Challenges With Classic or Deep Value

Historically, various economic backdrops have been more or less favorable for the investment in a value style of investing, amid the broader positive trend overall. Securities that appeared statistically cheap often coincided with being mispriced or undervalued given many of the companies that found themselves with low multiples were experiencing cycle headwinds or a transitory disruption to their growth trajectory. Most recently, however, the trifecta of low interest rates, low inflation and low GDP growth has been a significant headwind for many cheap businesses that are overly exposed to cyclical factors and may struggle with profitability and high leverage. The continued shifting of the economic makeup from an industrial orientation to being driven by the consumer could have profound impacts on value strategies like deep and traditional value anchored to these types of businesses. Furthermore, “classic” value managers who have used traditional valuation metrics such as price-to-book and price-to-earnings have become distorted as today’s accounting rules fail to properly reflect companies’ increased investment in intangible assets and the rising prevalence of corporate buybacks which is discussed in more detail in our paper, “Westwood and the Modern Era of Value Investing.” This becomes more pronounced during down market periods as classic value stocks have become much riskier than investors realize. Over the last 20 years, classic value — statistically cheap stocks — have become far more akin to high beta stocks explaining the disappointment investors have experienced.

The Path Forward

Classic value managers who have exclusively used “traditional” valuation metrics, such as price-to-book or price-to-earnings, to identify statistically cheap companies as a way of outperforming has failed many investors. In contrast, by utilizing the original definition of value — paying below intrinsic value for businesses — combined with emphasizing quality, can offer a compelling risk-adjusted return profile within the value investing segment. We believe realizing the return premium for value investors going forward will require actively managed and higher active share portfolios that maintain both attractive valuations relative to intrinsic value and quality characteristics. The ongoing challenge is many quality businesses are not necessarily mispriced and not sufficient alone to generate the return premium. Therefore, valuation is critical to unlocking the return premium. Westwood defines this opportunity set where the return premium exists as the “intersection of quality and value.”

Key characteristics common with high-quality companies

Profitability

In the new economy, analyzing return on invested capital (ROIC) and cash flow generation can be a better way to value a company’s intellectual capital and ability to generate profits from assets. Consequently, GAAP earnings can distort the “true economic” profitability of a company making traditional valuation methods such as Price to Book (P/B) misleading.

Financial Strength

Strong balance sheets, including the appropriate leverage ratios and ability to service debt throughout the investment cycle and cyclicality of cash flows.

Understanding how management is allocating capital to expand its business, including the ir ability to use equity and debt, is essential.

Competitive “Moat”

A company’s ability to maintain its advantage in order to protect longterm profits and market share from competing firms is critical. This is most important for maintaining strong fundamentals related to sustainable and predictable growth, stability of cash flows, earnings and capital expenditures.

| Alpha generation | We believe investing at the intersection has demonstrated strong upside participation while performing better during periods of volatility and market declines with great consistency through the years |

| Proven track record | Demonstrated long-term track record of successfully investing within the value universe with leading performance of several strategies across trailing 3-, 5- and 10-year periods |

| Team-based process | Ensures consistency of our approach and process over the long term while avoiding individual biases |

| High-conviction approach | Differentiated, bottom-up portfolio constructed of our “best ideas” with holdings across our strategies concentrated in those ideas |

| “True” market capitalization exposure | Most prevalent in the smaller part of the market capitalization spectrum, our portfolios are managed to maintain true exposure that our clients want and expect |

Why the Intersection of Quality and Value?

We believe that investing in undervalued, high-quality businesses can generate a return premium resulting in lower absolute downside risk and superior risk-adjusted returns. From a fundamental perspective, superior business models have sustainable competitive advantages that can consistently generate returns on capital in excess of the cost of capital. High-quality businesses also usually have better opportunities to reinvest their cash flows into the pursuit of M&A, value-add assets including both physical and intangible, or returning excess capital to create long-term value for shareholders. We have found that when we own portfolios of undervalued quality businesses versus simply statistically cheap companies, they perform better during periods of volatility resulting in lower downside risk. To realize the return premium, we focus on identifying companies that are at the intersection of quality and value. We believe this requires a fundamental, active, multifaceted approach analyzing valuation, profitability and financial strength specific across industries.

