Navigating Choppy Waters in Hazier Conditions

As we mentioned in our year-end report, there’s an evolution occurring as it pertains to risk assessment, valuation, and investment style that is taking hold. We believe that while some styles, such as value investing will once again gain popularity, the marketplace in the coming years will be one that will require a much higher level of skill, understanding and engagement to achieve alpha. Volatility and headline risks are likely to remain elevated for the foreseeable future as the globe readjusts to a now-dominant high inflation, rising interest rate climate.

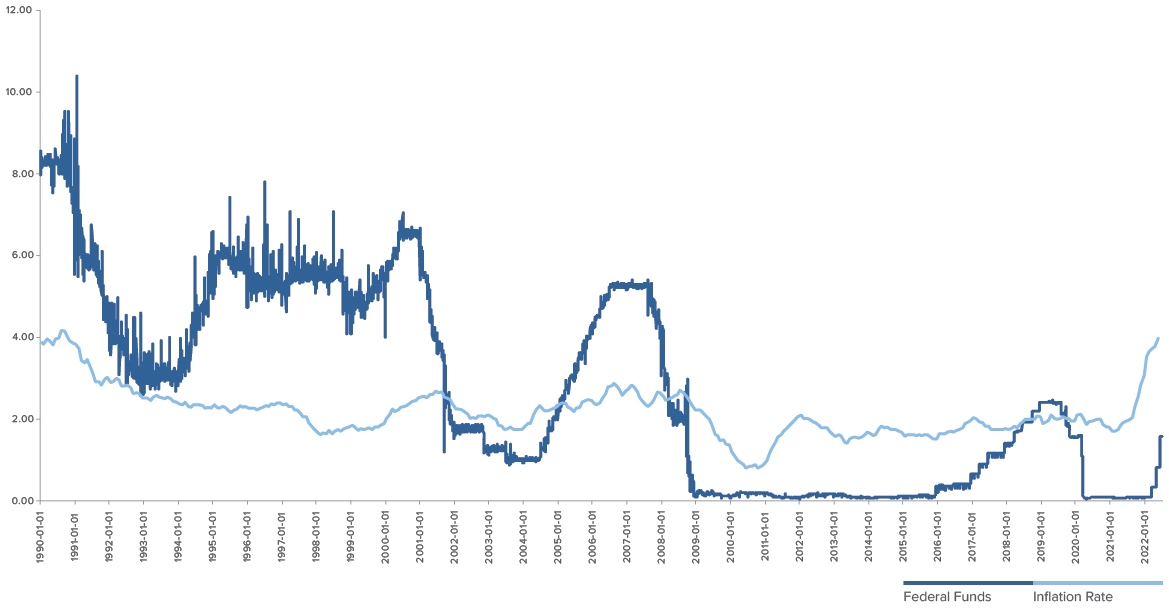

The action we saw play out in the first half was dramatically different from a year earlier. At the end of last year, it was full-steam ahead for risk assets. At the time, most of us realized the decade-long (mostly) bullish market had to end sooner or later, but the abruptness of the sentiment and market valuation shifts certainly shocked more than just the casual investor. The change in momentum was further fueled by several simultaneous events: Russia’s invasion of Ukraine, worsening global inflation and a Federal Reserve (the Fed) that unexpectedly enacted one of the most aggressive rate hike trajectories in history. And while the pandemic certainly sparked a global slowdown, most major markets did not experience a real recession for any extended period. The declines that we are seeing now in consumer behavior, such as spending and confidence, along with GDP growth are not likely to end by massive government stimulus or a vaccine this time around. The increasing probability of contraction/recession is more likely to be dealt with using more traditional methods, such as critically-timed interest rate adjustments. There is certainly a risk that the Fed will not be able to temper inflation without a full-blown recession, but it’s not all doom and gloom.

