The Intersection of Quality and Value

Westwood’s philosophy and our approach to small cap investing is focused on identifying companies that maintain both specific high-quality attributes along with attractive valuations to exploit a potential return premium. Our team-based investment process is multi-faceted and tailored to specific industries including cyclical companies that play an important role in the Russell 2000 Index. Our focus on downside risk in absolute terms as it relates to the permanent loss of capital is critical to investing in companies with stable fundamentals that can perform across a broad range of market environments. In other words, we look at worst-case scenarios first before moving on to an upside thesis. High active share is an intentional output of our investment process in order to express our best ideas at the intersection of quality and value.

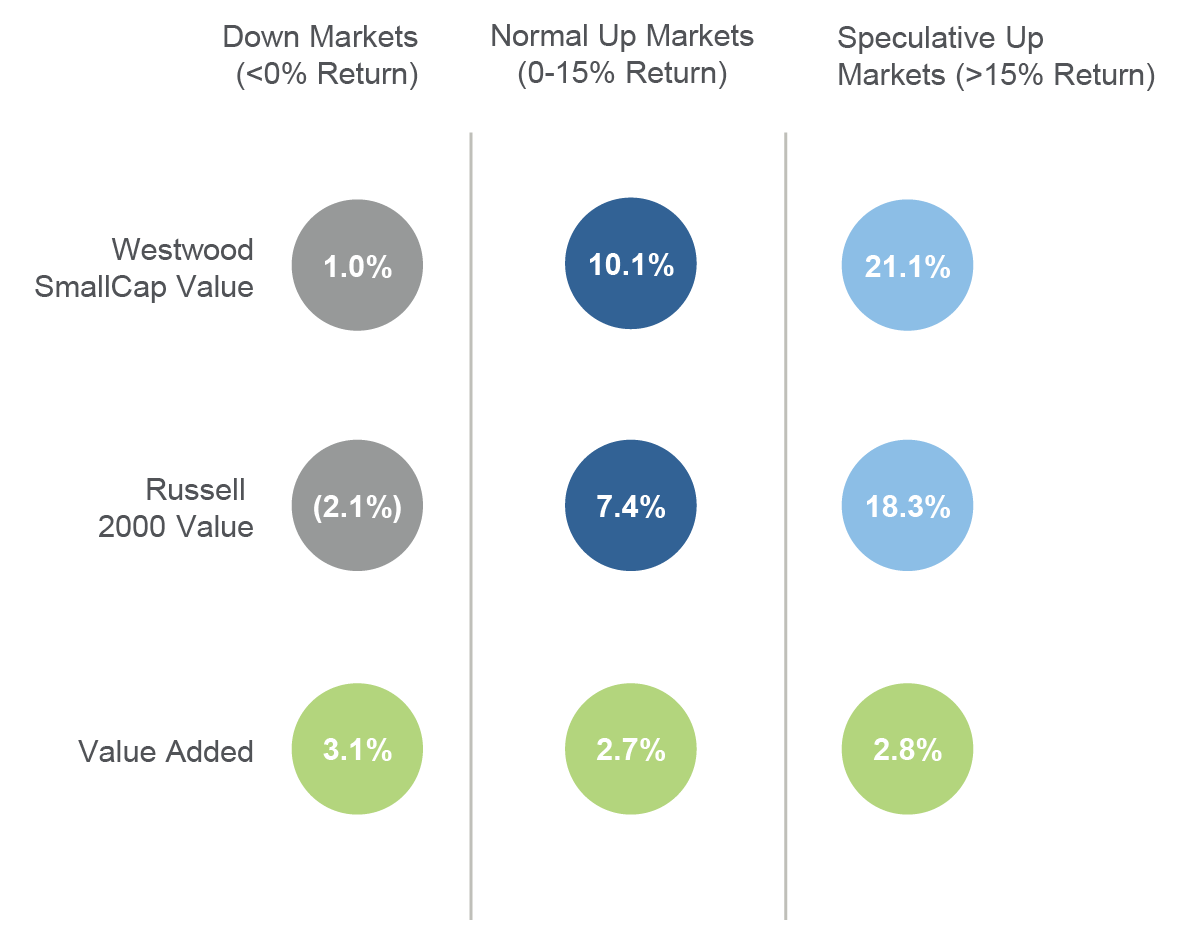

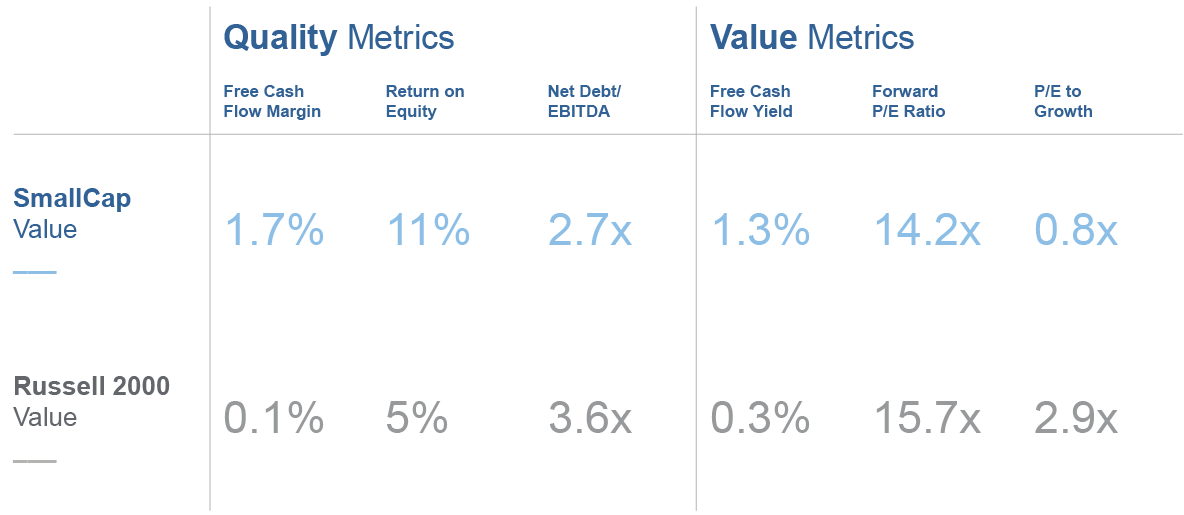

Figure 1 below highlights key characteristics and the overall profile of companies at the intersection. The Westwood SmallCap Value strategy has stronger quality metrics with better