Over the past decade, the fixed income asset class has experienced a profound shift as new sources of capital have steadily replaced large, money-center banks in corporate direct lending. This shift resulted from new banking regulations following the ’08-’09 Great Financial Crisis and has recently accelerated as private credit lenders explore new sub-sectors within fixed income to deploy capital. Historically, private credit and direct lending have taken market share from the leverage loan and high yield bond markets; however, recent capital raising has broadened out and funds are now targeting a variety of fixed income markets, including investment grade bonds, structured products, and asset-backed finance.

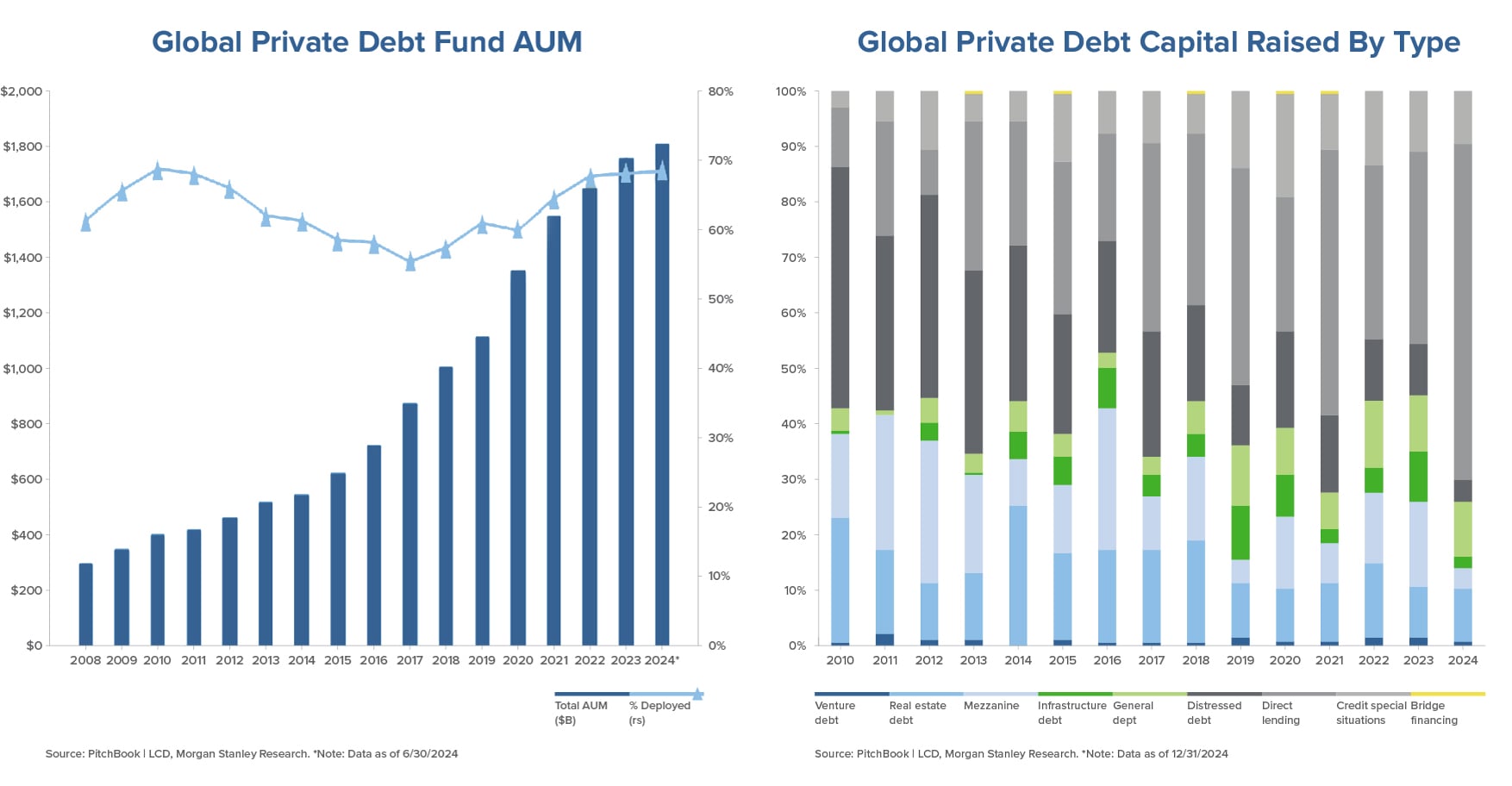

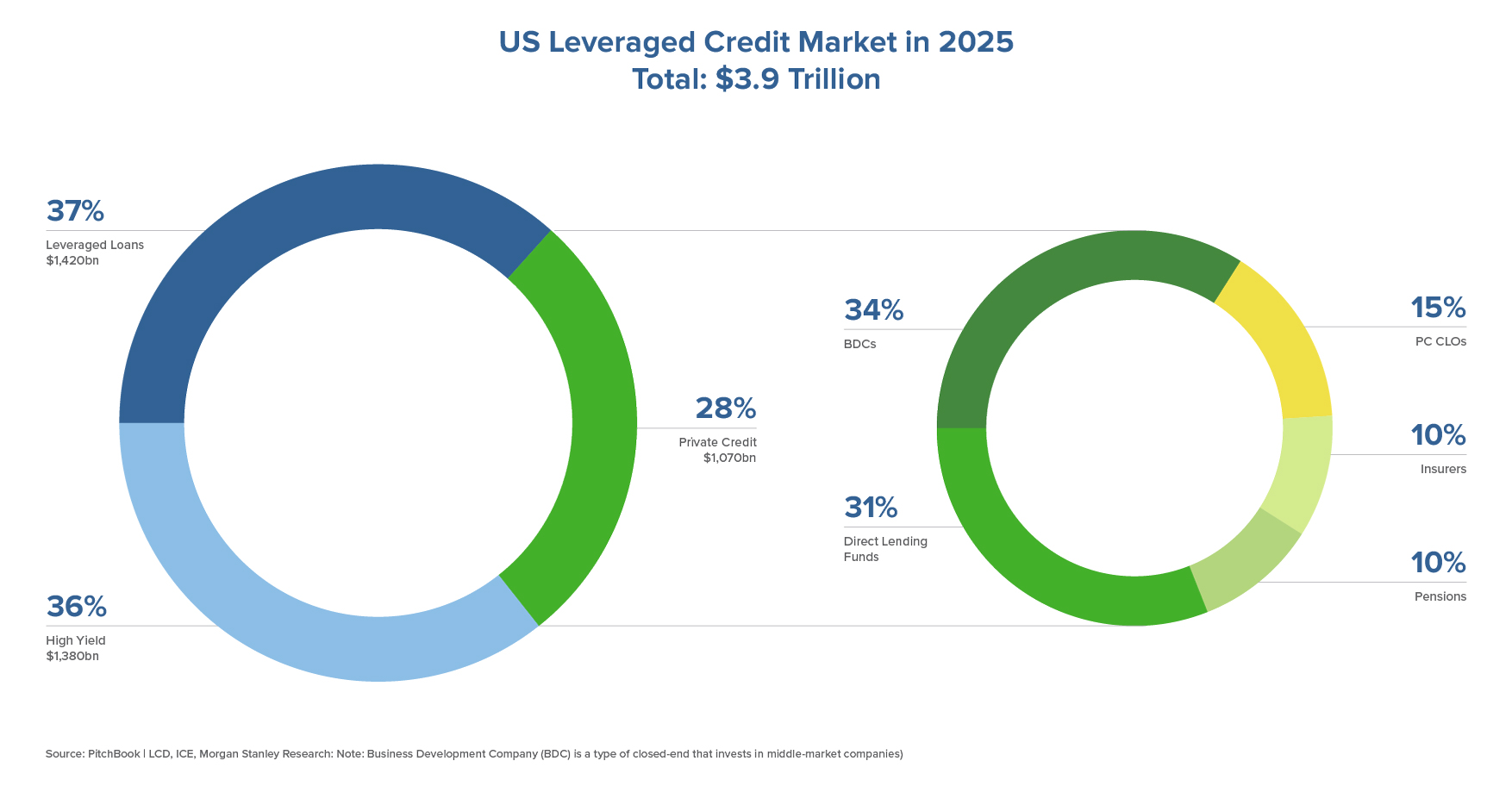

Today, U.S. private credit assets total > $1.0 trillion, representing ~30% of the U.S. leveraged credit market. Globally, private credit assets total > $1.8 trillion and the vast majority of these funds are earmarked for direct lending.

