The growing U.S. debt

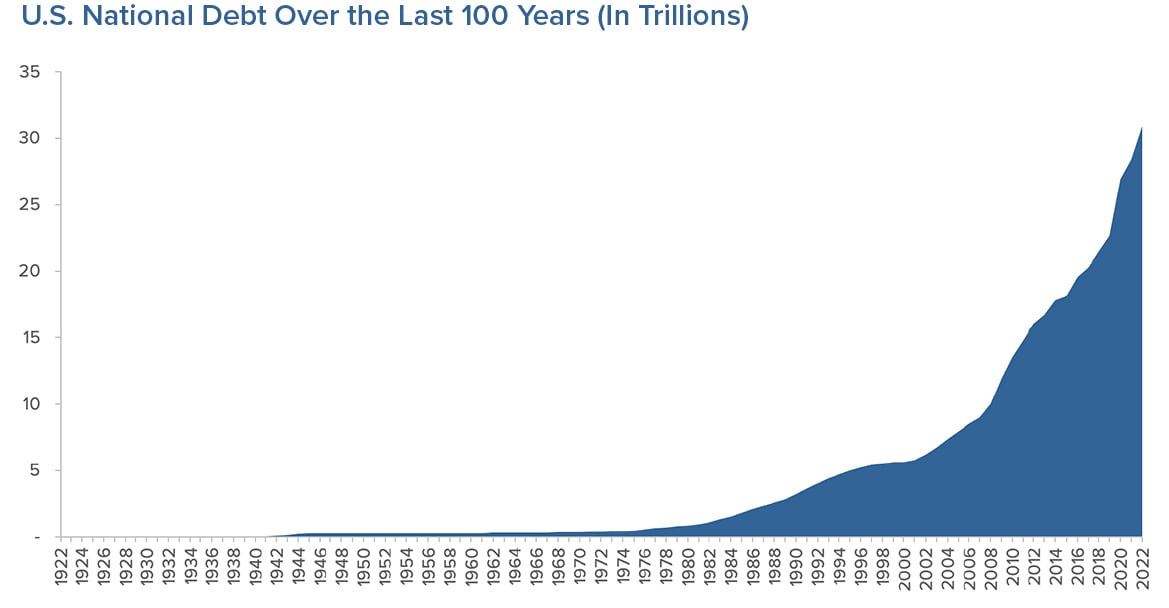

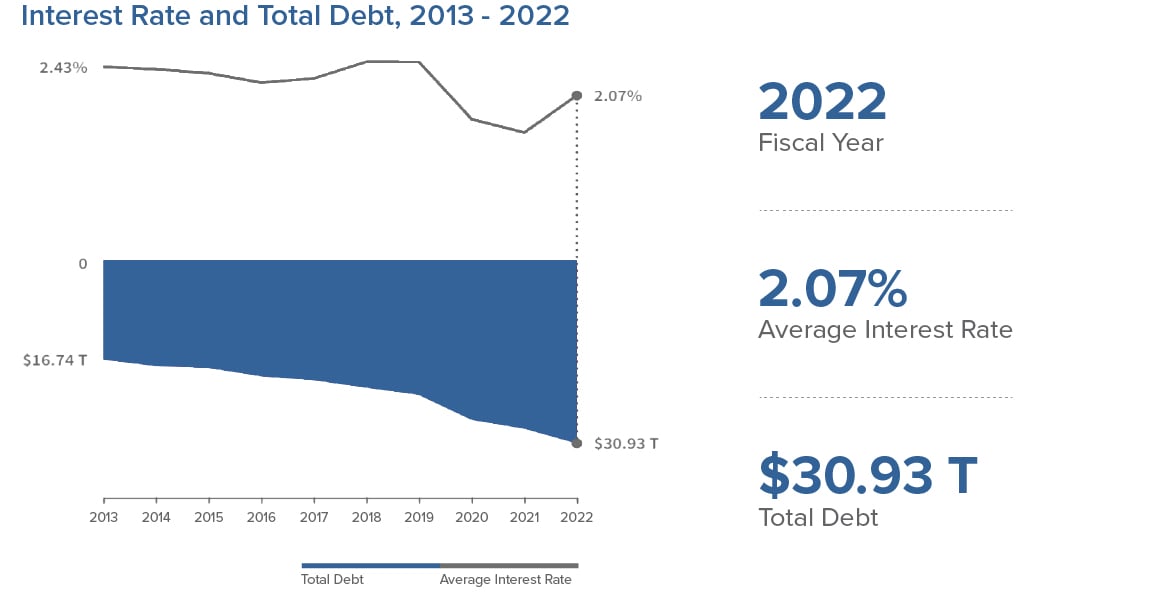

The United States has seen its debt grow significantly over the last 100 years starting from $408 billion in 1922 to $30.93 trillion in 2022. If you look further back into history, the United States’ first major debt crisis occurred during the Revolutionary War. Since then, the U.S. has continued to accumulate debt through a variety of factors such as wars, recessions and government spending. In theory, the national debt is the amount of the money the federal government has borrowed by issuing treasury bonds, bills, notes and inflation-protected treasuries to cover budget deficits. As of the end of 2022, the total U.S. debt stands at over $30 trillion, with a debt-to-GDP ratio of around 123%. This means that the country’s total debt is larger than its annual economic output, which has raised concerns about the sustainability of the debt and its potential impact on future generations.

Factors contributing to U.S. debt

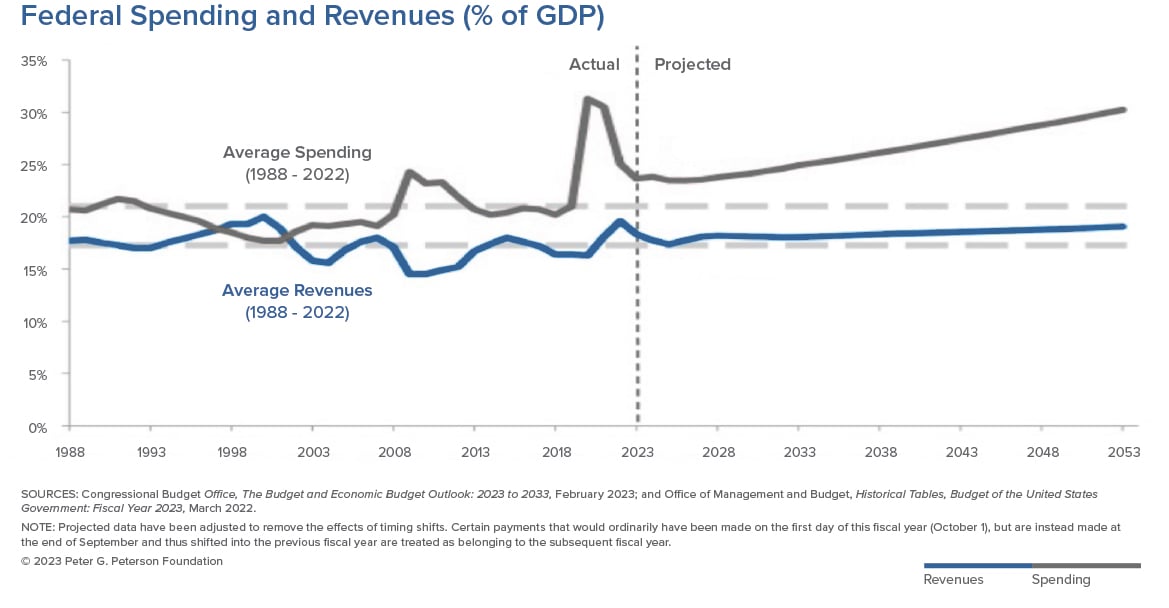

The U.S. national debt is the accumulation of budget deficits over the years. In other words, it is the result of the mismatch between government spending and revenues. The Congressional Budget Office (CBO) projects that federal spending will climb from 23.7% of gross domestic product (GDP) in 2023 to 30.2% by 2053; that growth is largely due to spending on healthcare and retirement programs for elderly Americans along with rapidly growing interest costs. Revenues, on the other hand, are only projected to climb from 18.3% of GDP in 2023 to 19.1% in 20531.

The government spending on entitlement programs like Medicare and Social Security benefits, defense spending, and the interest paid on servicing the existing debt have been the biggest contributors to the U.S. debt over the years. With our population aging and life expectancy increasing, Medicare and Social Security spending will continue to increase at the same time. The U.S. has historically been able to maintain relatively low borrowing costs due to its status as a global economic powerhouse and the use of the U.S. dollar as a reserve currency. As of February 2023, debt servicing contributes to 12% of total federal spending; however, continued growth in U.S. debt could eventually lead to even higher borrowing costs and other economic challenges.

