine’s declining exports of wheat and fertilizer, foodstuffs are also likely to see continued price and availability impacts. And these higher energy and food prices are likely to fuel higher or at least prolong higher than trend inflation, eating into household incomes and confidence as the year grinds on.

The conflict also raises questions around the safety and stability of current global trade agreements. Business leaders and lawmakers across the globe are rethinking cross-border dependency and supply chain footprints. The solutions obviously involve an increase in local sourcing and securing the most dependable (not cheapest) sources. And while this could be good for small to medium-sized farms and businesses across America, it also further fuels inflation and is likely to eat into some corporate profits as well over the next few years.

Interest Rates

As inflation picked up in 2021, markets began to anticipate a slightly higher interest rate trajectory. The continuation of above-trend inflation pressure and declining unemployment has forced the hand of the Federal Reserve. After keeping its benchmark interest rate anchored near zero since the beginning of the pandemic, the Federal Open Market Committee raised rates by 25 basis points (with a new range of 0.25% to 0.5%) in mid-March.

The move also pushes the prime rate higher, immediately increasing financing costs for many forms of consumer borrowing and credit. We expect the committee to continue raising for most of the six remaining meetings this year, and see the federal funds rate around 1.5% by year’s end. The committee sees three more hikes in 2023 then none the following year, but its final trajectory will be predicated on how deep of an impact inflation actually has on consumers, as well as how quickly its rate hikes slow the economy. We see it increasingly likely the United States may enter a recession in 2023, albeit shallow.

Central banks’ reaction to higher energy and food prices will prove difficult to predict, as the magnitude or speed of interest rate rises to combat inflation will have to be delicately balanced to support respective economies. The answer will depend on the extent to which higher energy prices dampen growth or alternatively fuel strong wage rises as workers try to protect their purchasing power amid a tight labor market.

Energy Still a Big Deal for Consumers and Earnings

China recently implemented COVID-19-related lockdowns in Shenzhen, Changchun, Shanghai and other areas, pushing oil prices down after their near parabolic runup since February. President Biden also announced a steady release of stock from the Strategic Oil Reserve. But we shouldn’t expect either to offer too much of a reprieve, unless China’s lockdowns trigger a bigger than expected decline in demand (much of that is already factored in).

On the trade front, it’s important to note that more than 80% of the world’s oil sales are transacted in U.S. dollars (as are the major benchmarks). Saudi Arabia, the world’s second-largest producer of oil behind America, has conducted all its sales in U.S. dollars since 1974, but American dependence on Saudi oil has declined while China has made the Middle Eastern nation a primary supplier, purchasing 25% of the oil it produces. A deal would bolster the Chinese currency and could further drive up the cost of unrelated exports to the United States. The lesson here is that China’s drag on oil prices could manifest inflationary pressures elsewhere.

From an earnings perspective, record high prices have helped buoy the S&P 500 earnings results as the energy sector’s earnings are expected to be up +193.5% from the same period last year, offsetting what could have been a negative earnings quarter had the sector been stripped out of the equation.

As for trading, we believe oil will trade around the $80 range by late 2022, with a bias to the high end, and we believe natural gas may continue to trade in the upper $4 to $5 level given record U.S. exports and Europe’s new initiatives to wean off of Russian supply.

With entities such as the energy sector, one can never pinpoint exactly what’s to come in the foreseeable future. However, with these measures and observations, there is knowledge and assurance to be found to help lessen the uncertainties and bring more clarity to the industry.

Expect Strong Employment, but Growing Caution Among Consumers

The American economy continues to add jobs. While the economy added 6.1 million non-farm-payroll jobs, payroll employment remains 3.9 million below its peak in February 2020. Many Americans also decided to quit their traditional jobs or move into the “gig” economy. These trends, plus continued baby boomer retirement trends, shrunk the labor force by 2.4 million people compared to February 2020, sending the labor force participation rate lower to 61.8% from 63.3%.

This lack of labor supply combined with strong economic growth should allow unemployment to continue to decline rapidly in the coming year. We see the unemployment rate falling below 4% by mid-year. Wages in many sectors have been rising as companies compete to hire and retain a limited supply of workers.

Unfortunately, the pandemic, rising prices, dwindling customer service and continued social stresses have weighed on American consumers. While we believe that the pandemic should be mostly behind us by the end of the first quarter, there is a risk that another variant or spike in closures or travel limitations could upend a great deal of the momentum that the economy has been gaining and put future growth at risk. That said, government spending programs and a tight labor market should support consumers who opt to move back into the general labor pool for traditional work.

