Income Alternatives for Resilient Portfolios

We believe alternative approaches to income investing can provide diversified sources of risk and return and potentially reduce volatility.

Absolute return-oriented and yield-focused strategies investing in securities not typically found in traditional fixed income portfolios

Strategies that can deliver income and capital appreciation potential regardless of the direction of the market.

Potentially reduce volatility with investment strategies that show lower correlation over a full market cycle.

A Market-Neutral Strategy for Risk-Averse Investors

We believe a market-neutral approach utilizing convertible arbitrage and opportunistic fixed income can potentially serve as a complement to bond allocations. Our framework consists of three primary sources of return that aim to neutralize systematic risk.

Consistently High Income from Non-Traditional Sources

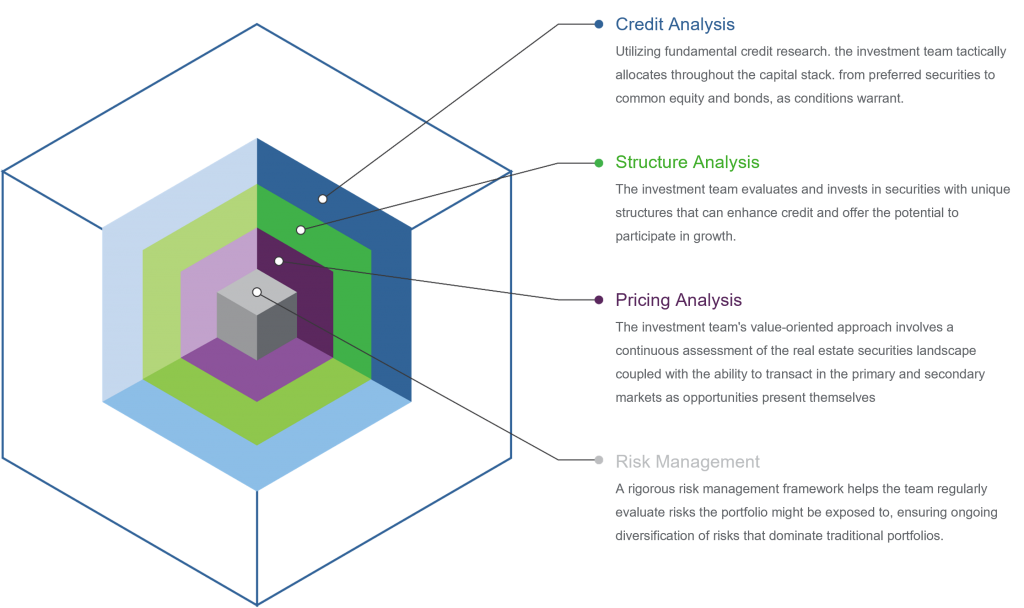

A strategy that invests in senior securities and high-income equities primarily issued by real estate investment companies. The managers focus on REIT preferred securities, but can diversify among preferred stocks, common stocks and bonds to seek income and total return.

The team supporting the Alternative Income strategy includes two portfolio managers and a half-dozen analysts, taking a bottom-up approach to credit analysis combined with a top-down macro-overview to navigate challenging market environments.

Bottom-up Multi-Asset investing can bring something very powerful and unique to a portfolio in...

Learn more