Strategy Description

The Westwood Alternative Income Fund aims to generate absolute returns through a combination of current income and capital appreciation with low correlation to equity and fixed income markets.

Fund Overview

**The advisor has contractually agreed to reduce fees and reimburse expenses until March 1, 2026.

***The subsidized SEC yield is calculated with a standardized formula mandated by the SEC. The formula is based on maximum offering price per share and includes the effect of any fee waivers. Without waivers, yields would be reduced.

Assumes an initial investment of $10,000 was made on the fund's inception date of 05/01/2015. The growth of a $10,000 investment in the fund is hypothetical and for illustration only. It does not represent any actual investment.

| Trailing Year Performance | YTD* | 1-Yr Trailing |

3-Yrs Trailing |

5-Yrs Trailing |

10-Yrs Trailing |

Since Inception |

|---|---|---|---|---|---|---|

| Alternative Income Fund Net of Fees | 7.55% | 7.55% | 6.78% | 4.39% | 4.38% | 4.10% |

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. The Fund charges a redemption fee of 1.00% as a percentage of shares redeemed that have been held less than 30 days. Investment performance does not reflect the redemption fee; if it was reflected, the total return would be lower than shown. For performance data current to the most recent month end, please call +1 (877) FUND-WHG. *YTD figure is calculated as of the most recent month end.

*The Adviser has contractually agreed to reduce fees and reimburse expenses until March 1, 2026.

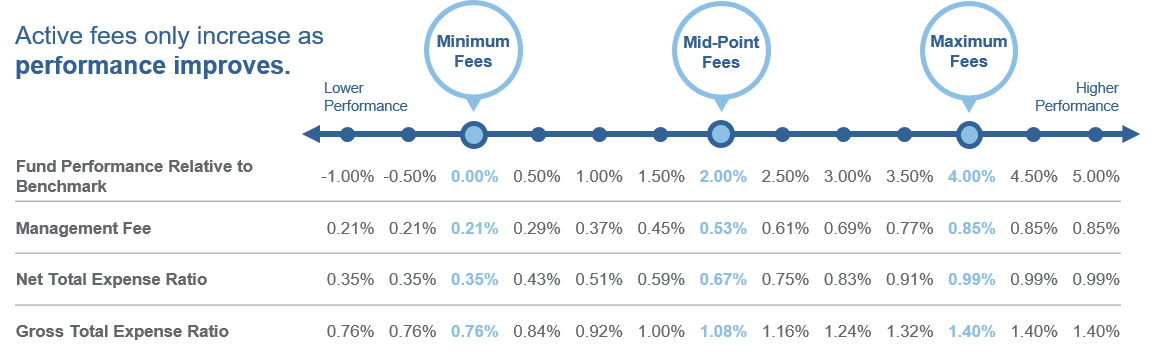

The Base Fee is an annual rate of 0.53%. The Index Hurdle is the FTSE 1-Month U.S. Treasury Bill Index plus 2.00%. The Performance Adjustment is calculated according to a schedule that adds or subtracts 0.0016% of the Institutional Shares’ average daily net assets for each 0.01% by which the performance of the Institutional Shares exceeds or lags the performance of the Index Hurdle over the Performance Period. The maximum Performance Adjustment (positive or negative) will not exceed an annual rate of +/- 0.32% of the Institutional Shares’ average daily net assets during the Performance Period, which would occur when the performance of the Institutional Shares exceeds, or is exceeded by, the performance of the Index Hurdle by 2.00% over the Performance Period. Accordingly, the management fee will range from a minimum annual rate of 0.21% to a maximum annual rate of 0.85%.

![]()

Aims to achieve an attractive return (net of fees) annualized over a full market cycle.

![]()

A portfolio designed to have low volatility relative to equity and fixed income markets.

![]()

Potential for uncorrelated returns and attractive diversification benefits with traditional equity and fixed income allocations.

![]()

Utilizes Sensible Fees to change the probability of achieving better absolute net returns for active investors.

Information is for the institutional share class only; other classes may vary.

Diversification does not ensure a profit or guarantee against a loss. The value of a convertible security in which the Fund invests is influenced by changes in interest rates, the credit standing of the issuer and the price of the underlying common stock. Fixed income securities are subject to a number of risks, including credit and interest rate risks. International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations. The fund may invest in derivatives, which are often more volatile than other investments and may magnify the Fund’s gains or losses. Beta is the measure of risk in relation to the market or benchmark. There can be no assurance that the fund will achieve its stated objective.

Copyright © 2026 Westwood Funds

Westwood Funds are distributed by Ultimus Fund Distributors, LLC. (Member FINRA) Ultimus Fund Distributors and Westwood Funds (or Westwood Holdings Group, Inc.) are separate and unaffiliated.

To determine if this Fund is an appropriate investment for you, carefully consider the Fund’s investment objectives, risk factors and charges and expenses before investing. This and other information can be found in the Fund’s prospectus which may be obtained by calling +1 (877) FUND-WHG (+1 (877) 386-3944). Please read the prospectus carefully before investing.