Who owns the U.S. national debt?

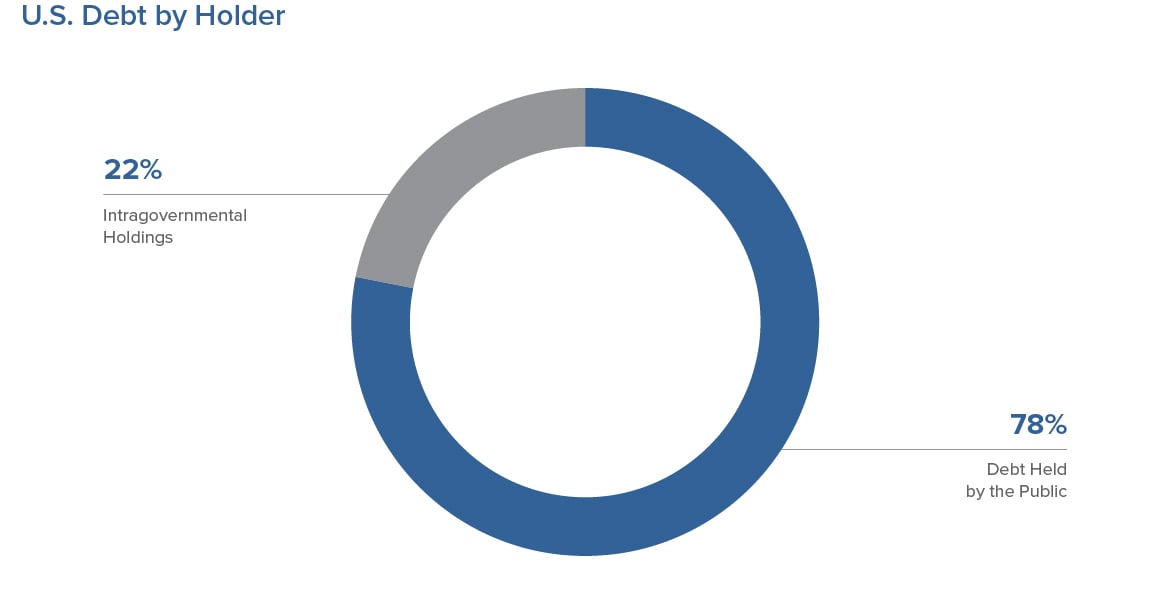

U.S. debt owners can be broken down into intragovernmental debt. Intragovernmental debt is held by the Federal Reserve and Social Security and other government agencies. Public debt is held by the public: individual investors, institutions and foreign governments. Internationally, Japan is the largest holder of U.S. debt, followed by China.

U.S. debt ceiling

The debt ceiling or limit is the restriction on the amount of the outstanding debt that the Federal Reserve can incur. It was created by the U.S. Congress in 1917. Once the debt ceiling is reached, the federal government cannot increase the amount of outstanding debt, losing the ability to pay bills and fund programs and services. The U.S. Government hit its debt ceiling in January of this year. Currently, the U.S. Treasury is using “extraordinary measures” to keep the government running. These measures include suspending payments to some government employee savings programs, underinvesting in certain government funds and delaying auctions of securities. The Treasury Department says it expects extraordinary measures to keep the government afloat until June.

Raising the debt ceiling has historically been a relatively routine procedure for Congress. Since 1960, Congress has increased the ceiling 78 times, most recently in 2021. As U.S. politics have become more polarized over the last decade, raising the debt ceiling has become more contentious. Since the United States has never defaulted on its obligations, the scope of the negative repercussions related to a default are unknown but would likely have catastrophic repercussions in the United States and in markets across the globe. However, we expect the fight on the debt ceiling to be delayed as much as possible but expect both parties to eventually come to an agreement and raise the debt ceiling before the U.S. Treasury runs out of backup options.

Is the rising U.S. debt concerning?

The rising U.S. debt is a matter of concern as it will have long-term implications for the economy, future generations and the global financial system. There are also concerns about the relationship between U.S. debt and inflation. Looking at historical data, there doesn’t appear to be a positive correlation between U.S. debt to GDP ratio and inflation.