A global equity fund that seeks to reduce authoritarian country risk by investing in democratic developed and emerging markets.

Product Overview

The Westwood LBRTY Global Equity ETF seeks to track the TOBAM LBRTY® All World Equity Index. The approach is grounded in academic research highlighting the economic advantages of democratic nations. The fund offers broad exposure to both developed and emerging markets, while reducing direct and indirect exposure to autocratic countries, such as China.

Highlights

*30-day median bid/ask spread reflects the median of the difference between the best bid and offer as of the end of each 10-second interval during each trading day of the last 30 calendar days.

Broad exposure to democratically governed countries, including developed and emerging markets; excludes companies with ties to authoritarian regimes, including direct exposure and indirect exposure.

Research links democratic governance with long-term profitability. Published academic studies validate the connection between companies operating in democratic environments and superior financial performance.

Clearly defined rules for exclusion are based on measures of political freedom, economic liberty and human rights; exclusion also applies to companies with indirect exposure to autocratic regimes.

| Trailing Year Performance | YTD* | 1 Month | 3 Months | 6 Months | 1 Year | 3 Years | 5 Years | Since Inception |

| Total Return NAV (%) | 20.99% | -0.02% | 3.32% | 9.86% | --- | --- | --- | 20.99% |

| Market Price (%) | 21.23% | 0.15% | 3.42% | 10.20% | --- | --- | --- | 21.23% |

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 800.994.0755. *YTD figure is calculated as of the most recent month end.

Fund NAV represents the closing price of underlying securities. Market Price is calculated using the price which investors buy and sell ETF shares in the market. The market returns in the table were calculated using the closing price and account for distribution from the funds.

| Name | Security Identifier | Symbol | Net Assets % | Market Price | Shares Held | Market Value | Market Value % |

| US DOLLARS | USD | USD | 99.98% | 1.00 | 2,279,792 | 2,279,792 | 100.07% |

| EURO | EUR | EUR | 0.00% | 0.85 | -8 | -10 | 0.00% |

| Receivables/Payables | RECPAY | RECPAY | -0.07% | 1.00 | -1,633 | -1,633 | -0.07% |

| 2025 | Q1 2026 | |

| Days at premium | 136 | 22 |

| Days at zero premium/discount | 21 | 4 |

| Days at discount | 37 | 11 |

The Premium/Discount of an ETF is defined as the amount the ETF is trading above/below the NAV of the underlying holdings.

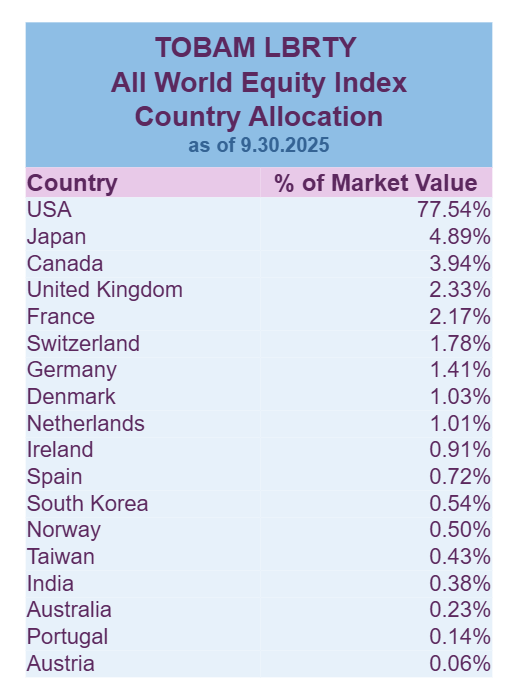

Country weights as of September 30, 2025. Holdings are subject to change.

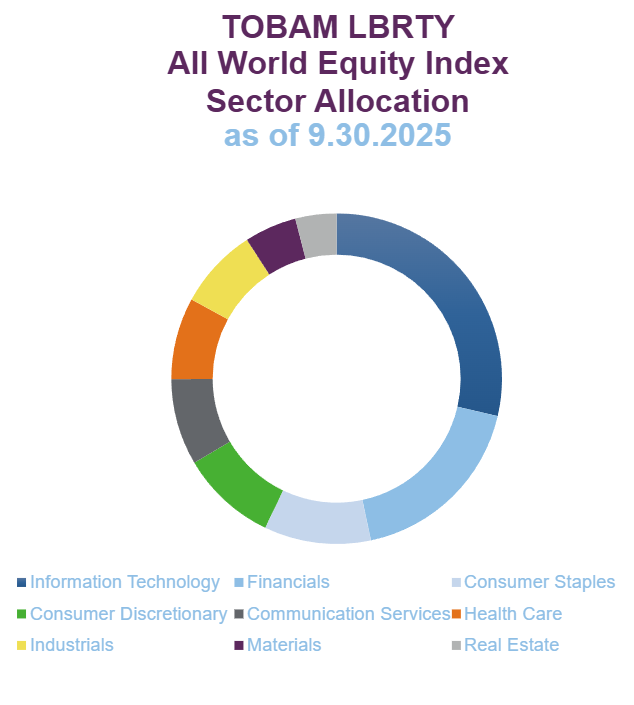

Sector weights as of September 30, 2025. Holdings are subject to change.

