The New Core Portfolio

We seek to deliver positive absolute returns through market cycles. We believe that tactical portfolio allocation can actively manage market exposure by adapting to economic conditions and internal market momentum.

Our approach is designed to rapidly adapt to changing market conditions across the capital markets to provide positive returns in all market, all weather environments.

We believe the strategy is the new core allocation that can diversify long-only active and passive equity portfolios in more volatile, low return equity environments.

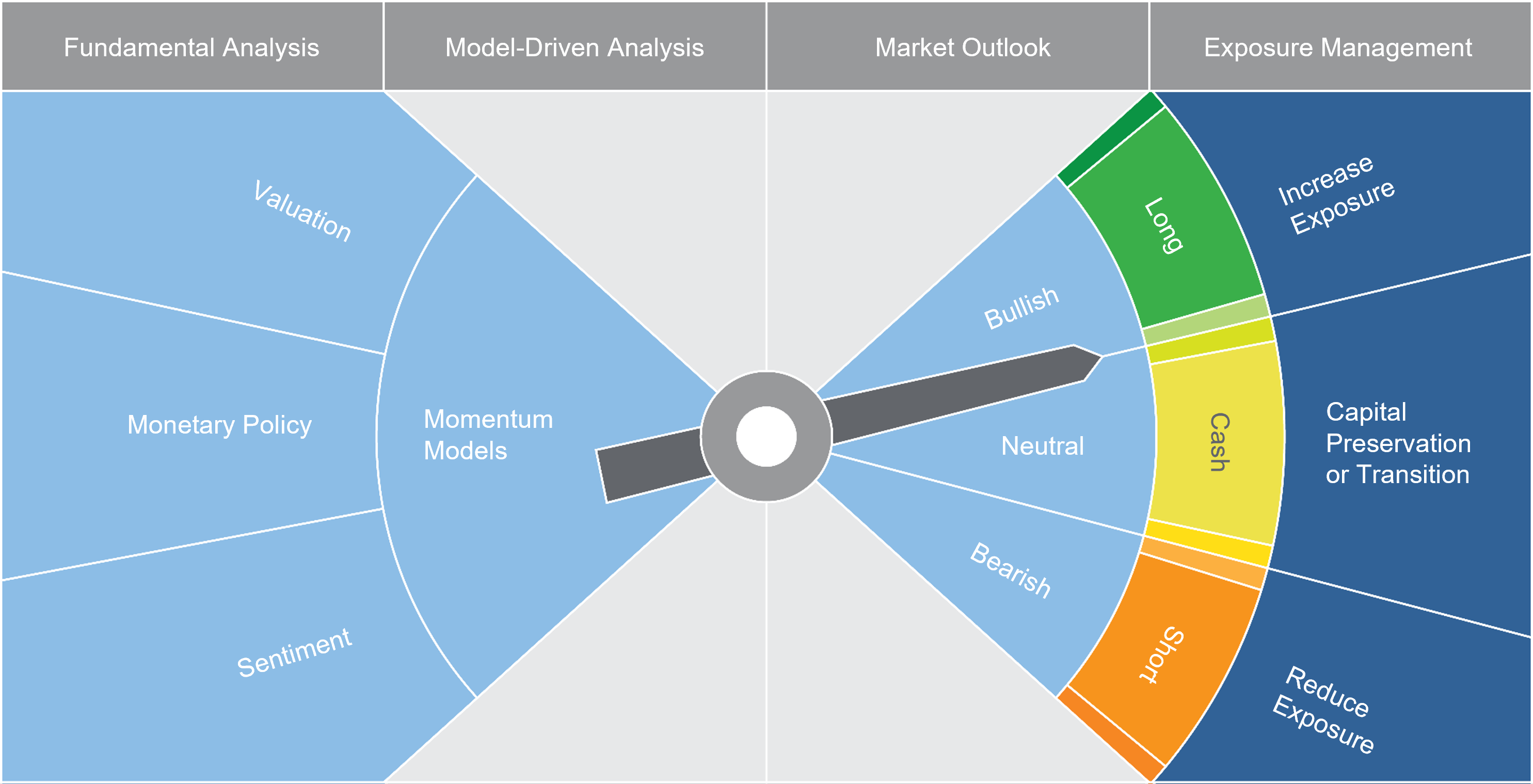

We employ a disciplined four pillar investment process where our market exposure decreases systematically if market risks are on the rise and fundamentals are deteriorating.

We believe that being fully invested in equities during periods of intense speculation and monetary tightening within an overvalued market is unwise. We also believe there are market environments in which investors should be fully invested and perhaps overweight higher beta sectors and indices. Our goal is to be in concert with the overall economic/business cycle.

There are four pillars of our investment process. The first three pillars – valuation, monetary policy, and investor sentiment – are qualitative in nature. Our fourth pillar is a quantitative assessment of volume and breadth-based momentum. Using a combination of these qualitative and quantitative metrics, we seek to manage risk and enhance alpha by tactically phasing into and out of major equity cycles.

Members of the Broadmark investment team have employed a strategy similar to the Tactical Growth strategy since 2001. The strategy derives from team members’ experience with market cycles over a period of more than 30 years.

Westwood Funds are distributed by Ultimus Fund Distributors, LLC. (Member FINRA) Ultimus Fund Distributors and Westwood Funds (or Westwood Holdings Group, Inc.) are separate and unaffiliated.