Performance-based fee fund models are garnering more interest in the marketplace as active managers attempt to improve alignment and trust with investors. As the dominance in passive products has risen, the relationship between asset owners and investment managers has tipped staunchly to the benefit of investors, driving existing active fees lower. While this progression has lowered beta costs for investors, the fee compression trend has done very little to direct investors to the best managers who can achieve their alpha objectives over the long term.

In other words, there is no correlation between fees and increased probability of outperforming the benchmark over the long term. So, while asset owners are enjoying record-low fees, there is still a segment of analysis in the evaluation and selection process that may need to be altered. Instead of hunting for the lowest fixed fee, consider a performance fee structure for a segment of the broader active allocation in certain asset classes, then quantifying the potential value using a reasonable scenario analysis.

In recent years, we have seen firms like Westwood, Aperture and Alliance Bernstein formally introduce new innovative fee models that attempt to address the misalignment of interests by tethering fees to differing performance metrics. The common thread with each fee structure is to reflect the proper market rate for beta and fee symmetry relative to the potential of the asset class to give investors a statistical advantage or “fee alpha” vs. a typical fixed fee structure.

Fee Alpha | What It Means to Pay a Zero Base Fee and 30% of Outperformance

Hypothetical Example

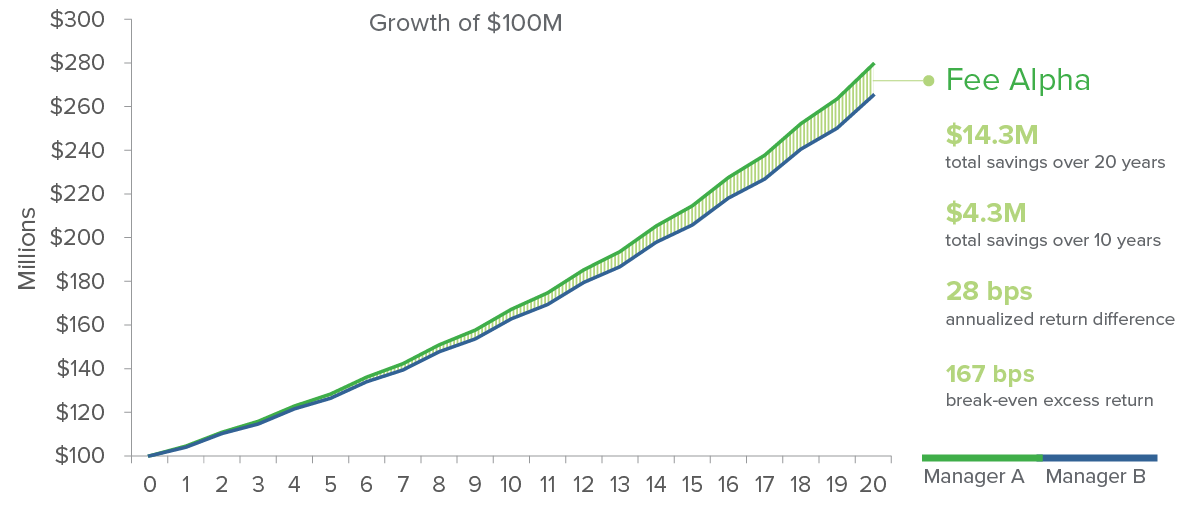

To illustrate the potential value of aligning with a well-constructed performance fee arrangement in an efficient asset class such as U.S. Large Cap, we examined a moderate allocation of $100 million using two skilled active managers called Manager A and Manager B. Manager A and Manager B both have similar risk and return objectives that produced varying excess returns versus a 5% annualized market return over a 20-year period.

We then assumed a reasonable relative return experience by forecasting that both managers will outperform their respective benchmark by 1.5% and underperform by -0.5% every other year, respectively, gross of fees. These assumptions seem reasonable for an above median performance experience when observing U.S. Large Cap strategies over the last 10 years.

Next, we quantified the cost impact both of using a simple zero-base performance fee model with the asset owner investing $100 million in Manager A, retaining 70% of excess returns against the benchmark generated, while Manager B charged a fixed fee of 50 basis points.

The results were revealing when you consider the true value of U.S. Large Cap beta, which is near zero, and paying for alpha using a performance fee model. Remember, both managers have the same total return and excess returns over the long term. Manager A, who implemented a zero-base fee model, significantly improves the return profile to the benefit of investors with what we categorize as “fee alpha.” While both managers would have outperformed by 50 bps annualized over both a 10-year and 20-year basis, Manager A saved the investor more than $4.3 million or 4.3% return over just 10 years, and $14.3 million over a 20-year period, essentially outperforming Manager B by 0.28% annualized over the 20-year period. What’s more, is that returns are exponential, similar to compounding interest.

Lastly, and maybe most important, is how investors should approach a decision between paying a fixed fee and utilizing a performance fee model. Based on Manager A and Manager B, the breakeven analysis is 1.67% in annualized excess returns, which historically would be higher than 88% of large cap managers. Performing the break-even analysis will then allow the asset owner to conduct a simple probability analysis. For example, do you have a higher probability of consistently performing in the top 12th percentile every year? Most asset allocators would say “no” and opt for the performance model to avoid paying fixed fees for the years where there is underperformance vs. the benchmark. When you consider a reasonable fee cap, the break-even analysis becomes significantly more attractive in favor of using a performance model. This would be in favor of the asset owner since there is a significantly lower probability of achieving top decile returns year in and year out vs. experiencing years when a manager underperforms the benchmark.

While we recognize holding periods are shorter historically for the U.S. Large Cap asset class, we affirm maintaining a performance fee segment as part of a stable of managers will compound exponentially over time to the benefit of investors.

In summary, as investors reconsider active management or are replacing underperforming managers, the two most important corollaries to outperformance will be active share and fee structures.

A properly constructed performance fee structure will not only signify insight on management style and confidence, but also change the probability of outperforming for investors by avoiding overpaying for years where there is median or poor performance.

A zero or low-base fee performance model can potentially make the index seem expensive over the long term, exponentially increasing cost savings when compared to a manager with a high fixed fee model with comparable performance.