What is good for investors individually is not necessarily good for investors as a group

- Money invested in index products is indiscriminately allocated toward the purchase of the largest market cap stocks in that index, potentially creating a disconnect between the price of the stock in the market and its fundamental value.

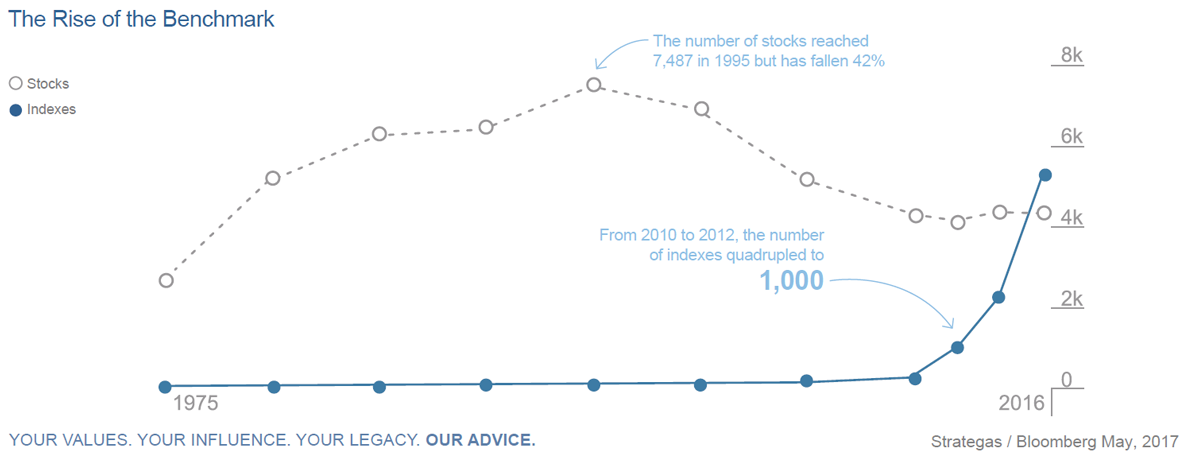

- As you can see in the chart below, there are just over 4,000 publicly traded stocks in the United States, while there are more than 5,000 indexes. This has changed significantly in the last 20 years. In 1995, there were approximately 7,500 public companies and only about a dozen index funds.

- Thirty percent of NASDAQ stocks do not earn any money, but they receive full representation in various indexes and, therefore, exchange traded funds (ETFs).

- Passively managed investments (such as ETFs or index funds) have outperformed over actively managed investments recently; but as inflation rises and central bank assets shrink, this is expected to shift and we believe actively managed investments should outperform passive investments.

- Corporate governance is compromised as index funds tend to vote exclusively based on management recommendations.

- Since 2009, the “rising tide” of accommodative monetary policy has “lifted all companies” but frequently overlooks fundamental strength or weakness. Index membership is often a key determinant of a stock’s performance.

These scenarios have created concern as to what happens if there is a market correction. It is possible that down markets would force index funds to disproportionately sell securities, associated with the largest companies, as withdrawals increase, potentially creating a downward spiral. At Westwood, we are committed to actively managing our proprietary investment solutions. As part of this commitment, we occasionally leverage a passive security within a broader, actively managed strategy. If you have questions about how your portfolio is being managed today, we would be happy to discuss that with you.

The information contained herein represents the views of Westwood Holdings Group, Inc. at a specific point in time and is based on information believed to be reliable. No representation or warranty is made concerning the accuracy or completeness of any data compiled herein. Any statements non-factual in nature constitute only current opinion, which is subject to change. Any statements concerning financial market trends are based on current market conditions, which will fluctuate. Past performance is not indicative of future results. All information provided herein is for informational purposes only and is not intended to be, and should not be interpreted as, an offer, solicitation, or recommendation to buy or sell or otherwise invest in any of the securities/sectors/countries that may be mentioned.