Domestic equity markets closed the quarter once more at new all-time highs. The optimism that began last November as news of positive COVID-19 vaccine trials was announced has persisted across the country.

Individuals and businesses alike are beginning to emerge from the lockdown looking to spend, reconnect and resume a more normal life. However, some of the changes that developed in consumer and corporate behaviors are not likely to go back to the way things were before. These shifts will have continued impacts for years to come.

This year, 2021, began with great hope — multiple vaccines had proven highly effective in preventing serious COVID-19 cases and even in limiting the asymptomatic spread. This provided a positive tailwind for the stock market, as investors looked forward to consumers returning to shopping, dining and travel in the coming quarters. Similarly, corporations began to loosen their purse strings and started increasing their investments in both capital expenditures such as plant, property and equipment, as well as human capital via hiring new employees. These efforts to restart the economy were further helped by additional fiscal stimulus, adding another $1.9 trillion with President Biden’s “American Rescue Plan” to the already unprecedented levels from the prior year. This most recent bill included direct financial support to individuals as well as additional funding for vaccines, rent relief and much more. Collectively, this provided a strong backdrop for the stock market, which rallied higher, while other markets, such as the U.S. Treasury market, saw rising interest rates weigh on returns.

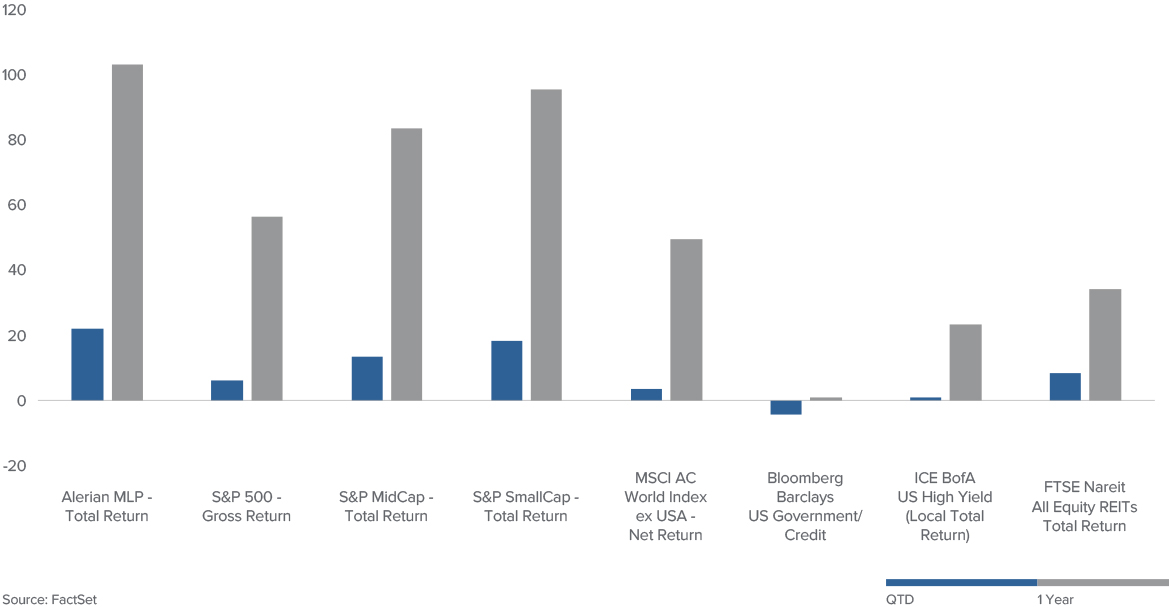

2021 First Quarter and 1-Year Trailing Returns Across Asset Classes

Interest rate levels remain historically low, however, the surge in optimism has pushed them notably higher. The first quarter of 2021 saw the third largest quarter-over-quarter increase in rates in the last 20 years, as the yield on the 10-year Treasury bond rose from 0.91% to 1.74%. This served as a meaningful headwind to the bond market, with corporate bonds rated as investment-grade suffering their worst quarterly performance since late 2008. Corporate bonds have enjoyed decreasing credit spreads, the amount of interest required over the U.S. Treasury rate to borrow money, to offset the initial rise in rates. But with spreads already at pre-pandemic levels, they are not likely to go significantly lower. The Federal Reserve remains on watch but has continued to provide highly supportive monetary policies in hopes of spurring economic growth and positive inflation from their policies. With the economic environment improving, rates rising, and inflation potential higher as well, investors will have to grapple with a different backdrop than seen in the last several years.

Westwood's Outlook

Throughout the year, we set scenarios to help guide our investment outlooks and assumptions. This provides both a time for introspective analysis for what has transpired as well as what opportunities and pitfalls may await in the coming periods. We start with our operative scenario, the most likely vision of the future, and then push our intellectual flexibility to alternative outcomes.

For 2021, the key themes within our operative scenario — “The Shawshank Redemption” — remain the same as they did to start the year: unleashing spending by consumers and corporations.

COVID-19 Retreats Further:

The vaccine deployment ramped up quickly, allowing lockdowns to be lifted and freeing the populace from self-imprisonment to spend, spend, spend! Consumers use their high levels of savings to binge on new adventures and new outfits. This helps drive corporations to invest themselves in hiring new workers as well as investments for productivity and capacity enhancements. A virtuous cycle unfolds with second quarter GDP showing the greatest rebound in growth for the year, with latent strength from stimulus and reopening persisting into 2022.

Stimulus Increases:

Global central banks don’t consider removing the “punch bowl,” and the party for risk assets continues fueled by extraordinary market support from historically low policy rates. Fiscal stimulus reloads for another large round of direct payments, helping replace incomes for some consumers and filling more of the consumption gap created by the pandemic. The healing process continues to be supported by economic and employment improvements. The combined impact pushes corporate profits higher, justifying current valuations and making risk assets look attractive.

Political Rhetoric Fades:

Trade policy returns to the spotlight with the new administration taking a more conventional approach to diplomacy. This helps lower overall volatility in the market though some tough negotiations remain ongoing. A more conventional approach likely limits further escalation, but investors remain hopeful for lower tariffs to offset potential rising inflation. However, tax increases to pay for fiscal spending may dampen the animal spirits at work in the markets depending on the nuances within the potential legislation.

While we believe the scenario laid out above remains the most likely, there are certainly events in the foreground that could cause a “Raging Bull” to be unleashed. With congressional control by the Democrats, large fiscal impulses are underway, and should they come without tax increases, this could remove a potential headwind currently contemplated by investors. Confidence is coming back for CEOs and individuals alike, but further research may increase the faith in the vaccines’ ability to control the pandemic and spur even more spending, driving valuation multiples higher at the same time earnings are revised upward.

In contrast, if “There Will Be Blood,” such a retrenchment would start with a vaccine showing limited efficacy with new potential variants of COVID-19, raising safety concerns that cause reinstatement of onerous lockdowns on corporations and consumers. Rising inflation and potential for further populist policies could see volatile flareups and pressure valuation multiples as risk premiums increase.