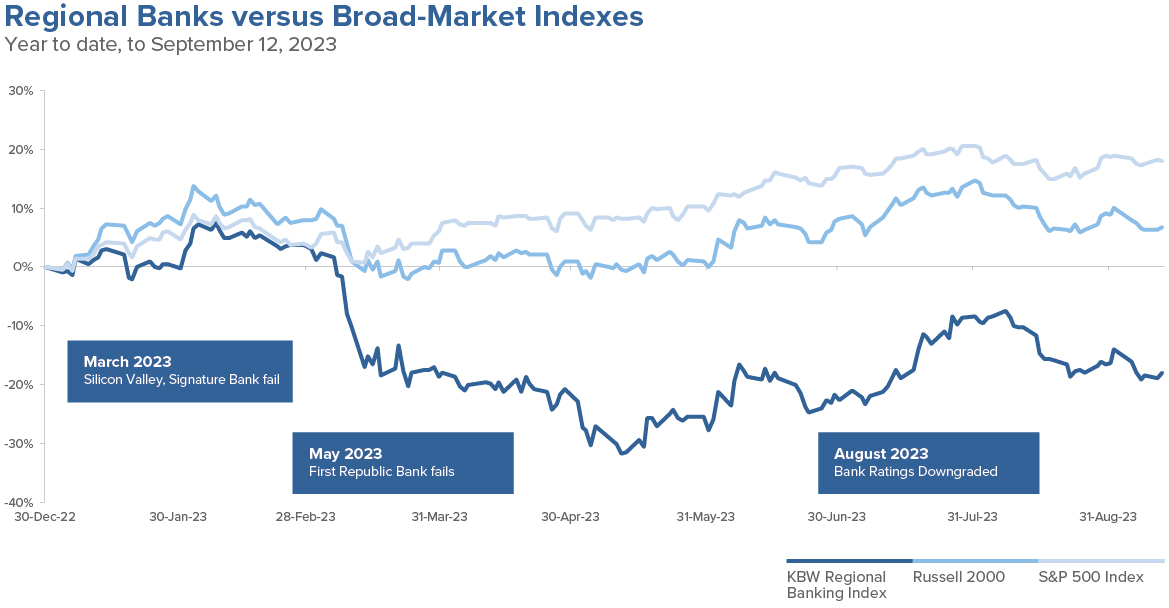

The banking industry was scarcely given time to mourn the loss of its compatriots before being again thrust into battle with familiar foes: regulators, rating agencies, and rates. Never one to let a crisis go to waste, regulators are racing to implement several new regulations that will require the industry to fund balance sheets with more equity and long-term debt, reducing return on equity (ROE). Rating agencies, ever committed to closing the stable door after the horse has bolted, have taken it upon themselves to remind the market with great regularity that the industry is in rude health. And while they’ve proven time and again to not be particularly prescient, they’re not particularly wrong in this case, either. While we may be past the existential crisis, the banking industry has not made it through unscathed.

Customers, Banks Adjust to Higher Rates

Having spent the summer meeting with bank management teams, it’s clear that deposit outflows have slowed materially in recent months. Corporate clients continue to evaluate the appropriate level of operating cash, sweeping non-operational deposits into interest-bearing products. However, after six months of intense remixing, most clients are nearing the minimum level of deposits needed to facilitate daily cash flows, suggesting the bulk of the remixing is behind us.

In fact, the latest Federal Reserve rate hike has not generated near the excitement from deposit holders as past rate hikes. As if in response to the sweltering heat, the bank runs of March have slowed to a trot in August. Regardless, if the Fed is “higher for longer” and continues to shrink its balance sheet, the pressure on deposit levels, mix, and cost will remain. There will be a long tail on deposit repricing, even once the Fed pauses. A granular, operational-deposit-heavy deposit base is paramount to maintain an appropriate economic return.

