Executive Summary

The Westwood Alternative Income strategy is a market neutral strategy that’s positioned to take advantage of both yield and arbitrage opportunities. In today’s market environment, we see swaths of opportunities with elevated levels of volatility, higher yields and pricing dislocations persisting across the credit complex. We believe a market neutral approach including arbitrage and global convertible bonds can offer an attractive opportunity for credit investors who demand low correlation to both equities and traditional credit allocations. With equity valuations compressed at multi-year lows and credit spreads widening out, a market neutral approach can allow conservative to moderate risk investors potential for equity price appreciation with limited downside risk provided by the debt features. We have been managing our market neutral strategy since 2011 with an experienced team focused on combining short duration convertible bonds with a levered convertible arbitrage strategy to take advantage of attractive credits, mispriced volatility and potential pricing catalysts. Our dedicated team has over 60 years of experience managing an estimated $1.5B focused arbitrage, convertibles, equities and credit.

5 Reasons to Consider a Market Neutral Allocation in the Current Credit Environment

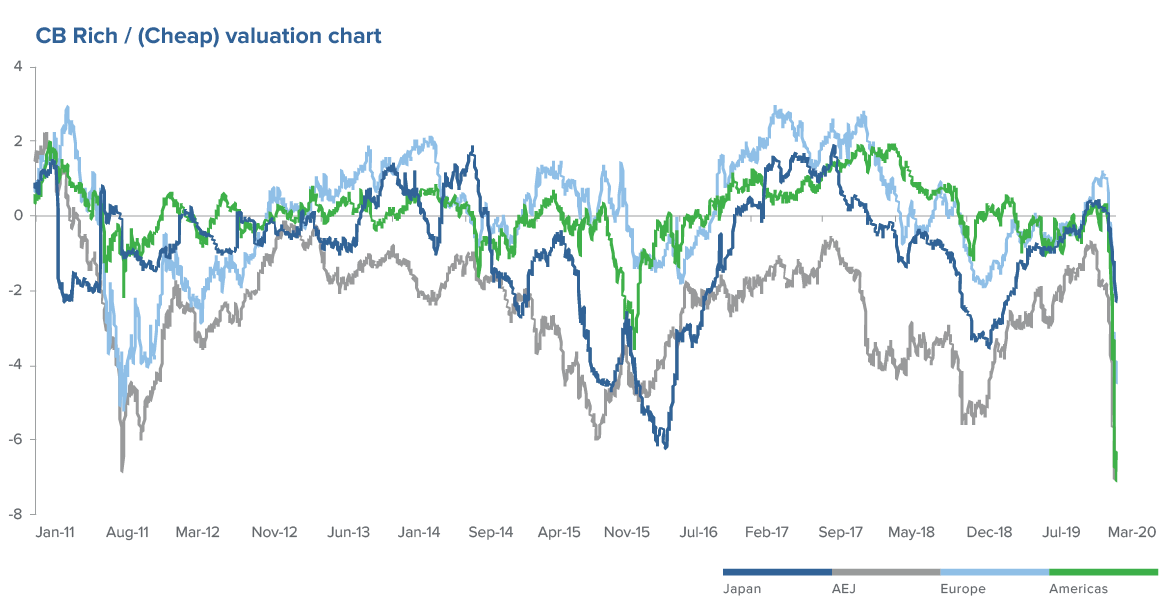

Theoretical fair valuations for Convertibles have de-coupled during the recent market collapse in the equity and credit markets resulting in “extreme cheapness” globally.

We have shifted our views from seeing “pockets of opportunity” in short duration convertible bonds to “vast opportunities across the board.” Credit spreads have gaped out providing a significant positive carry for BBB and BB rated issues plus the convexity from the embedded equity optionality is attractive with markets declining 30% to 40% globally.

The unprecedented monetary policies enacted by global central banks as a result of COVID-19 have (ironically) increased the correlation among equity, rates and credit, with volatility products also losing advantage to such an extent that allocators need to consider new tools to balance public and private portfolio risk and inter-relational forces that have diminished the desired “hedging” effect.

