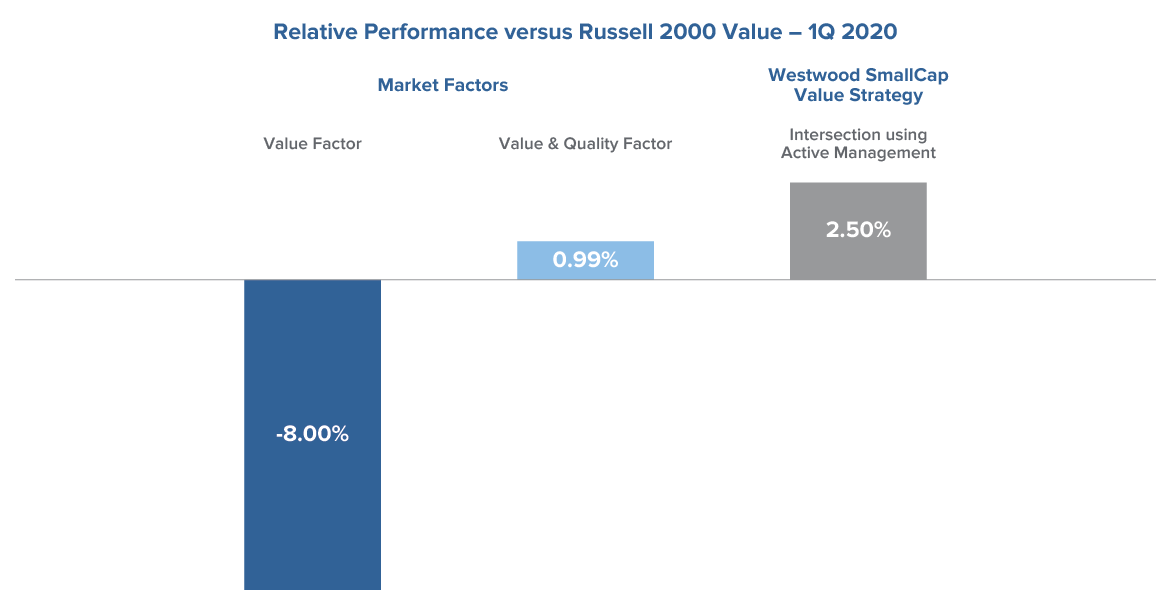

The first quarter of 2020 proved to be a challenging time for small-cap stocks, particularly small-cap value stocks. The Russell 2000 Value, a small-cap value focused index, suffered the worst quarterly decline in history falling 35.67%. Investors looking to exploit the historical risk premia found in value stocks, particularly smaller cap shares, found themselves significantly underperforming during this period of market stress. As shown below, the value factor for the small-cap universe did even worse in the first quarter, underperforming the Russell 2000 Value by 8%. We believe that investing in undervalued, high-quality businesses can generate a return premium resulting in lower absolute downside risk. This was observed in the first quarter, as a passive combination of quality and value factors netted 99 basis points in excess return versus the Russell 2000 Value while our actively-managed portfolio, at the intersection of quality and value, saw an even greater delta of 250 basis points better than the loss of the Russell 2000 Value.

Traditional Value Not Enough on Its Own…

Investing in small-cap value stocks has historically been advantageous — over the last 20 years, small-cap stocks have outperformed large-cap stocks, and within small-caps, value outperformed growth. Currently, Small Value could be particularly attractive, as it is trading at just 73% of its long-term average P/E and well below the relative levels of Small Growth.

The most recent period has been more challenging for small-cap value, however, as investors looking to exploit the historical risk premia found in value stocks, particularly smaller cap shares, found themselves significantly underperforming during this period of market stress. This has created the potential for a reversal of “fortunes” as small-cap value is now trading at the cheapest multiples relative to other styles and caps.