free cash flow, significantly higher ROE and less leverage than the Russell 2000 Value benchmark. Furthermore, our portfolio is typically constructed with lower valuation metrics when evaluating forward P/E ratios and lower PEG ratios.

Figure 1: What the Intersection Looks Like as of Q4 2019

Getting Valuation Right is Key to Unlocking the Return Premium

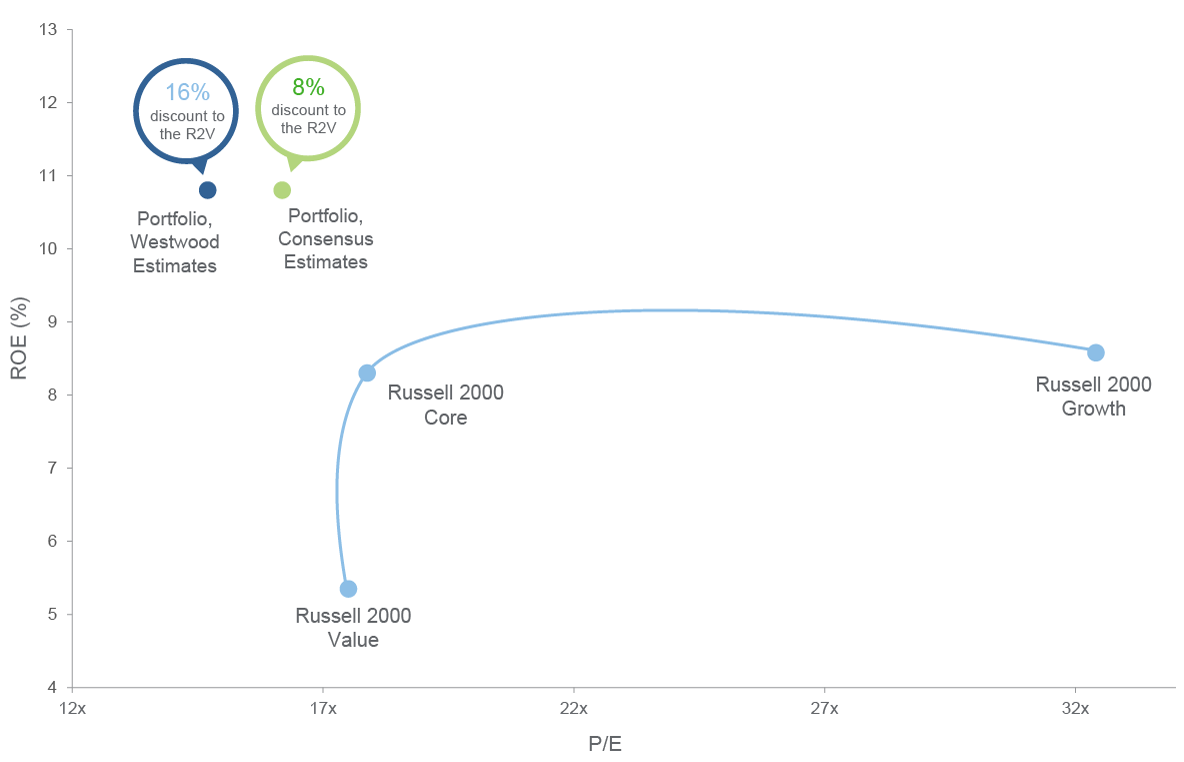

Valuing a small cap company is a complex process. Gathering and assessing the quality of metrics is just as important as the data itself. The small cap space transcends style boxes which are not unique to any asset classes and maintain both unstable memberships and relationships to value. Our valuation techniques focus on cash flow and earnings rather than price-to-book (P/B). This has been critical to identifying high-quality companies trading at discounts to their intrinsic value. Today, our portfolios exhibit both higher-quality attributes with better earnings prospects while trading at a discount to the benchmark. As you see in Figure 2, the Westwood SmallCap Value strategy has a higher ROE and lower P/E ratio vs. the Russell 2000 Value.

