The SECURE Act 2.0 was passed on Dec. 29, 2022, to help Americans save for retirement and was a continuation with enhancements of the prior legislation, the SECURE Act, which passed in 2019. Many provisions of the SECURE Act 2.0 are currently active, with additional provisions expected to take effect in 2024 and subsequent years. Several notable provisions set to take effect in January 2024 deserve attention, as they might impact you or your family this coming year. Here are some newly established provisions you might find important to understand.

No More RMDs for Designated Roth Accounts (DRAs)

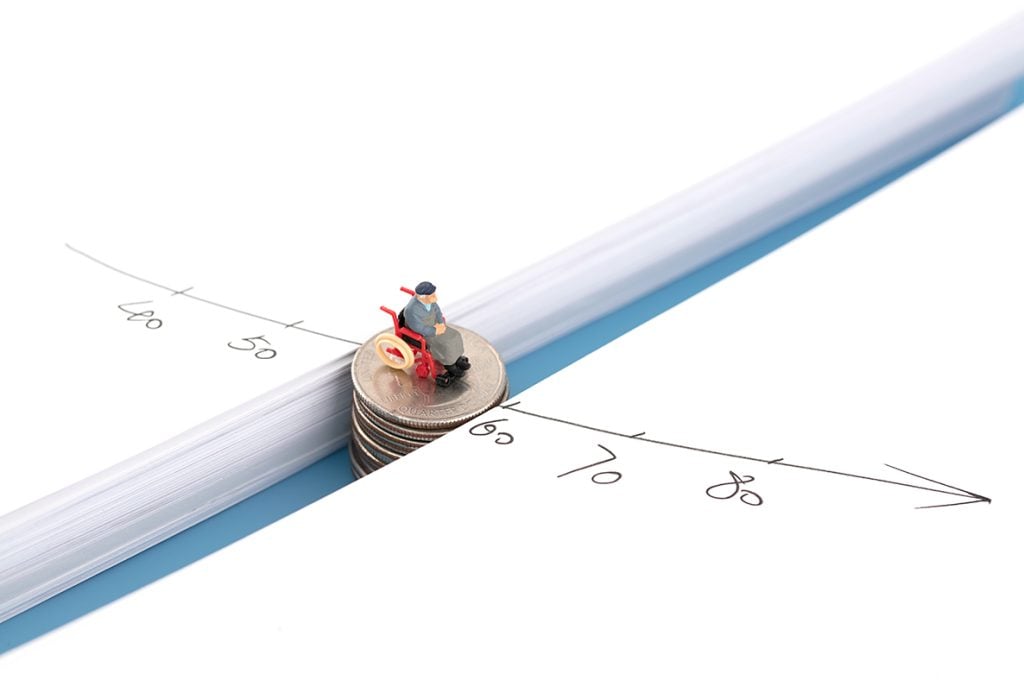

Required minimum distributions (RMDs) represent the mandated minimum amounts individuals must take out of their retirement accounts annually. Typically, withdrawals must commence from traditional IRAs, SEP IRAs, SIMPLE IRAs and other retirement plan accounts upon reaching the age of 72 (or 73 if one attains age 72 after Dec. 31, 2022).

For participants in a workplace retirement plan, such as a 401(k) or profit-sharing plan, the option exists to postpone RMDs until the year of retirement, unless the individual holds a 5% ownership stake in the business sponsoring the plan.

On the contrary, Roth IRAs differ in that they don’t require withdrawals during the owner’s lifetime. However, designated Roth accounts within a 401(k) or 403(b) plan must adhere to the RMD rules for the year 2023. Subsequently, as of 2024, RMDs will no longer be obligatory for designated Roth accounts. It’s crucial to note that RMDs remain applicable to designated Roth accounts for 2023, including those with a required beginning date of April 1, 2024.

Surviving Spouse Can Elect to Be Treated as the Deceased Spouse When Inheriting IRAs From Late Spouse

Surviving spouses currently have several options when inheriting IRAs from their deceased spouses. These options include keeping the account as an inherited IRA and taking distributions over their lifetime, using the five-year rule, or treating the IRA as their own. Effective in 2024, the SECURE Act 2.0 will allow surviving spouses to elect to be treated as the deceased spouse when inheriting IRAs from their late spouse. Below are three benefits to consider as a result of this provision.

- The surviving spouse’s requirement to take minimum distributions will be delayed until the age at which the deceased spouse, based on their birth year, would have started mandatory withdrawals — either at age 73 or 75.

- Once the RMDs for the decedent would need to commence, the calculation method would shift from the Single Life Expectancy Table, currently mandated for surviving spouses and other beneficiaries, to the IRS Uniform Lifetime Table. This transition to the Uniform Lifetime Table is expected to result in a lower calculation for RMDs.

- If the surviving spouse passes away before the start of their RMDs on the deceased spouse’s IRA, the surviving spouse’s beneficiaries will be treated as if they were the original beneficiaries designated by the initial account holder. This provision enables eligible designated beneficiaries within this group, in accordance with the original SECURE Act, to stretch distributions over their life expectancy, avoiding the need to follow the 10-year distribution rule.

The new rule tends to favor surviving spouses who are older than the deceased spouse. Let’s look at an example of how the above provisions might play out.

As of Dec. 31, 2023, Elizabeth, age 60 and James, age 65, are a married couple. Elizabeth dies on Jan. 30, 2024. Elizabeth’s RMDs would have started in 2038, the year she would have turned 75. James elects to be treated as the deceased spouse when inheriting Elizabeth’s IRA worth $1 million in 2024 and keeps the account separate from his other retirement accounts. Fourteen years later, the account is now worth $2 million. In 2038, once the RMDs for the decedent would have needed to commence, the first-year RMD would be $2 million divided by 24.6, or $81,301 using the Uniform Lifetime Table. The RMD using the Single Lifetime Table at age 75 would be $2 million divided by 14.8, or $135,135. This would equate to a difference of $53,834.

For individuals who find themselves in this situation, the advantages can be significant. Delaying the RMDs on the IRA of the younger deceased spouse permits tax-deferred growth of the account over time. Depending on the age of the account owner at the time of death, this strategy can result in substantial additional assets for the surviving spouse during the period between the account owner’s death and the mandated commencement date for RMDs. Additionally, the ability to use the Uniform Lifetime Table instead of the Single Lifetime Table for determining RMDs is beneficial to the surviving spouse.

529 Savings Plan to Roth IRA Rollover

Starting in January 2024, the SECURE 2.0 legislation permits tax-free transfers from a pre-existing 529 account to a Roth IRA designated for the same beneficiary. This adjustment offers the possibility for remaining educational funds to initiate savings in the beneficiary’s Roth IRA. Nevertheless, there are specific limitations associated with this provision. Here is the information available to date:

- The 529 savings account must have been open for at least 15 years.

- The beneficiary of both the 529 savings account and the Roth IRA must be the same person.

- The annual transfer limit is equal to the IRA contribution limit for the year, less any regular or Roth IRA contributions made that year.

- A beneficiary is capped with a lifetime total rollover limit of $35,000.

- Rollovers are restricted from including contributions (or their earnings) from the preceding five years.