As equities moved lower in the early part of the year, high valuation growth stocks, namely tech names, took the worst of the blow. Following a false recovery rally in mid-March, stocks resumed selling, sending all major stock indexes to or past widely accepted correction levels of 20% or more from previous highs. Technical traders and algorithms that use charts to trigger trades added to downside momentum as many stocks fell below their key 50- and 200-day moving averages. At the same time, investors have also been exiting riskier debt instruments (high-yield bonds) and moving into more safe-haven investments such as utilities, staple dividend earnings and high-grade government debt. Gold hit an all-time high, piercing above $2,000 per troy ounce, but has since seen its price trimmed as its luster fades with a strengthening U.S. dollar in addition to a broad-based commodity selloff that began towards the end of the second quarter.

It’s important to note that the broad indices don’t always paint a complete picture and this sharp, broad-based correction will surely uncover buying opportunities in securities that are “guilty by association,” but have strong value or future growth potential as alibis. Larger, heavily weighted companies wield tremendous influence over indexes and can often set a “tone” for a sector, influencing the prices and subsequent valuations of less-weighted peers. It’s important, now more than ever, to heavily examine individual names and subsectors to unlock value, especially as these “valuation disconnects” increase in frequency and magnitude during periods of elevated uncertainty.

Unfortunately for would-be bulls, investors are likely to be reluctant to re-engage in larger, bullish positions with vigor until several tail risks (such as the effects of continued rate hikes) have subsided and the masses see a trough or stability in economic data sets. Simply put, this means that volatility is likely to remain in the back half of 2022, and dramatic rallies are less likely to be sustained for extended periods. It could also mean flattish returns for the broad indexes for the next six months to a year.

Investors are also now realizing that a recession is all but inevitable and that the days of monetary hyper-accommodation and unprecedented government stimulus are both over … at least for a while. And though this is a hard pill to swallow for many, it’s actually a positive that masses accept the recession potential as it’s often better to get a positive surprise than a negative one. And this looming recession that we see likely taking hold later this year is not likely to feel anything like the Great Recession of 2009, especially if the Fed manages their “soft landing,” which we remain hopeful for, but doubtful of as price pressures are in need of a “shock and awe” response if they are to be quelled.

As stated previously, expect a protracted period of economic slowness as central bankers work to undo surging global inflation that was ironically borne by a pandemic. More accurately, the inflation pressures we are seeing today have been triggered by the COVID-19 pandemic’s effects on trade, labor forces, transportation and governments’ swift, but arguably overdone monetary, fiscal and policy responses.

Interest rates, inflation and the consumers’ condition

There is no doubt that the current environment is certainly abnormal and, in many ways, unprecedented. When the pandemic hit, governments around the world acted swiftly, and perhaps in overabundance, to combat what seemed like another meltdown-type event like we experienced in 2009. Lawmakers injected tens of trillions of dollars in stimulus directly into the pockets of consumers and businesses alike. While their actions did stave off a potentially deep recession (the jury is still out on what would have happened), their actions have had unintended consequences, namely far-reaching inflation, and a hyper-demand rebound on a global supply chain that was crippled by lockdowns, travel and shipping restrictions and a lack of workers. All of this, and the rate-hike remedies to combat sticky inflation, have resulted in massive financial penalties for consumers in the form of borrowing costs, high prices in nearly every consumable good and obvious blows to sentiment.

We believe that relief is on the way for global supply and retailers, as supply chains either normalize or get re-routed, while helicopter money dwindles on the demand side. Many large retailers are already warning of excessive inventories as consumers start to pump the brakes on spending. Higher prices and rates are already beginning to influence consumers and central bank action, demand-side concerns and even recent energy-related White House policies have already had a substantial impact on commodity prices. Obviously, we are watching closely to see if these trends hold.

But with inflation still at a 40-year high in June, the Fed has become far less concerned with keeping unemployment as a primary focus, as it may have to be the scapegoat in order to get prices under control. That became evident as new language was added to their statement following the largest rate hike since 1994. The new test said that the Fed is “committed” to getting inflation back to its target rate of 2%. Chairman Powell reaffirmed this perspective in several media appearances over the last month or so. And as part of this commitment, and similar tone from the White House, both entities are likely to allow the labor market to cool (perhaps considerably) as a necessary economic sacrifice to drive prices lower and slow the velocity of money in the economy. Last year, in order to rebound America from the pandemic, the focus on bolstering the jobs market was much more of a priority in the recovery process of the economy and the American psyche. Now, the Fed is hiking rates at a record pace. We expect another 50bp hike in September following recent CPI and PPI readings along with other data metrics that support longer-term inflation expectations.

