Fees should reflect the market rate for beta, the alpha potential of the asset class, unique manager/product attributes and the overall probability of a favorable outcome.

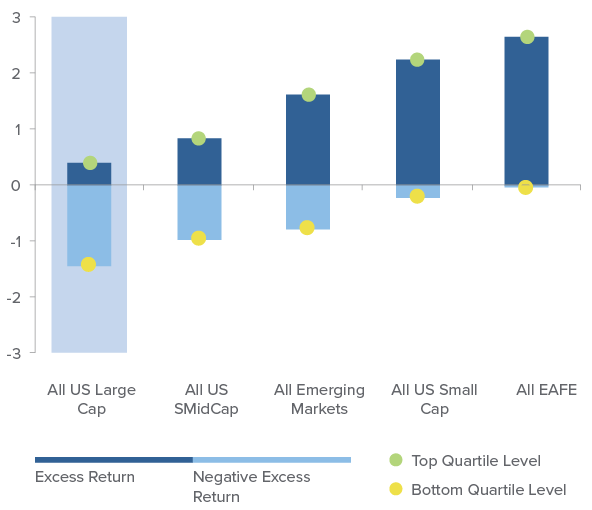

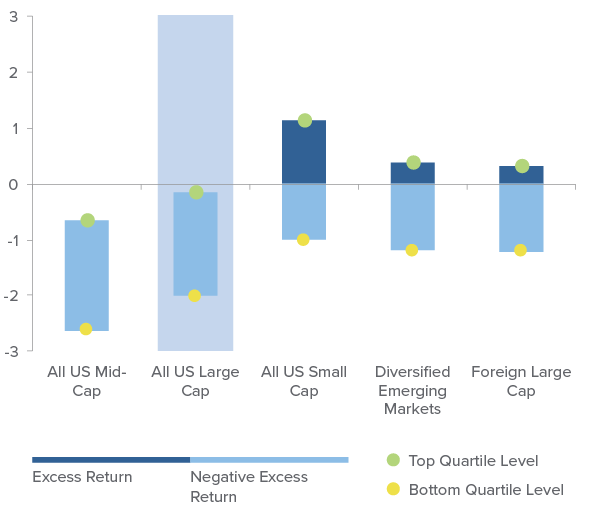

We believe the largest misalignment between client advantage and active manager compensation occurs most often in U.S. Large Cap.

Institutional Strategies 10-Yr Annualized Excess Returns (%)

Top & Bottom Quartile Levels, Net of Fees

Mutual Funds 10-Yr Annualized Excess Returns (%)

Top & Bottom Quartile Levels, Net of Fees

Without the proper fee symmetry between the asset manager and asset owner, the relative value proposition during periods of outperformance may not be enough to offset periods of underperformance when you consider a high fixed fee in the context of the asset class — further adversely skewing the probability of winning for active investors.

Applying sound reasoning, investors could potentially improve the probability of winning by aligning with a sensible fee structure that offers symmetry with a favorable outcome, combined with a high active share strategy, understanding that these are the two corollaries that truly impact the odds for investors.

While an extremely limited number of asset managers have experimented with Fulcrum Fees, we affirm that traditional Fulcrum Fees and other fee structures may not be best aligned for a traditional efficient asset class like U.S. Large Cap where beta is priced like a commodity and the true value of active management needs to be measured in relative risk-adjusted terms.