Perhaps more important is the ability to rapidly reprice assets to a level appropriate for the current rate environment. With rates pinned at the lower bound for over a decade, many banks developed a habit of deploying deposits into long-duration, fixed-rate assets in a reach for yield. Hundreds of banks have securities portfolios yielding less than 2.5%, which they are funding at a marginal cost of more than 5.0% today. Securities reprice in due time, but with bank deposit costs asymptotically approaching the Fed funds rate, earnings are likely to be impaired for the foreseeable future. Ironically, the antidote to all that ails in the industry is a cut in the Fed funds rate, which would recapitalize the system, reduce the pressure on deposits and ease the pressure on client debt service coverage ratios.

Mark to Market: Greater Transparency May Lead to Tighter Lending Standards

Typically, a bank unable to earn its cost of capital would look to sell. However, upon acquisition, a bank’s balance sheet is marked to market for both rates and credit. In the current environment, those marks – particularly for the hundreds of banks with low yielding, long duration, fixed rate securities described earlier —are often greater than the tangible common equity of the bank (i.e., mark-to-market the bank is insolvent). To shore up capital, banks are tightening lending standards materially. No loan is being made without the promise of a deposit. Many banks are putting pencils down on new loans altogether, having enough trouble as it is funding prior commitments.

Bankers don’t like to be told they can’t support their clients. Clients don’t like to be told their bank is no longer open for business. This is an opportunity for banks with excess capital and liquidity. The best loans on a bank’s balance sheet are being made today, with wider spreads, lower leverage, and greater credit enhancement. The ROE of a client who brings with them a deposit is materially higher than that of a loan-only client, given that loan-only clients generate a mid-single digit ROE.

Many businesses, particularly in Texas and the Southeast, continue to expand and would prefer a bank with the wherewithal to remain open for business in all interest rate environments. The banks Westwood has long preferred (i.e., banks with excess capital, excess liquidity, low loan/deposit ratios, and a through-cycle focus on relationship banking) are able to win bankers and clients from banks in a more precarious position.

| Moody’s Analytics August 8, 2023 |

S&P Global Ratings August 22, 2023 |

| Ratings Downgrades | |

| M&T Bank | Associated Banc-Corp |

| Pinnacle Financial | Comerica, Inc. |

| BOK Financial | KeyCorp |

| Webster Financial | UMB Financial Corp. |

| Commerce Bancshares | Valley National Bancorp |

| Old National Bancorp | |

| Prosperity Bancshares | |

| Amarillo National Bancorp | |

| Fulton Financial Corporation | |

| Associated Banc-Corp | |

| Negative Outlook | |

| PNC Financial Services | River City Bank |

| Capital One Financial Corp. | S&T Bank |

| Citizens Financial Group | Zions Bancorporation |

| Fifth Third Bancorp | |

| Huntington Bancshares | |

| Regions Financial Corp. | |

| Cadence Bank | |

| F.N.B. Corporation | |

| Simmons First National Corp. | |

| Ally Financial | |

| Bank OZK | |

| Ratings Under Review | |

| Bank of New York Mellon Corp. | |

| Northern Trust Corp. | |

| State Street Corp. | |

| Cullen/Frost Bankers | |

| Truist Financial Corp. | |

| U.S. Bancorp | |

Regulators Focus on Capital Standards, After the Worst is Behind Us

Banks tightening credit and widening spreads, on top of assets and cash flows repricing to a higher-for-longer environment, will inevitably lead to an increase in non-performing loans and net charge-offs. While banks are more prepared for this credit cycle than most, every cycle is unique and unpredictable.

Regulators and supervisors, embarrassed by the failure of four banks, are being more proactive and telling banks with low levels of capital to recapitalize (a further rise in long rates, consistent with a higher-for-longer environment, would put more pressure on the capital ratios of banks with long duration securities portfolios). Reticent to raise equity in this environment and perhaps spark another bank run, these banks are being pushed into the waiting arms of the well-heeled banks in our portfolios.

In fact, there have been three post-Silicon Valley failure acquisitions in the banking industry, and we have owned each of the acquirers. “When the going gets tough, the tough start buying,” as they say.

Recession or not, the next year will be challenging for the banking industry. We remain committed and more confident than ever in our preference for high-quality banks.