Fixed income investors facing short and intermediate term risk-free rates of <1.00% combined with rising correlations to equities have an opportunity to monetize market volatility while also hedging credit risk to enhance returns and reduce correlation. We believe current market events will serve as an attractive entry point and “rebirth” for convertibles which have been overlooked by many investors and arbitrage as we enter a new credit cycle starting with credit spreads trading at 800 to 1000bps over treasuries.

Improve portfolio efficiency in any fixed income or credit allocation to lower correlation and costs with our innovative, Sensible Fees™ solution.

Key Highlights

The Market Opportunity for Convertible Arbitrage

[Pricing Dislocation + Yield + Gamma Capture]

Convertible arbitrage strategies include buying a long convertible bond position paired with a short stock position in the same company. In stable, efficient, bullish market environments, these strategies tend to yield fair results, but during and after crisis in a more volatile climate, skilled managers can exploit exogenous effects that create inefficiencies in common/convertible relationships, as well as valuations in general. As global markets declined 30% to 40% peak to trough during the first quarter of 2020, a cheap equity market creates new potential catalysts for long-term investors seeking attractive returns relative to core bonds as we look toward a 2021-2022 time frame.

With an unprecedented accommodative central bank policy and fiscal policy around the world designed to flood the system with liquidity and support markets, we expect pricing dislocations to eventually abate, higher quality credit spreads to improve thereby supporting equity prices, and a moderate P/E multiple expansion over the next one to two years. Today, we also see extreme relative cheapness in the convertible market which was trading near FV at the beginning of the year and now is trading at an average theoretical discount of roughly 8%, a multi-year low. Utilizing a modest amount of leverage, this could potentially generate double-digit returns, and provide a great entry point for institutional investors.

In the rising equity market scenario we presented above, the long convertible bond position will typically make more than the short stock position loses, generating a positive net profit as delta increases. If we are, in fact, entering a market where elevated volatility persists over the long term, and/or equity markets continue to decline, the long convertible bond position, will typically lose less than the short stock position makes, providing a floor for investors. It’s important to note that convertibles, while typically more volatile than bonds, historically display standard deviations that can be 20% to 50% lower (or more) than the underlying stock or prevailing index.

Convertibles also tend to “lose less” during market downturns as they carry an attractive yield component and a maturity date at which the investor would receive their principal back; both factors cater to propensity to “hold” rather than “sell.” During the final quarter of 2018, the Barclays U.S. Convertible Index lost just 12%, while the S&P 500 and Russell 2000 fell 23.5% and 25%, respectively.

A market neutral approach utilizing convertible arbitrage can offer fixed income investors the ability to generate asymmetric returns in both up and down markets, by capturing volatility as a return source. Adjustments in timing and ratios can also be made by the manager to finely tune delta exposure.

For allocators modeling lower capital market assumptions as a result of zero or negative risk-free, volatility becomes a hedged return source allowing for greater return potential versus traditional fixed credit strategies with a potentially similar risk profile.

The Opportunity for Short-Dated Convertible Bonds

[Yield + Equity Optionality]

As an asset that tends to be underutilized, there can be an increased incidence of unrecognized mispricing arbitrage and event-driven opportunities using short duration convertible bonds. One strategy to capture return is the combination of long credit exposure and the purchase of a synthetic long equity call option, using a limited maturity convertible bond, which when executed properly, can provide attractive yields with low duration or interest rate risk during periods of volatility.

