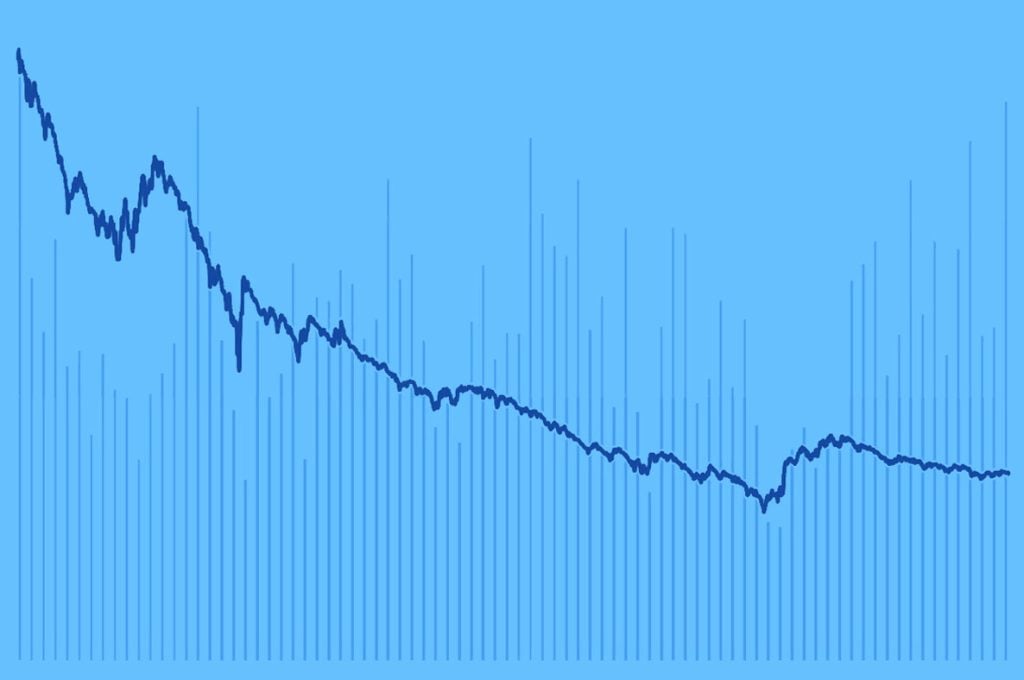

The 2024 post-election landscape echoes patterns we’ve seen before. Looking at that S&P 500 tracking chart comparing 2016 to 2024, it’s almost uncanny how similar they are.

The most intriguing aspect of all this is how the investment thesis isn’t just about the election — it’s about how policy changes intersect with existing market dynamics and longer-term trends. Consumer spending remains resilient (though uneven across income groups, as shown in retail spending charts), real wage growth is supportive, and we’re seeing a healthy broadening of market participation beyond just the megacap tech names that have dominated returns.

While we are upbeat and are finding opportunities in sector rotations especially, we’re seeing something rather remarkable in the markets right now — a widespread tendency to dismiss current economic data as “old news” based on anticipated policy changes. It’s almost as if there’s a collective hand-waving away of concerning indicators, from that tepid small business optimism data to other warning signs, all based on the assumption that everything’s about to change.

But here’s the reality check: the U.S. economy isn’t a speedboat — it’s a massive supertanker. Even with the most aggressive policy changes, turning this ship takes time. Just look at the chart showing household debt versus federal debt — these kinds of fundamental economic shifts happen over years, not months.

This sets up what could be a critical disconnect: The market is pricing in rapid, effective policy implementation and immediate economic impact, but the first 100 days of the new administration will need to deliver tangible, measurable progress to support these expectations. We’re not just talking about policy announcements — we need to see actual changes reflected in hard data: business sentiment improving, capital investment increasing and leading economic indicators responding positively.

This makes the initial months of 2025 perhaps one of the most consequential “first 100 days” periods in recent memory, at least from a market perspective. The current market valuations — which data shows are already above historical averages — are building in a lot of optimism about rapid policy effectiveness. If we don’t see concrete evidence of economic acceleration by spring, we could be setting ourselves up for a significant valuation reset.