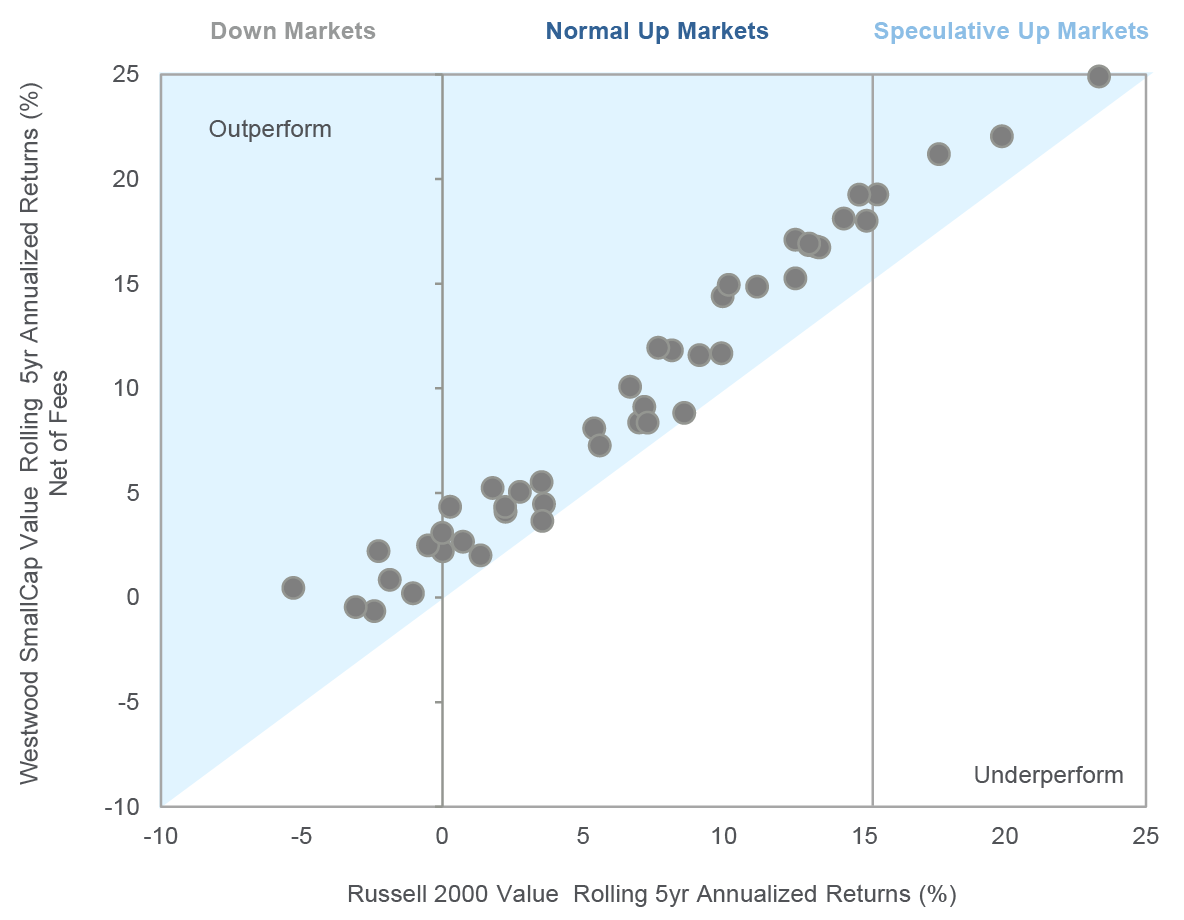

In summary, investing in great businesses across different industries trading at attractive valuations can result in more consistent performance through the investment cycle. See Figure 3. Westwood’s unique SmallCap Value strategy can be a critical building block for Value investors or as a diversifier to Value strategy that is focused on rewarding investors over time with more consistency and fewer favorable events.

Figure 2: Westwood SmallCap Value – Investing at the Intersection of Quality and Value

Forward P/E vs. ROE

5-Year Average as of Dec. 31, 2019

Figure 3: Delivering Consistency Across a Wide Array of Market Environments

Annualized Rolling 5-Year Returns Net of Fees Since Inception

Westwood SmallCap Value vs. Russell 2000 Value Index

*Overall Batting Average: 100%

Market Environment