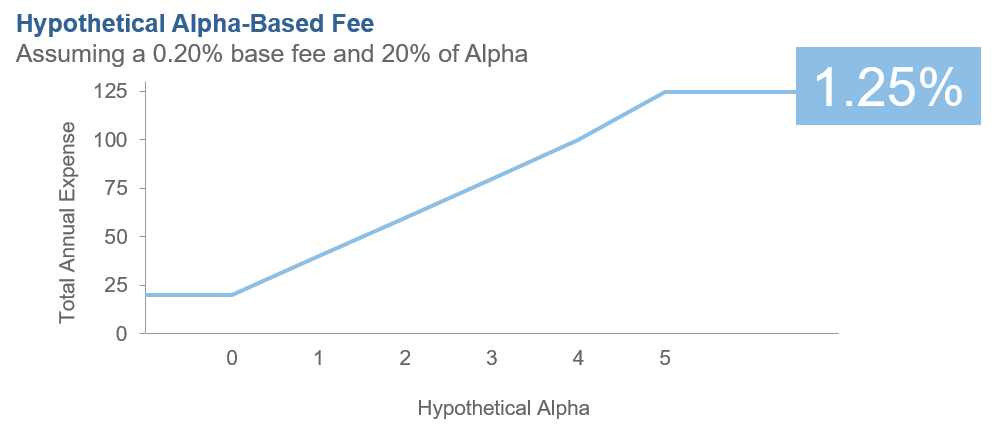

Low Index-Like Fee + [ % of α ]

For the most frugal investors who need alpha to reach their return goals, we offer WW Alpha-Based Sensible Fees™. We believe this solves the fee problem by creating a simple structure with a low index-like fee that is cheaper than most index and ETF products plus a linear fee, directly linked to risk-adjusted outperformance only when pure alpha is earned.

Westwood (WW) has developed a new, innovative and simple fee framework available to eligible investors on strategies or products in which we are offering an Alpha-Based Sensible Fee™ framework. Westwood Sensible Fees™, embrace the core principles of evaluating pure manager skill, addressing the low cost of indexing and protecting investors using risk-based fees — all with the goal of changing the probability of winning in an efficient asset class and reversing the historical precedent set in the industry by giving the asset owner the asymmetric advantage.

A performance-based fee generally introduces the following risks: (i) Performance-based fee arrangements may cause Westwood to make investments that are more risky or speculative than otherwise; (ii) Westwood may receive increased compensation (compared to a fixed fee) based on unrealized appreciation as well as realized gains on assets in the client’s account, (iii) clients may pay a performance fee even if an account declines in value, and (iv) no compensation or refund is paid if Westwood underperforms the benchmark. Sensible Fees are only available to those investors which are \”qualified clients,\” as defined in Rule 205-3 of the Investment Advisers Act of 1940.