If you’re feeling overwhelmed by the many choices for your investment portfolio, you’r...

NAV Return represents the closing price of underlying securities. Market Return is calculated using the price which investors buy and sell ETF shares in the market. The market returns in the table are based upon the midpoint of the bid/ask spread at 4:00 pm EST, and do not represent the returns you would have received if you traded shares at other times.

The performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted above. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information current to the most recent month-end, please call toll-free (877) 386-3944.

Tracking error measures the divergence of returns between an investment and a benchmark. Beta is a measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole. A beta of 1 indicates that the security’s price will move with the market. A beta of less than 1 means that the security will be less volatile than the market. A beta of greater than 1 indicates that the security’s price will be more volatile than the market. Out of the money is also known as OTM, meaning an option has no intrinsic value, only extrinsic value. A call option is OTM if the underlying price is trading below the strike price of the call. A put option is OTM if the underlying’s price is above the put’s strike price. The SEC 30-Day Yield is a metric used to measure the income generated by a mutual fund or an exchange-traded fund (ETF) over a 30-day period. It is calculated by taking the net investment income earned by the fund over the past 30 days and annualizing it. The Unsubsidized SEC Yield represents what a fund’s 30-Day SEC Yield would have been had no fee waivers or expense reimbursement been in place over the period.

To determine if this Fund is an appropriate investment for you, carefully consider the Fund’s investment objectives, risk factors and charges and expenses before investing. This and other information can be found in the Fund’s prospectus which may be obtained by downloading at westwoodetfs.com or calling (800) 994-0755. Please read the prospectus carefully before investing.

The Fund is newly formed and has limited operating history.

As with any mutual fund or ETF, there is no guarantee that the Fund will achieve its investment objectives. You could lose money by investing in the Fund. Many factors influence a fund’s performance. An investment in the Fund is not intended to constitute a complete investment program and should not be viewed as such. All securities investing and trading activities risk the loss of capital. The principal risks of investing in the Fund, which could adversely affect its net asset value and total return.

The fund is subject to Authorized Participant Concentration Risk: Only an Authorized Participant (as defined in the “How to Buy and Sell Shares” section of this prospectus) may engage in creation and redemption transactions directly with the Fund. The Fund has a limited number of institutions that act as Authorized Participants. To the extent that these institutions exit the business or are unable to proceed with creation and/or redemption orders with respect to the Fund and no other Authorized Participant is able to step forward to create or redeem Creation Units, Fund shares may trade at a discount to NAV and possibly face trading halts and/or delisting.

Authorized Participants may be less willing to create or redeem Fund shares if there is a lack of an active market for such shares or its underlying investments, which may contribute to the Fund’s shares trading at a premium or discount to NAV.

Absence of Prior Active Market. While the Fund’s shares are listed on an exchange, there can be no assurance that an active trading market for shares will develop or be maintained. The Fund’s distributor does not maintain a secondary market in shares.

Trading Issues. Trading in shares on an exchange may be halted due to market conditions or for reasons that, in the view of the exchange, make trading in shares inadvisable. In addition, trading in shares on an exchange is subject to trading halts caused by extraordinary market volatility pursuant to the exchange’s “circuit breaker” rules. There can be no assurance that the requirements of an exchange necessary to maintain the listing of the Fund will continue to be met or will remain unchanged. Shares of the Fund, similar to shares of other issuers listed on a stock exchange, may be sold short and are therefore subject to the risk of increased volatility and price decreases associated with being sold short.

Investing involves risk, including loss of principal. The value of the fund’s shares, when redeemed, may be worth more or less than their original cost.

To determine if this Fund is an appropriate investment for you, carefully consider the Fund’s investment objectives, risk factors and charges and expenses before investing. This and other information can be found in the Fund’s prospectus which may be obtained by downloading at westwoodetfs.com or calling (800) 994-0755. Please read the prospectus carefully before investing.

Westwood ETFs are distributed by Northern Lights Distributors, LLC (Member FINRA). Northern Lights Distributors and Westwood ETFs (or Westwood Holdings Group, Inc.) are separate and unaffiliated.