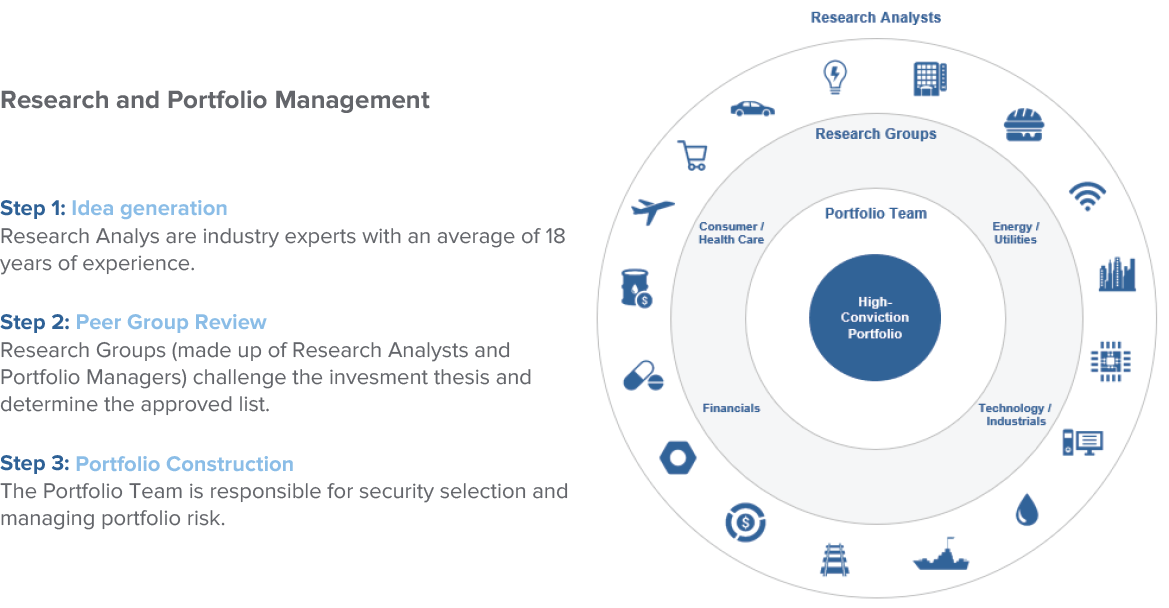

Westwood Research Process

Our process consists of a deep and rigorous fundamental analysis performed by our team of experienced analysts and portfolio managers. Our investment team comprises analysts and portfolio managers (who also serve as analysts) organized by industry coverage rather than market capitalization. This provides a deeper understanding of the dynamics and nuances in each industry and provides additional insight to leverage in their work. There are no forced screens or strict guidelines nor is there a myopic focus on asset value, often found in classic value approaches. Rather, our analysts have freedom to evaluate their respective universes of businesses with an open mind toward evaluating current intrinsic values relative to future potential financial outlooks, rather than a potentially flawed starting point of statistically cheap stocks. In this modern approach to value, companies with superior fundamentals can simultaneously have higher valuations and yet also be mispriced relative to their intrinsic value. The analyst’s work culminates in an initiation report including our proprietary, detailed thesis identifying the mispricing and our internal valuation framework for both absolute upside and downside supported by the analyst’s three-year forward-looking financial forecasts.

True to our team-based approach, we believe a differentiated aspect of our process is our Research Groups — teams of our analysts organized by sector of coverage. The Research Groups play a crucial role as a quality control check within the process. After conducting thorough analysis on securities within their area of expertise, analysts present their best ideas to the respective Research Group. The Research Group members rigorously challenge the investment case for the analyst’s recommendation, leveraging their collective knowledge and industry expertise to challenge assumptions and methodology to determine if the company fits our philosophy. This process can be iterative and require further clarification and refinement of the investment recommendation after it has been presented. This key step concludes with a vote, as the Research Group controls the addition of new ideas to the Approved List, a thoroughly scrutinized, vetted and approved list of securities. The Approved List provides a constant stream of new ideas and replacement candidates for the Portfolio Team to consider for their respective strategies.

Investment Process — Team-Based Approach

Modern Value Portfolios: Westwood’s Approach

“Nothing lasts forever” is a bedrock principle most long-term investors have come to understand, particularly those invested in value disciplines. Value investing using a deep or classic value orientation often fails to live up to expectations, getting it backwards by capturing more downside and less upside. Active management has a path forward — through intellectual flexibility, adding quality to the process and taking a modern approach toward value investing. A quality value approach provides a complementary set of exposures to broader economic trends and the incorporation of quality helps avoid classic value traps by limiting positions with deteriorating profitability, over-extended balance sheets, and the magnitude of cyclical risk in a portfolio. This is a challenge to replicate through either passive vehicles or purely quantitative approaches given the issues with the current accounting standards, which all would point to companies that are “statistically cheap,” but for good reason. By providing strong returns during the good times and resilient performance during periods of volatility, Westwood believes investing at the intersection of quality and value is the optimal solution for an all-weather exposure to value return drivers.

Perhaps the most dangerous words in investing are “this time is different.” The identification of and best method of implementation in the pursuit of buying securities below their real value may change, it may evolve, but such is the nature of investing. The ability to truthfully pursue investing with intellectual flexibility is not easy, requiring actively managed portfolios to deliver into the alpha potential. This is a challenge to replicate through either passive vehicles or purely quantitative approaches given the issues laid out above with the current accounting standards, as well as requiring a belief that the past will repeat in the future. Allocators are faced with challenging times, in adapting their view of value or relative value as we defined it, with our belief firmly centered in the benefits of investing at the intersection of quality and value as the solution for today’s current issues.