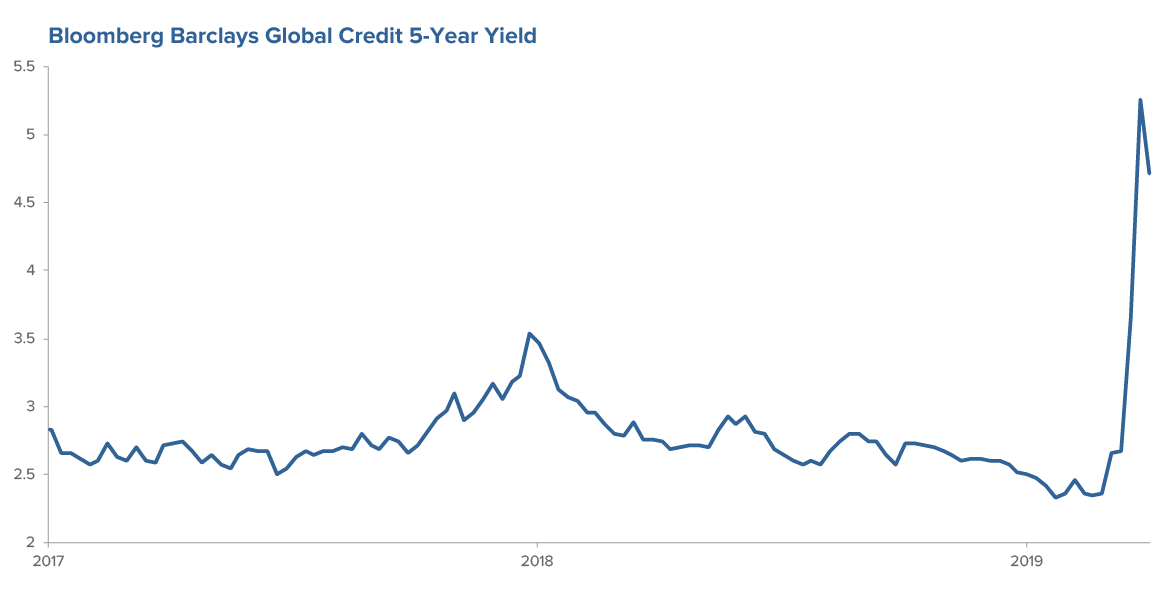

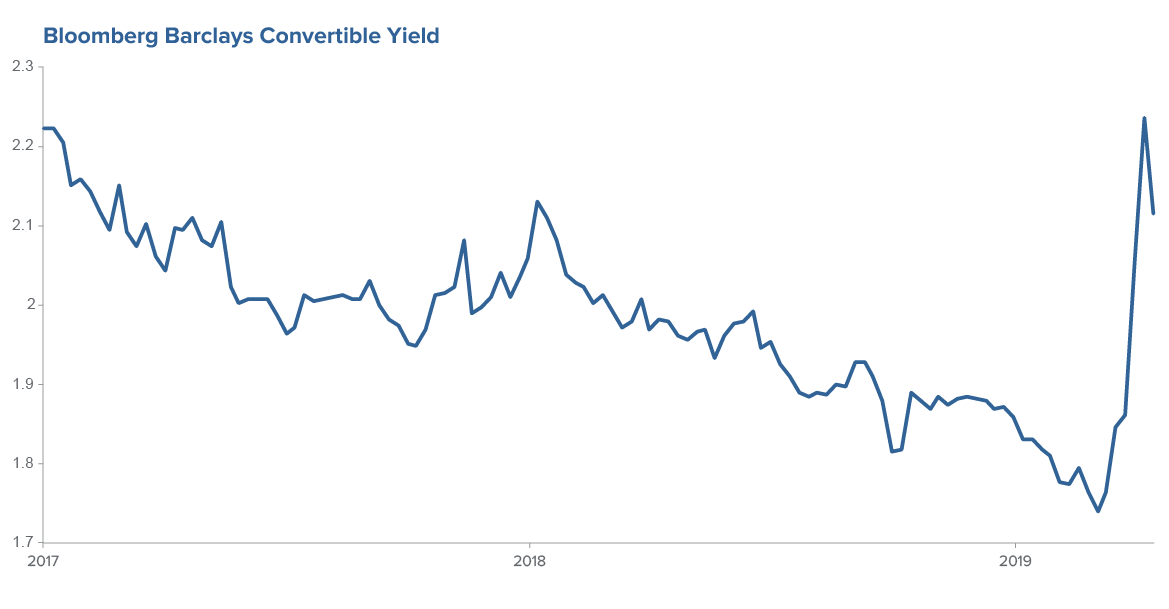

The embedded equity call option can also provide upside convexity during periods of market turbulence and lower drawdowns providing an asymmetric return profile as volatility increases. Since the COVID-19 crisis roiled credit markets, we have seen high short duration, high quality credits go from yielding 1% to 2% with average maturities of roughly 1 year to 5% to 8% during the month of March (see charts below).

We believe a short-dated yield strategy is perfectly suited to benefit investors if equities and credit spreads improve to outperform core bonds with an attractive level of yield and potential price appreciation as equities risk and the value of the synthetic option increases. If the equity markets are falling, we would expect single A, BBB or BB credit-rated companies to avoid defaults on their shorter maturity bonds thereby mitigating the potential for capital losses and deeper loss in long-term confidence which can raise future borrowing costs substantially.