Current P/E as a Percentage of 20-Year Average P/E

| Value | Blend | Growth | |

| Large | 89.7% | 99.8% | 106.3% |

| Mid | 81.7% | 90.0% | 104.3% |

| Small | 73.0% | 95.1% | 134.3% |

Quality Critical to Realizing the Return Premium

However, adding Quality into the mix helped improve relative performance, as shown in the “Relative Performance versus Russell 2000 Value – 1Q 2020” chart above, and generated nearly 1% better performance versus the Russell 2000 Value for the first quarter. Currently, nearly 40% of the small-cap universe is unprofitable, and that figure is likely to rise in the near term given the current economic uncertainty.

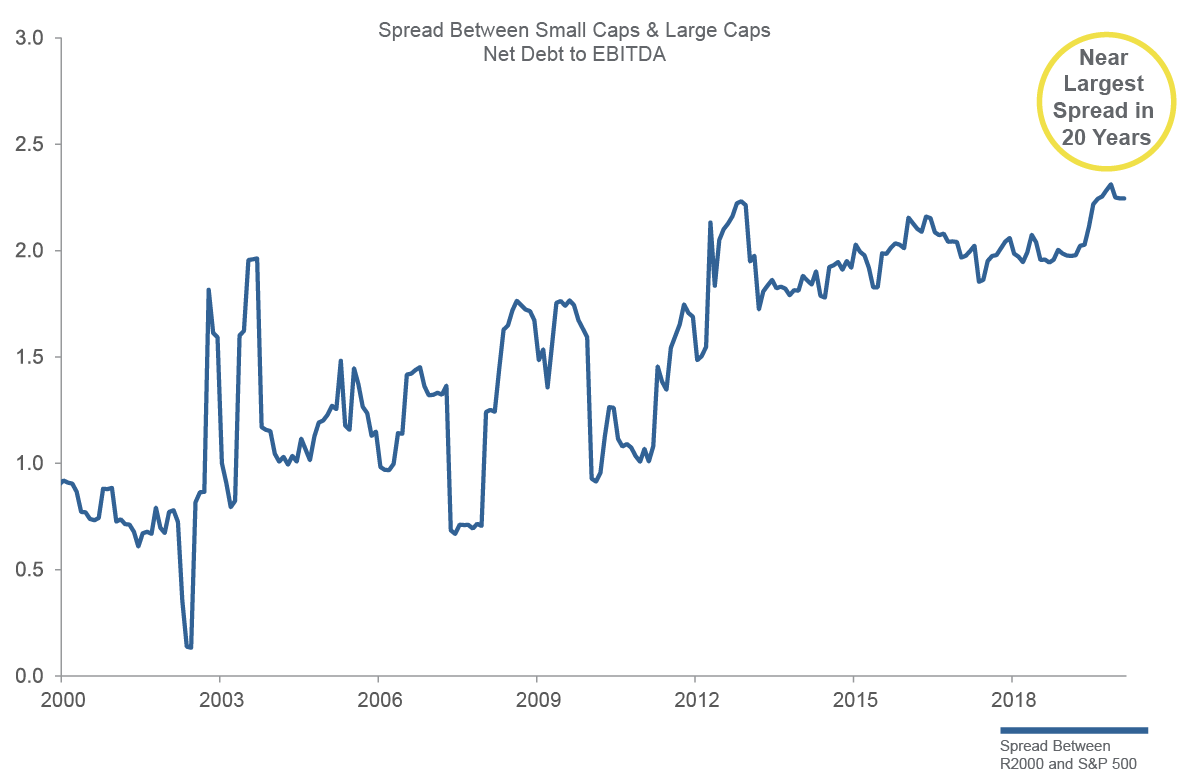

Leverage is also elevated for small-caps relative to their large-cap peers as companies have enjoyed easy access to financing with low interest rates for many years. By focusing on the higher-quality cohort, those with stronger returns and balance sheets within the small-cap universe, investors improved their outcome significantly.

