Someone once said, “It’s incredibly hard to become a quality company and it’s hard to ‘un-become’ a quality company.” Unfortunately, this statement doesn’t apply when investing in small cap equities. Changes can happen rapidly as less capitalized or hyperfocused business models are especially susceptible to shifts in consumer sentiments, economic health and/or competitive forces.

The dictionary definition of quality is: “a distinctive attribute or characteristic possessed by someone or something as measured against other things of a similar kind.” With the stock market sensing the economic cycle is in the later phase, many small cap investors are considering a rotation out of expensive growth into value stocks to reduce potential overexposure to high-priced volatility. Investors may also transition out of more “expensive” investments (more on this shortly), into areas of higher quality and value. And yes, quality and value both exist in the small cap universe, but can be more difficult to identify.

Morgan Stanley recently revised expectations for equities to return a sobering 4.9% per annum over the next 10 years, citing lower growth and inflation expectations. Considering investors have logged more than 300% returns in the S&P 500 since the March 2009 low, in what’s now the longest expansion in history, it’s logical to expect a rotation or “twist” from growth to value.

And while the transition seems logical, and even simple on the surface, traditional value investing can be different than “high-quality” investing and can be linked to heavily indebted, highly cyclical and unprofitable companies.

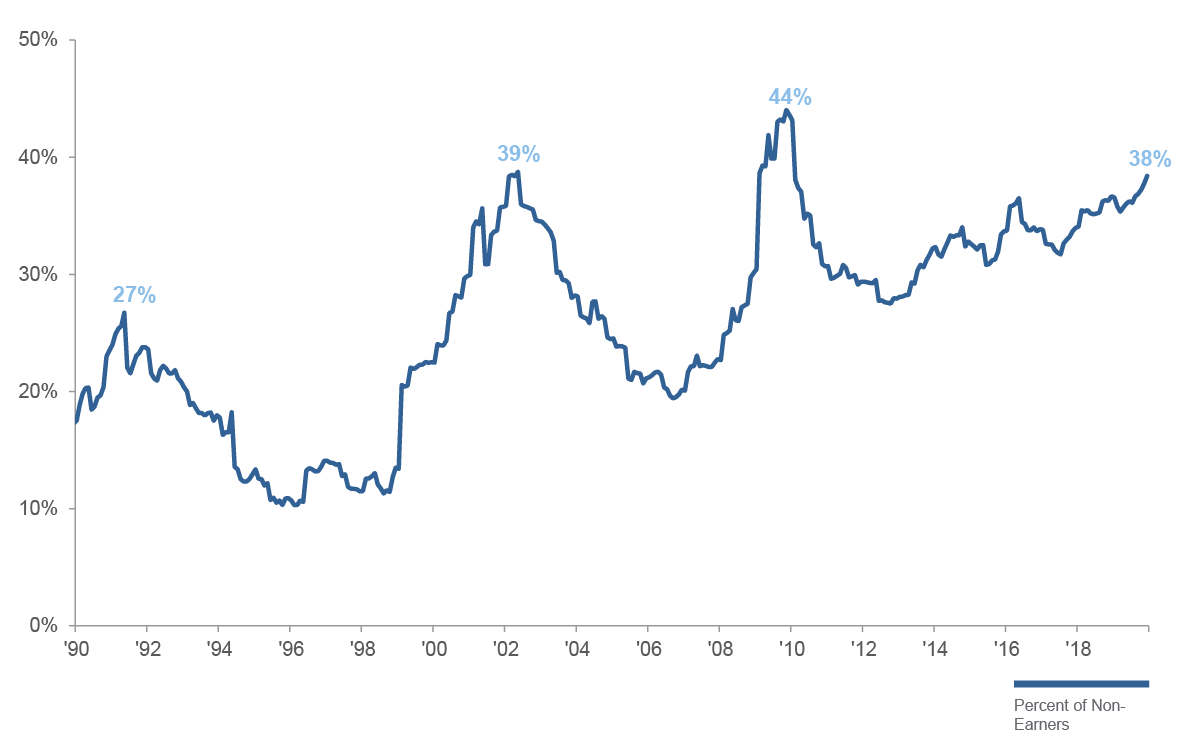

This is a critically important aspect of value that many investors tend to get wrong. In fact, with nearly 40% of small cap companies in the Russell 2000 index losing money at the peak of the cycle, quality is a distinctive investment attribute that should not be confused with traditional value investing.