For allocators facing lower capital market assumptions in bonds, who still believe equity markets will rebound in 2020-2021, a market neutral allocation that implements a convertible strategy can provide a reasonable middle-ground alternative.

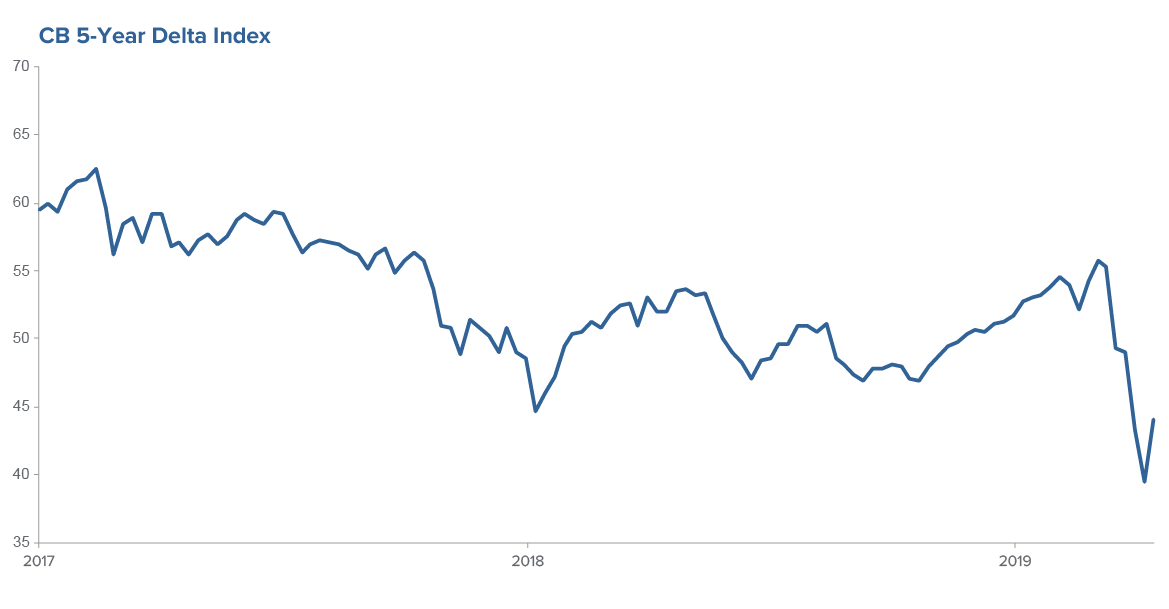

If equity markets rally, we expect convertible deltas (beta) to increase from the low 0.40s back to longer-term averages of over 0.50 across the universe (See 5YR CB Delta Index Chart). The resulting increase in this equity/credit correlation dynamic in turn triggers improvements in “bond floors” as medium- to lower-quality companies utilize their stock as currency to de-lever if necessary. The resulting action should further push theoretical deltas higher across the space, allowing investors to participate in the equity market rally through increasing deltas and improving credit quality, all while “clipping a coupon” and limiting downside.

Summary

Arbitrage and opportunistic strategies in convertibles can provide traditional fixed income investors a liquid alternative that can offer low correlation and reduced volatility to enhance returns and improve diversification in a low rate environment. We have been managing our market neutral strategy since 2011 with an experienced team focused on combining short duration convertible bonds with a levered convertible arbitrage strategy to take advantage of attractive credits, mispriced volatility and potential pricing catalysts.

As of December 31, 2019, the team managed $1.4B across both absolute return and global convertible bond mandates.

Alternative Income | Delivered Consistent Returns

| Annualized Returns | 4.44% |

| Sharpe Ratio | 0.88 |

| Correlation to S&P 500 | 0.26 |

| Correlation to Barclay’s Global Aggregate Bond | 0.34 |

| 1 Year Trailing Standard Deviation | 6.58 |

| 1 Year Trailing Beta vs. S&P 500 | 0.24 |

| Max Drawdown | 7.42 |

| Recovery Rate | 3 months |