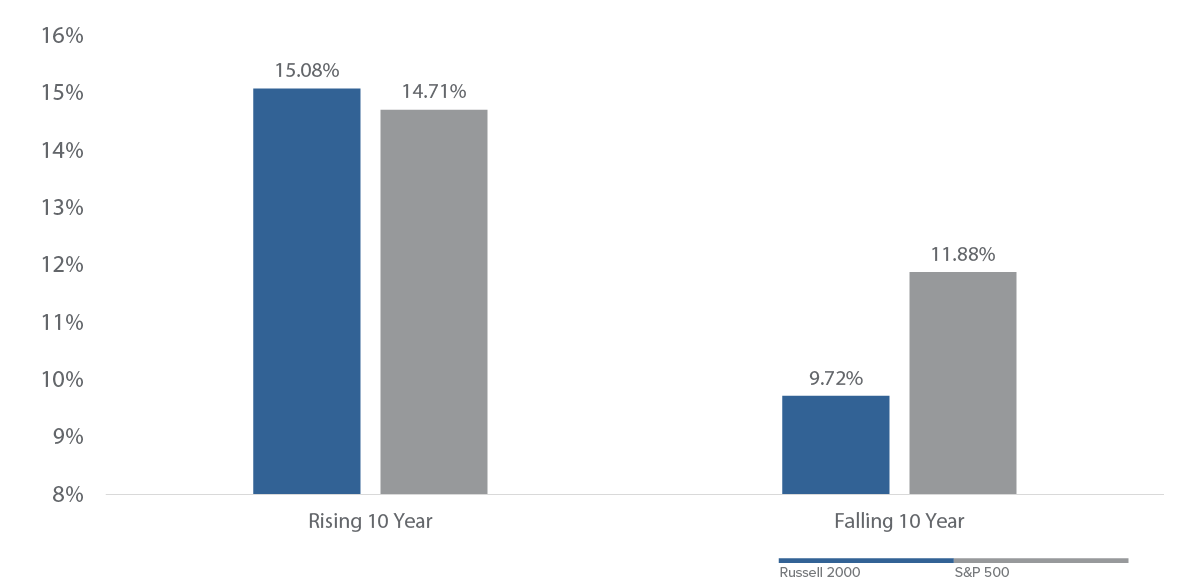

Small caps have historically performed well in rising rate environments, even outpacing large caps.

Average 12-Month Performance When 10-Year Treasury Rates Are Rising and Falling (Since 1980)

Why it Matters

If interest rates rise resulting in price to earnings multiples and profit margins peaking, avoiding marginal companies with a greater emphasis on high-quality companies trading at attractive prices will be increasingly important. We are already seeing this play out in the Russell 2000 Index where one-third of the stocks in the Russell 2000 have not been profitable in 12 months, a level normally only seen in recessions.

Source: Strategas Research Partners, 2017. Past performance is not indicative of future results.

Take Action: Learn More About Our Approach to Small Cap Investing

Annualized Alpha Since Inception

Using net of fees returns vs. Russell 2000 Value

Down Market Capture Since Inception

Using net of fees returns vs. Russell 2000 Value

Active Share

High-conviction portfolio focused on 50 to 70 holdings

Percentile Ranking

Total net return performance in U.S. Small Cap Value Equity Universe since inception

Westwood SmallCap: Key takeaways

A high-quality approach to small cap investing could be a way for investors to strategically allocate to the asset class in an attempt to improve consistency over the long term.

![]()

High-Quality Focus

We believe high-quality businesses that are operating well with undervalued earnings potential offer competitive risk-adjusted returns.

![]()

High-Conviction Investing

Focused best ideas portfolio with historically high active share. Number of securities typically ranges from 50 to 70.

![]()

Team-Based Approach

Our strategy utilizes a team-based fundamental bottom-up approach to identify high-quality companies.