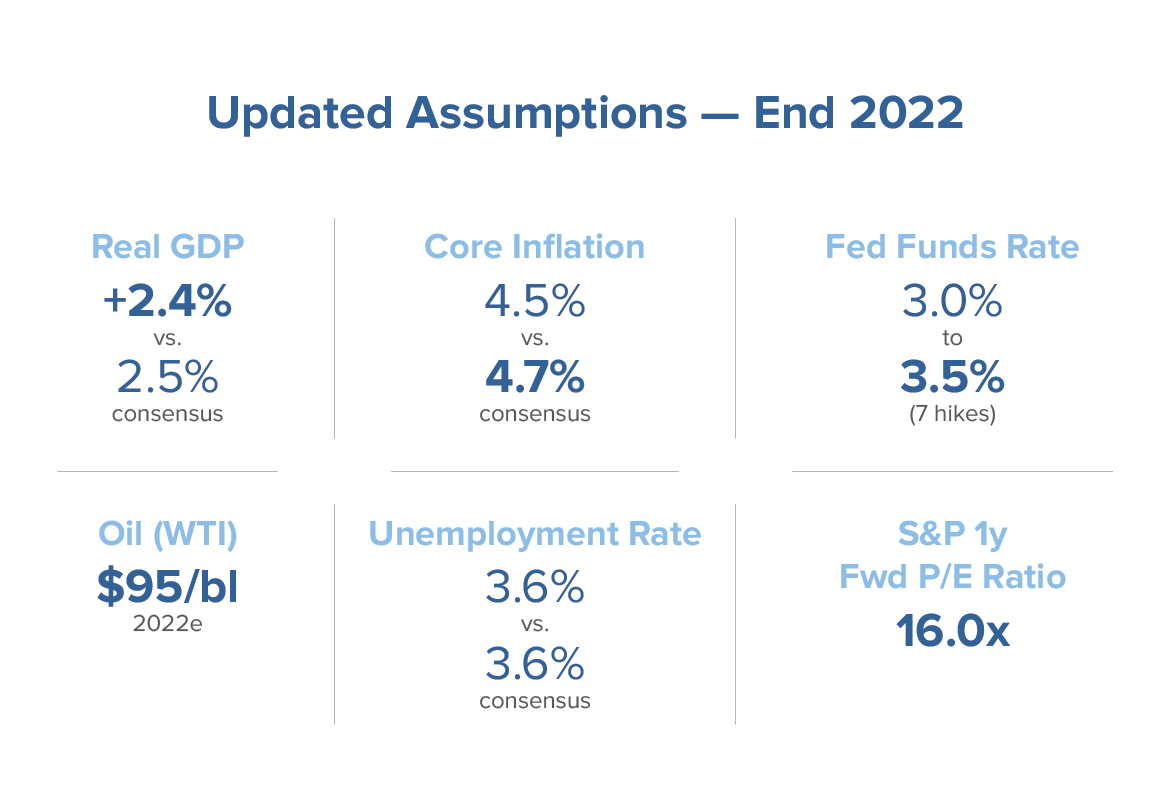

Our new year-end federal funds rate projections target 3.25% to 3.50% by year end.

Obviously, rate hikes have pushed the prime rate and mortgage rates higher, immediately increasing financing costs for many forms of consumer borrowing and credit substantially. The housing market appears to be in much better shape today, with far more institutional ownership and less leverage than 2005-06; both factors reduce the risk of a crash in that marketplace. The dearth of inventory and immense amount of average equity should also help support that marketplace. We expect home prices to moderate as increased inventory comes up for sale, but do not expect a widespread, dramatic correction in home values unless rates continue far beyond current expectations. And if/when a recession hits, it will be the Fed’s response to GDP (gross domestic product) contraction that will mostly dictate just how deep we go. Depending on inflation and labor market conditions, the FOMC could certainly reverse course and cut rates during the contraction. We believe it more likely that they would stop increases and hold for an extended period once contraction is confirmed, so long as prices moderate.

