As a financial planner, I frequently hear concerns from individuals about the longevity of Social Security. Many people rely on Social Security benefits as a significant part of their retirement income, and with discussions about potential funding shortfalls, it’s natural to wonder whether Social Security will still be available in the coming decades. As a millennial, I also wonder whether Social Security will be there for my child and me. However, I am confident that Social Security will remain available for all of us in the foreseeable future, and I will share the reasons why. In this article, we will explore the current state of the Social Security system, the challenges it faces and potential solutions that could ensure its sustainability.

The History of Social Security: Then and Now

The Social Security system was established on August 14, 1935, when President Roosevelt signed the Social Security Act into law. The federal program was created to provide financial support to retirees, disabled individuals and survivors of deceased workers. It is primarily funded through payroll taxes under the Federal Insurance Contributions Act (FICA). Employers and employees each contribute 6.2% of wages (up to an annual earnings cap, $176,100 in 2025), while self-employed individuals pay 12.4%. The funds collected are not stored for individual workers but are instead used to pay current entitled beneficiaries. Any excess revenue is placed in the Social Security Trust Fund, which helps cover benefits when payroll tax collections are insufficient.

The Growing Challenge: Social Security Trust Fund Depletion

The Social Security Administration’s annual report has consistently warned that the system is facing a financial shortfall. The main concern is that the ratio of workers to retirees is shrinking. Several other factors are also contributing to this issue and are outlined below.

- Aging Population: The baby boomer generation is retiring in large numbers, often referred to as the “silver tsunami,” increasing the number of beneficiaries while decreasing the workforce contributing to the Social Security system. According to an article published by Yahoo!Finance in 2024, more than 10,000 boomers are retiring daily, and this is expected to continue until 2030.

- Increased Life Expectancy: Longer life expectancies mean retirees are collecting benefits for a more extended period than originally anticipated. In 1940, when the first benefits were paid out, someone turning 65 had a life expectancy of age 79. Today, the average number is closer to age 85.

- Declining Birth Rates: Fewer workers entering the labor force means fewer people paying into Social Security. With fewer workers entering the labor force, there are fewer people contributing to Social Security. To put this into perspective, my mom had me when she was 23, while I had my first child last November at the age of 31.