Record home prices and rent rates will continue to pressure consumers and unlike the Great Recession, the current boom is being fed by a lack of supply, high cost to build new and the remote work revolution, which has and will continue to shift traditional real estate trends, population density and the types of homes Americans desire. We expect real estate prices to continue to trend higher, with interest rates having only a moderate effect on value and activity. Investors have acquired large swaths of real property since the Great Recession and did so using much less leverage compared to the last boom. These owners will be less likely to “panic sell” and should add stability even in recessionary periods.

Westwood’s Broad Outlook – Looking Ahead

Despite the overall decline in COVID-19-related impact globally, there’s a strong probability that risk premium and overall volatility in both stocks and bonds is likely to persist throughout the year. Governments around the globe are now challenged with maintaining economic growth in a high inflation environment (which is very difficult to do). Without being able to slash interest rates and/or inject money into their respective economies, many nations will be limited on monetary tactics, relying on less-effective policy shifts. Rising rates will continue to impact the discounting of high-growth stocks’ long-term cash flows, resulting in less favor from investors. The hunt for yield is likely to drive interest in select emerging markets, but expect a more difficult landscape to navigate.

We believe the ongoing chip supply/demand imbalance will stimulate longer-term demand as consumers continue to feel emotionally stressed and a fear of missing out (FOMO) fueled by a lack of availability. But their strength and willingness to spend will be tempered by a myriad of aforementioned forces, including inflation, rising rates (mortgage rates saw their biggest six-month surge in 50 years), market volatility, lack of affordable housing and headlines. But there are signs that at least some supply-chain woes are easing. Domestic used car prices have declined for two months in a row. The largest chipmaker, Taiwan Semiconductor, noted softening demand for smartphones, PCs and TVs in China, and the Logistics Manager’s Index, which tracks supply chain metrics, did cite a continued surge in global inventory levels (which could help push prices lower) and a declining backlog of ships waiting off the coast of Los Angeles (indicating improving movement in goods shipments).

Look for continued volatility in equities and an increased disconnect in typical correlations as higher rates, geopolitical concerns and headline risk alter the typical behaviors observed over the last few years. Economic and corporate growth should remain above trend in the near term, but will come under threat toward the end of the year. We remain positive on credit with a preference for crossover quality selections. We see continued improvements in energy and the securitized sectors in this landscape. Credit spreads remain cheap and there are good risk-return opportunities even if valuations become stretched as spreads are still near 5-year lows. In terms of rates, we are underweight duration and see a continued rise in the 2- to 5-year yields, but a more range-bound target in the 10-year note as monetary tightening will impact growth trajectories.

In terms of sectors, we favor emerging markets and chips (semiconductor and related), as well as value in general and mRNA vaccines for future expansion and integration into other medicines.

Capital Markets Outlook | Scenario Assessment

As of March 2022

OPERATIVE Scenario:

Higher risk but known unknowns

60% Probability

- Geopolitical risk premium all of 2022.

- Uncertainty in fiscal outlook and rising rates a source of market volatility.

- U.S. Federal Reserve lifts off (hikes) this year with elevated inflation and heightened jobs demand.

- Improving global immunity and lower virus concern drives consumer confidence and heightens consumption from increased consumer savings.

- Economic growth falls from 2021 but remains above trend. Inflation remains elevated.

Scenario #2:

Cessation of risk and hostilities

25% Probability

- Less concern of broadening hostilities.

- Some fiscal impulse passes through Congress with less tax increase.

- Labor and consumer mobility improves sharply, and supply chain bottlenecks alleviated, reducing high inflation.

- Federal Reserve responds with measured rate hikes, dependent on market response.

- Increased consumer confidence leads to spending their heightened savings.

- Economic growth continues well above trend; global economy operating to capacity.

Scenario #3:

The unknown unknowns

15% Probability

- Fears of central bank tightening slow prospective growth impacting markets.

- Any broadening of the war in Ukraine beyond the Ukrainian border.

- High inflation continues, forcing the Fed’s hand to tighten financial conditions.

- Higher U.S. Dollar, global decline in export demand and supply chain problems.

- Rising risk-free yields leads to a negative response cycle from equities.

- Economic output drops while inflation remains elevated. Stagflation concern.