Employment

At 3.6%, the unemployment rate is inching closer to the 50-year lows seen just before the pandemic took hold. The demand for labor is an obvious contributor to the upward pressure on inflation, and Fed Chairman Jerome Powell suggested earlier in the year that urging employers to cut vacancies may do the trick without a wave of layoffs. In recent interviews, however, Powell and the Fed have outlined a plan that sees unemployment rising modestly this year as inflation cools (hopefully) following their aggressive tightening. This is being referred to as a “soft landing.” Fed Governor Christopher Waller went on to say, “If we can get unemployment to just 4.25%, I would consider that a masterful performance by the central bank.” And as the Fed relaxes its efforts in the labor market, we expect policymakers and pundits alike to further project increasing unemployment in the next two years than previously anticipated, as well as slower GDP growth.

Projections like these directly acknowledge the threat of a future recession and there’s a growing consensus acknowledging it. And while the Fed remains confident in its plans, economists see the historical data and remain skeptical, as do we. In the past, whenever unemployment has risen by at least half a percentage point over its low from the year prior, a recession tends to follow with even higher unemployment rates coming shortly after. Economists seem to have little faith that the Fed will be able to pull off cutting vacancies without a significant rise in unemployment. Many Fed officials view the labor market as an indicator of how much idle capacity exists across the economy. This view lends itself to the belief that tighter labor markets will lead to more persistent inflationary pressures. With fewer workers in the pool, employers compete for what’s left with wage increases, thus driving inflation up even more. If that pressure begins to subside and wages begin to stabilize, so can inflation. In the end, it feels as if the Fed has two evils — inflation and unemployment — and has decided on which they think the lesser of the two is. The hope remains that they will be able to toe the line that balances unemployment, inflation and the looming recession. We believe that inflation risks will drive overly aggressive hawkish policy that will likely tip the scales toward a not-so-soft landing.

Foreign markets likely to dip further

Though accommodative policies remained in effect for many developed nations earlier this year, there’s been a rather dramatic shift in those policies as of late, given the unique widespread inflationary struggles faced. That said, ECB (European Central Bank) President Christine Lagarde continues to play down recession risks in the bloc as recently as late June. In Europe, many of the same headwinds as seen in the U.S. are mounting, such as supply chain disruptions and rising prices from energy to food and more, putting pressure on the consumer. Europe is especially vulnerable to energy prices due to its dependence on Russian supply and pricey liquefied natural gas imports. At the time of this writing, the ECB is in no hurry to reduce their monetary policy accommodations. This could prove to be a mistake if inflation doesn’t subside. Europe’s high debt levels are also deterring policy makers from hiking rates as tighter monetary policy would have more profound impacts on debt-laden countries like Italy.

China is also working hard to emerge from its worst economic slowdown since 2015, which many now believe will lead to additional stimulus through easier monetary policy. These factors, along with a relatively strong economy and rising rates, are pushing the U.S. dollar higher, which in turn is creating additional earnings headwinds as roughly 40% of the earnings for the S&P 500 are derived outside of the U.S., and those earnings will be worth less with a strong greenback.

And before jumping across the pond to redirect money to Europe’s seemingly attractive valuations, investors should realize that prices may not yet reflect all the bad news, especially as the European Central Bank has been slower to react to stubbornly high inflation rates, now approaching 7%. In fact, while the MSCI Europe index price-to-earnings ratio was recently in the low double digits, it has dipped into the single digits twice over the last 15 years. What’s more, European economists have revised their GDP forecasts lower and their inflation estimates higher, and at a time when the European Central Bank is beginning to remove policy stimulus. This creates an unattractive risk/reward profile for bullish investors looking to put money to work.