Westwood SmallCap Value: The Power of Active Management at the Intersection of Quality and Value

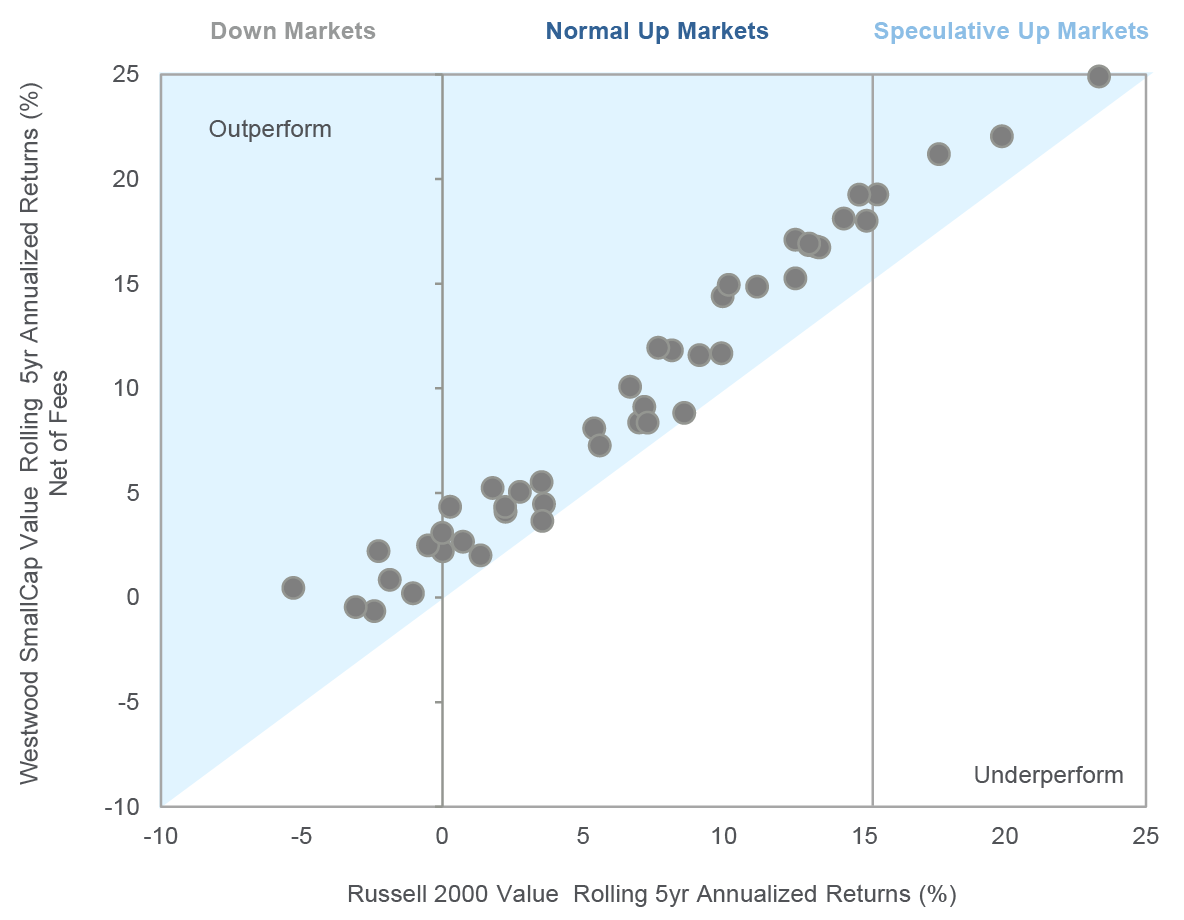

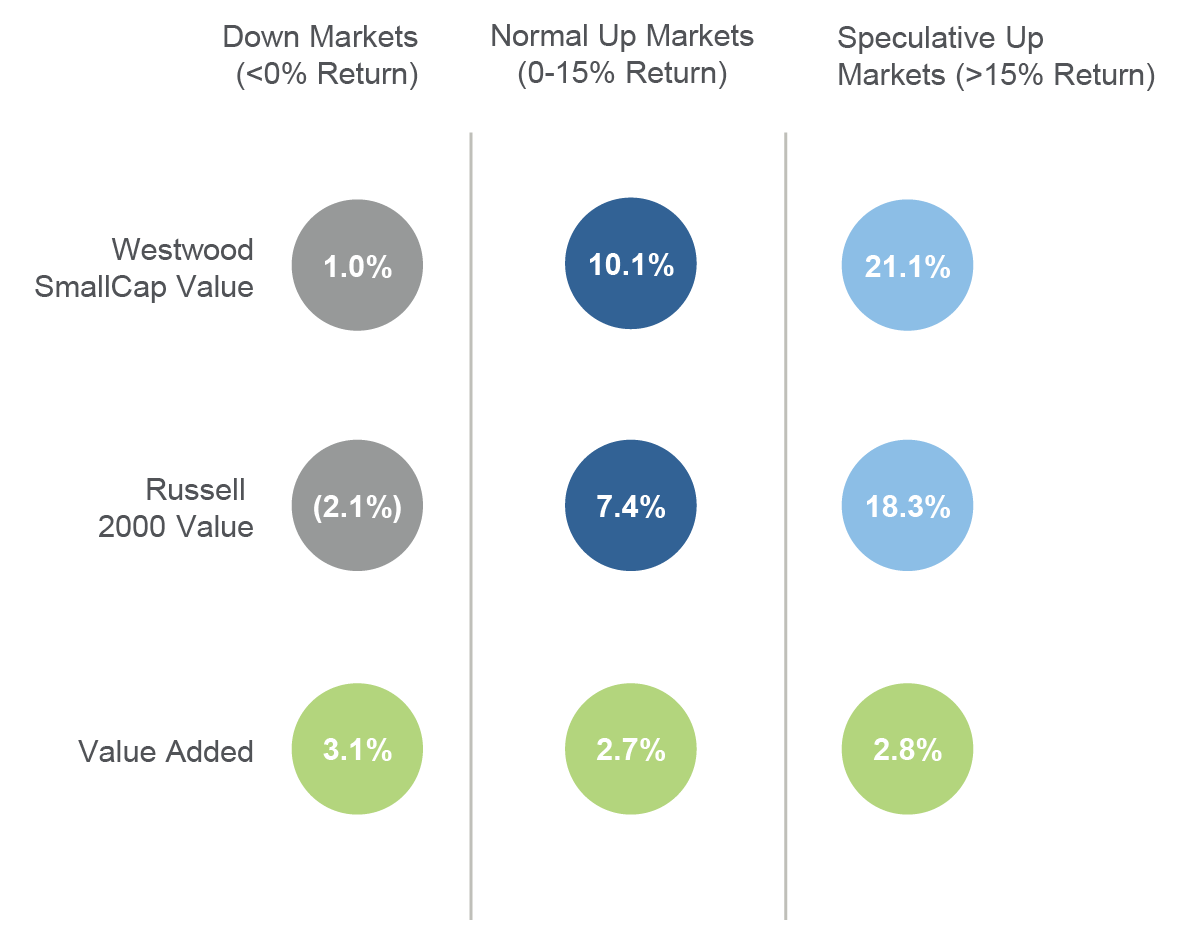

Adding one more element, active management, further improved the outcome for investors during the first quarter of 2020. While a passive quality and value combination generated nearly a 1% return premium to the Russell 2000 Value return in the first quarter, Westwood’s focus on investing at the intersection of quality and value through high-conviction portfolios increased the magnitude of the relative performance captured by 2.5 times. The uncertainty of the current market environment has had vastly different impacts on various businesses and industries, further separating “winners” from “losers” with expectations that this will persist into the future. Westwood believes investing in these high-quality businesses with strong fundamentals and attractive valuations produces more consistent performance, not just during times of stress, but throughout the investment cycle. Westwood SmallCap Value has a long track record of generating superior risk-adjusted returns using rigorous fundamental analysis to identify undervalued companies with strong cash generation, return metrics and balance sheets. Additionally, our team-based approach to portfolio construction, with the intent to deliver high-conviction and high-active share portfolios, has generated strong risk-adjusted returns across multiple market environments over the last 15 years.

Annualized Rolling 5-Year Returns Net of Fees Since Inception

Westwood SmallCap Value vs. Russell 2000 Value Index

*Overall Batting Average: 100%