Objective

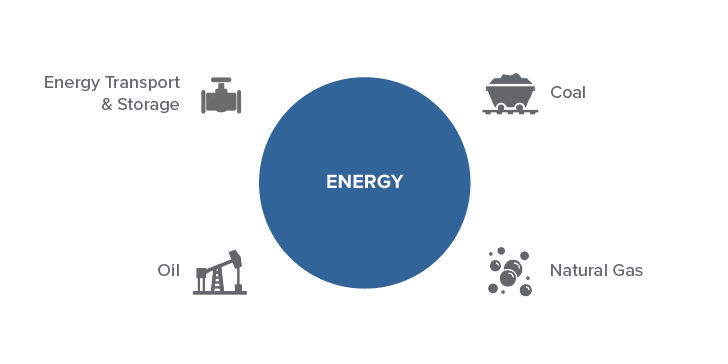

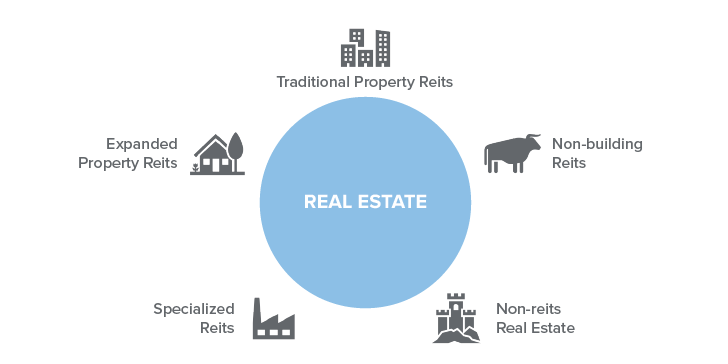

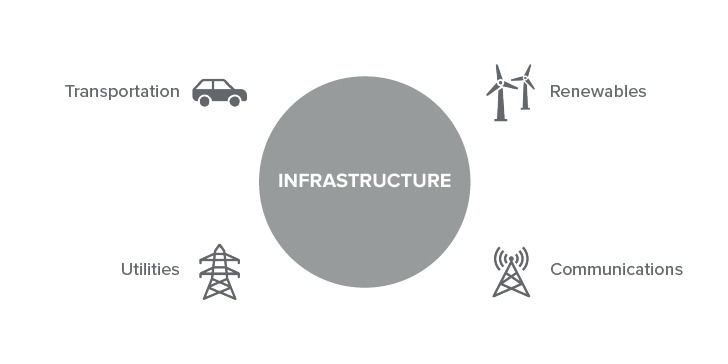

The Westwood MIS Real Assets Strategy seeks to generate capital appreciation and consistent income by investing in publicly traded equity securities of companies in the energy, real estate, infrastructure and natural resources industries.

Strategy Overview

| Separate Account | |

| Commingled Trust |

Real assets are tangible, physical assets that derive their value from intrinsic characteristics and utility, rather than a contractual claim (like equities or debt). The strategy invests in companies that own, operate or develop these assets. Defining the industries and sub-asset classes is critical to achieving the desired volatility, diversification and inflation characteristics.