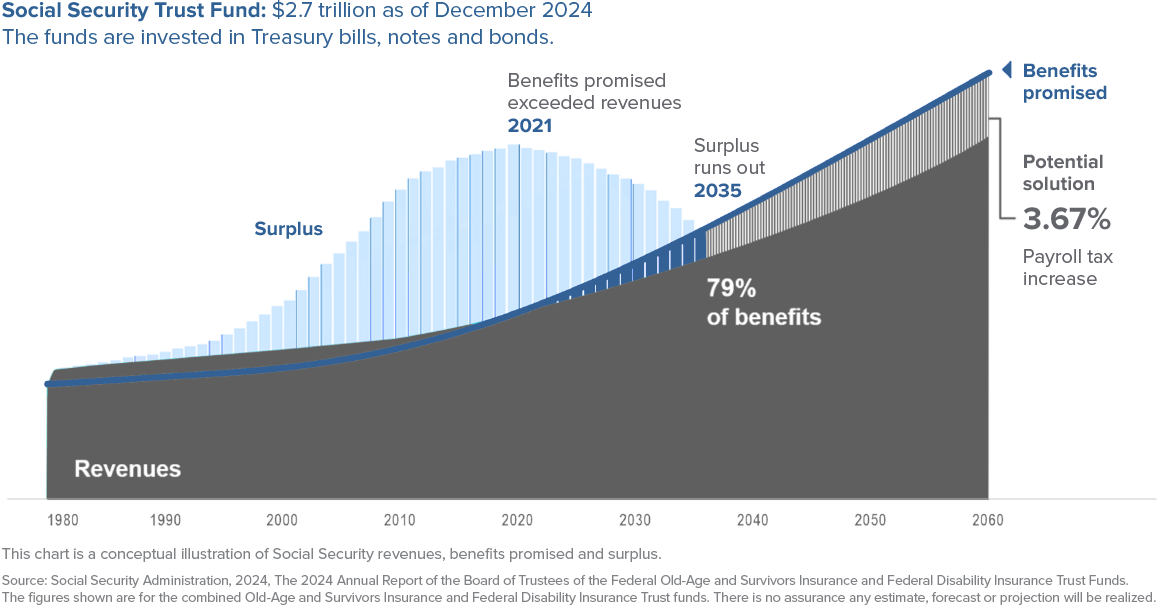

The Social Security Trust Fund currently has $2.7 trillion as of December 2024. The funds are invested primarily in Treasury bills, notes and bonds. The Social Security Administration is forecasting that the current surplus the Trust Fund has will run out in the year 2035. This does not mean benefits will disappear entirely, but it does suggest that payroll tax revenues alone would only be sufficient to cover about 80% of scheduled benefits. If Congress takes no action, benefits will be reduced by approximately 21%, meaning anyone receiving Social Security will only collect 79% of their benefits.

Potential Solutions to Address Social Security’s Challenges

Despite the challenges mentioned, there are several potential solutions that could help sustain Social Security for generations. The following reasons are why I am optimistic and confident Social Security will prevail. While no single solution is perfect, a combination of approaches could help bridge the funding gap.

Increasing Payroll Taxes

One option is to increase payroll taxes, which are 12.4% by 3.67% to 16.07%, split evenly between employees and employers. Such a raise could significantly extend the program’s solvency. However, higher payroll taxes could place a burden on the working class and employers.

Eliminating the Earnings Cap

Currently, Social Security payroll taxes only apply up to a certain limit known as the “earning cap,” which stands at $176,100 in 2025. Eliminating this cap, similar to how Medicare works, would require high-income earners to contribute more into the system. For example, if someone earns $500,000, they currently only pay Social Security taxes on the first $176,100 of their income. Under a system without an earnings cap, they would pay Social Security taxes on the entire $500,000, significantly increasing their contribution to the program.

Raise the Full Retirement Age to 68

Since people are living longer, another solution is to gradually raise the full retirement age to 68. While this could reduce the total benefits paid out over a retiree’s lifetime, it could be seen as an equitable response to longer life expectancies. Currently, for individuals born in 1960 or later, the FRA is age 67.

Implement Means Testing for High Income Retirees

Another option involves reducing or eliminating benefits for higher-income retirees who are less reliant on Social Security for their living expenses. Let’s be honest, someone like Jeff Bezos or Warren Buffet won’t be losing sleep over a missing Social Security check. What do you think? While this could preserve funds for lower-income beneficiaries, it seems controversial since all workers pay into the system regardless of income level.

Invest and Diversify the Social Security Trust Fund

Currently, the Social Security funds are invested in Treasury securities, which are considered low risk and yield a modest return. Allowing a portion of the funds to be invested in stocks or other assets could generate higher returns over time.

While this strategy could potentially increase revenues, it also introduces investment risk into the equation.

Final Thoughts

Although Social Security is facing financial challenges, it is unlikely to disappear entirely. I hope this article has provided some peace of mind, knowing that viable solutions exist to address the issue. However, changes will be necessary to ensure its long-term viability. Policymakers will need to take action to address the program’s funding shortfall, whether through tax increases, benefit adjustments or other reforms.

I encourage you to prepare for retirement with a diversified strategy that does not rely solely on Social Security. By planning ahead and making informed financial decisions, you can better secure your retirement future regardless of what happens to Social Security.

If you have concerns about how Social Security fits into your retirement plan, connect with your wealth advisor to discuss strategies tailored to your specific situation.

Did You Know?

- The Social Security Administration has a policy to stop payments at age 115 to prevent fraud. Social Security collects death data via funeral home directors, family members, financial institutions, and through Medicare by verifying if individuals are still enrolled.

- According to the Center of Budget and Policy Priorities, only 0.1% of Social Security benefits are paid to people over the age of 100. That means 99.90% of benefits are paid to individuals aged 100 or younger.