Investing at the Intersection of Quality and Value

We believe investing in undervalued, high-quality businesses can generate a return premium resulting in lower absolute downside risk and superior risk-adjusted returns.

Research analysts serve as industry experts with an average of 23 years of experience.

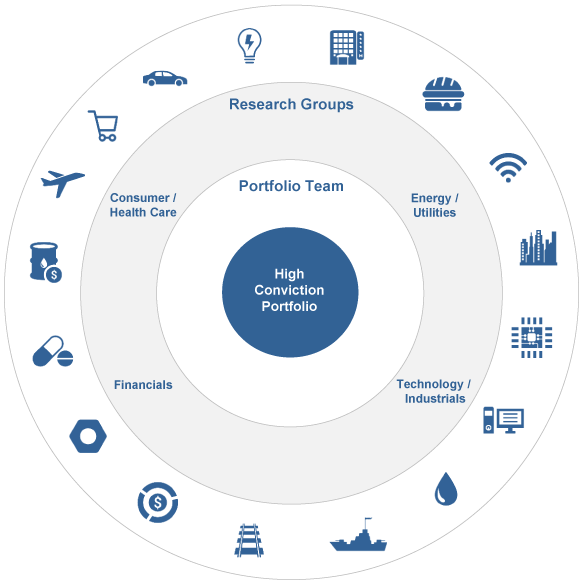

Research Groups (made up of Research Analysts and Portfolio Managers) challenge the investment thesis and determine the approved list.

The Portfolio Team is responsible for security selection and managing portfolio risk.

Our U.S. Value Equity Team includes industry analysts and research groups that are involved throughout the portfolio management process. By employing our core principles, we seek to invest in high-quality companies with undervalued earnings potential while limiting absolute downside risk.

Someone once said, “It’s incredibly hard to become a quality company and it’...

Learn more