The road ahead

Equities have been quick to correct, and there are certainly many stocks that have seen their share prices slashed undeservedly. That said, there is a great “re-valuation” happening now as investors reassess what future growth prospects look like for each sector and just what “value” actually means in this new environment. History has shown us that recessions are times of reset, and surely, we see this correction as pivot point to reevaluate portfolio risk/reward among sectors and securities.

As we move into the second half of 2022 and beyond, we continue to see a unique set of challenges emerge for American consumers and businesses alike. Even as pandemic impacts fade, and recent China shutdowns hopefully come to an end, the direct and related effects and the impacts (remote work, extraordinary stimulus, substantial cultural shifts, etc.) of how we dealt with the pandemic will linger. Given the complex global landscape and “re-pricing” of the value of equity and debt, there’s a strong probability that risk premium and overall volatility in both stocks and bonds is likely to persist throughout the year.

Governments around the globe are now challenged with sparking/maintaining economic growth in a high inflation environment (which is very difficult to do). Without being able to slash interest rates and/or inject money into their respective economies, many nations will be limited on monetary tactics, relying on less-effective and harder-to-enact policy shifts. And with no foreseeable solution to the Russia-Ukraine war, energy supply will remain challenged, keeping prices elevated. The region’s declining critical exports of wheat and fertilizer also mean that foodstuffs are likely to see continued unfavorable price and availability impacts. This is likely to further drive prolonged above-trend inflation, eating into household incomes and confidence as the year grinds on.

Corporate leaders and Wall Street analysts used the first quarter earnings season to “peel off the band-aid” in many situations and dramatically reset expectations for the coming year. So, while a great number of stocks are seeing corrections, there will be mispricing opportunities where a particular security is unjustly thrown out. Given our experience in targeting equity value, we believe the expected volatility in the coming months could present a plethora of candidates.

We remain positive on credit with a preference for crossover quality selections, and we expect continued improvements in energy and the securitized sectors in this landscape. Credit spreads remain cheap and there are good risk-return opportunities even if valuations become stretched as spreads are still near five-year lows. In terms of rates, we are underweight duration and see a continued rise in the two- to five-year yields, but a more range-bound target in the 10-year note as monetary tightening will impact growth trajectories.

We’re likely to see the U.S. economy decelerate as supply chain constraints continue to dampen manufacturing growth, the Fed combats worsening inflation with tighter monetary policy, and geopolitical events negatively impact sentiment and cross-border commerce activity.

With nominal rates rising and bond prices falling, equities remain relatively attractive as a hedge on inflation due to their growing earnings and dividend streams. Rising rates will continue to impact the discounting of high-growth stocks’ long-term cash flows, resulting in less favor from investors. The hunt for yield is likely to drive interest in select emerging markets as well but expect a more difficult landscape to navigate.

Within equities, we continue to believe the current environment lends itself well to our philosophy of investing at the intersection of quality and value. Our methods seek out companies with proven pricing power to manage through this period of elevated inputs and supply chain variability, along with high return on invested capital, and valuations that are undemanding. Our portfolio continues to target visible and sustainable earnings growth as macroeconomic growth decelerates with a strong focus on fundamentals. We believe this is critical in capturing the return premium at the intersection of quality and value and delivering superior risk-adjusted returns and lower volatility against the benchmark.

For now, there’s likely to be a continued contraction in goods and services that fall in the frivolous category, but not all discretionary spending stories are bad. Disruptive technology as well as spin-offs and mergers are areas of interest, as well as one of our core expertise, value. The rotation into value began in 2021, well before we experienced strong jumps in inflation and interest rates. And though the sharp interest rate hikes have been an additional catalyst for the rotation from growth to value in equity markets, we see value outperforming even when rate hikes subside. In recent years, value outperformance has become increasingly tied to interest rates, but perhaps the wide valuation divergence between growth and value and the recent dramatic corrections in growth stock prices may trigger a decoupling of this relationship.

We are confident that value can continue to outperform over the next few years, both to reduce portfolio volatility and for the simple fact that investors are getting a reminder of their tendency to overestimate how long growth companies will grow. Conversely, tech stocks rallied into a bubble while interest rates were relatively high ahead of the dot-com bust and subsequent recession.