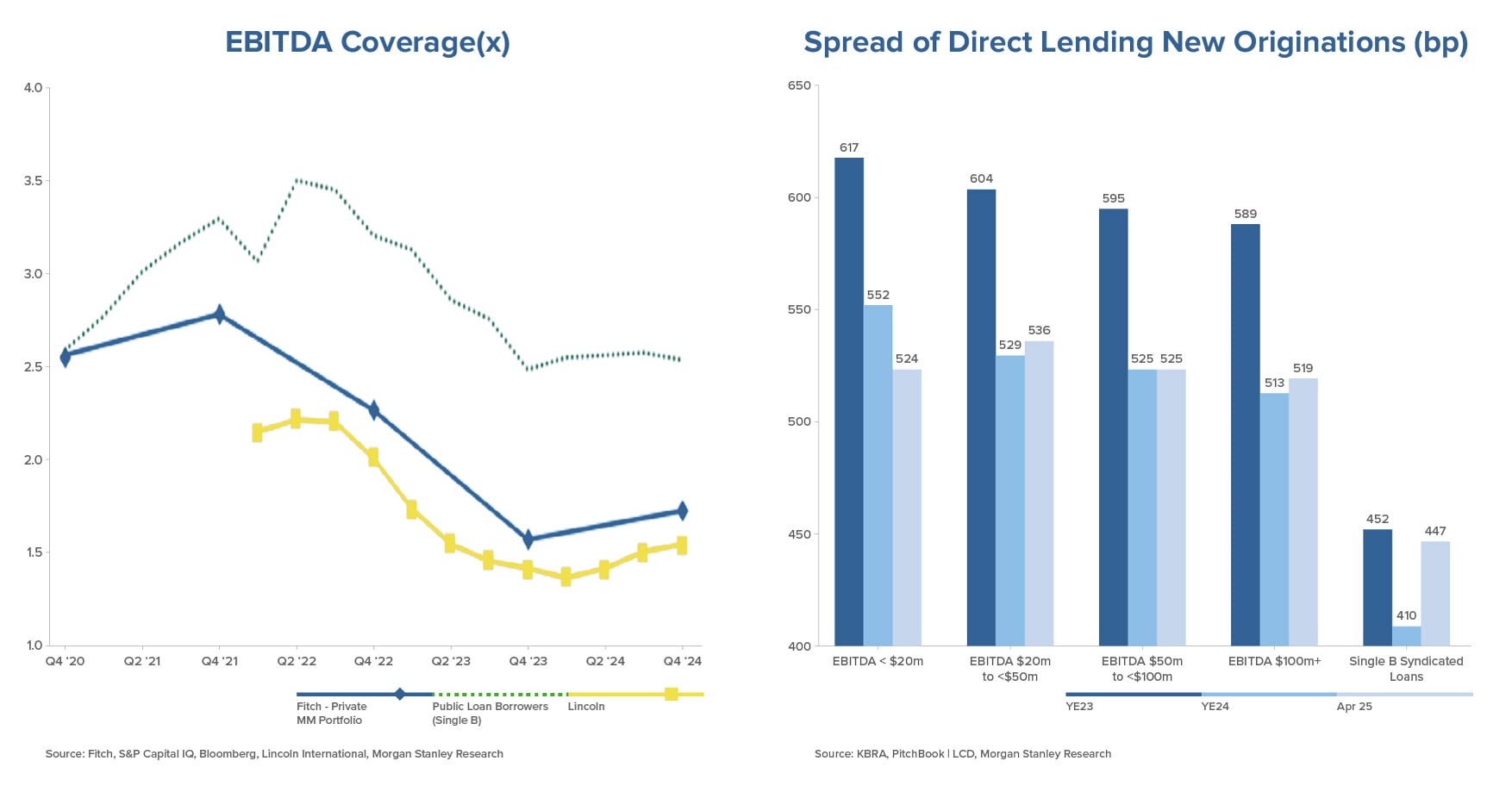

As capital has flooded into private credit, we have (unsurprisingly) seen new origination spreads decline and overall returns retrace from peak levels. With more players chasing fewer opportunities, some funds are lowering return thresholds, loosening covenants, leveraging questionable collateral, and issuing “PIK” instruments, all in order to deploy capital. As a result, credit quality has deteriorated throughout the leveraged loan and direct lending asset class and will ultimately lead to lower recoveries for creditors in a stressed environment. While we are not predicting a broad decline of the private credit, we do believe a “shake-out” will occur, which will highlight funds’ underwriting capabilities relative to their peers.

What about public leveraged credit? With all of the publicity surrounding private credit, high yield bonds and broadly syndicated loans are often overlooked as a destination for fresh capital. In the U.S., leverage loans ($1.4tn) and high yield bonds ($1.4tn) are both larger asset classes relative to U.S. private credit and offer a major advantage: liquidity.

The private credit asset class is highly illiquid. Investors in private credit have historically been willing to trade this illiquidity for higher returns and stronger credit documentation; however, with origination spreads declining and covenant packages loosening, we believe compensation for this illiquidity has dramatically declined. Furthermore, private credit is heavily exposed to the Technology sector, which is squarely in the crosshairs of the AI tech revolution. Putting it all together, we expect default rates in the private credit markets to eclipse those in public markets, with lower ultimate recoveries as well.

On the public side, we continue to see a steady flow of opportunities and expect the public markets to reclaim some market share lost to the private assets over the past few years. With comparable yields, similar documentation, and substantially more liquidity, we believe public credit offers a compelling opportunity today.