Figure 1: Percent of Non-Earners in the Russell 2000 Index

(Based on Companies With Available Data)

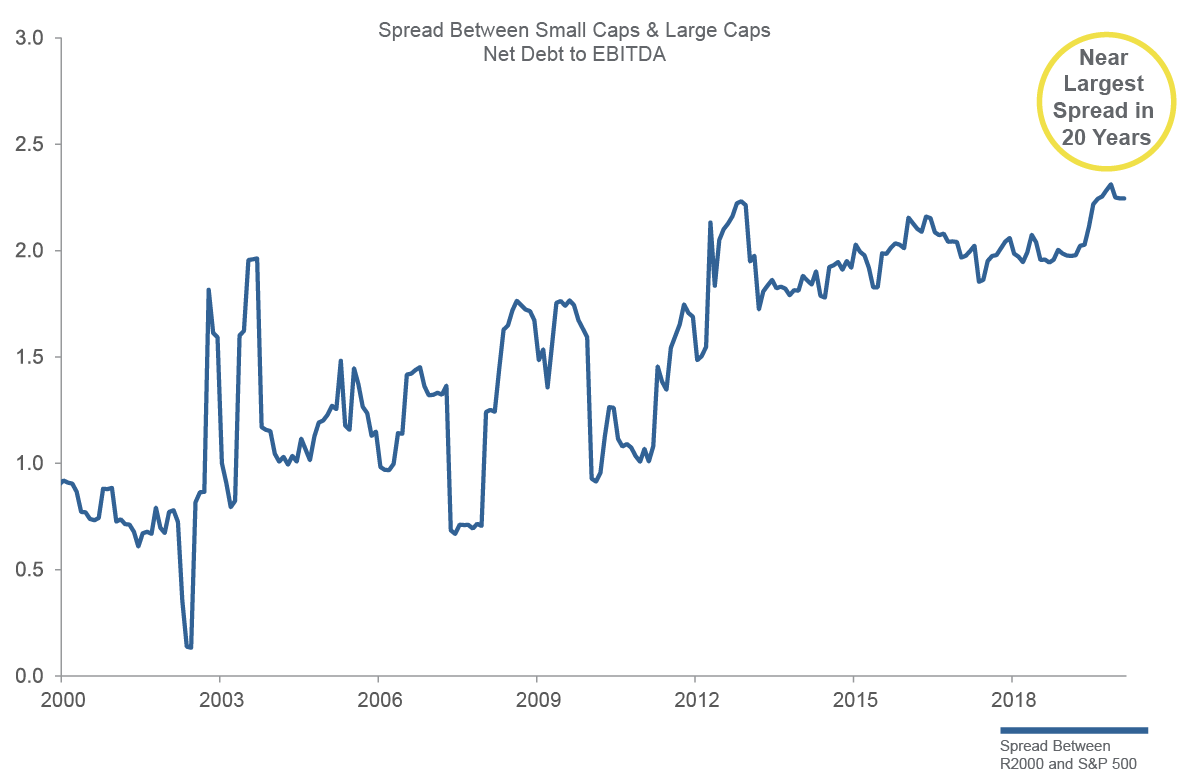

What’s more, this shift to value comes at a time when financial leverage within small cap stocks is at a multi-year peak when measured by Net Debt to EBITDA for the Russell 2000 Index (see Figure 2). This should be a red flag for investors and negates the high-quality investment thesis for more than half of the investable small cap universe despite attractive valuations.

Westwood believes there is a return premium at the intersection of quality and value resulting from “true” economic profitability, stronger balance sheets, stable business performance and lower downside risk. These same attributes are often lacking in traditional or deep value stocks. It is also often misunderstood by many investors, contributing to the secular underperformance in value as whole, and misallocation to value strategies.

Figure 2: Multi-Year Peak – High Leverage for Small Caps

Spread Between Small Caps and Large Caps (Net Debt to EBITDA)