Objective

Designed to achieve an attractive rate of total return while maintaining a low-volatility profile.

Strategy Overview

| Separately Managed | $25M |

| Other Pooled Vehicles | $5M |

| Assets Under Management | $1.4B |

| Inception Date | 01/01/03 |

| Holdings | 144 |

| QTD | YTD | 1-Yr Annualized | 3-Yrs Annualized | 5-Yrs Annualized | 10-Yrs Annualized | Since Inception | |

|---|---|---|---|---|---|---|---|

| Income Opportunity Strategy Gross of Fees | 2.86 | 12.50 | 12.50 | 10.90 | 5.63 | 7.19 | 8.39 |

| Income Opportunity Strategy Net of Fees | 2.66 | 11.61 | 11.61 | 10.02 | 4.91 | 6.44 | 7.73 |

| 40% / 60% Blended Benchmark* | 1.72 | 11.58 | 11.58 | 11.79 | 5.51 | 7.21 | 6.74 |

*Blended Benchmark is comprised of 40% S&P 500 Index, 60% Bloomberg Aggregate Bond Index

See disclosureWhy Westwood

We have applied the same investment philosophy and core principles since our founding in 1983. Our competitive advantage is centered around how we manage money and how we align our business with our clients’ success.

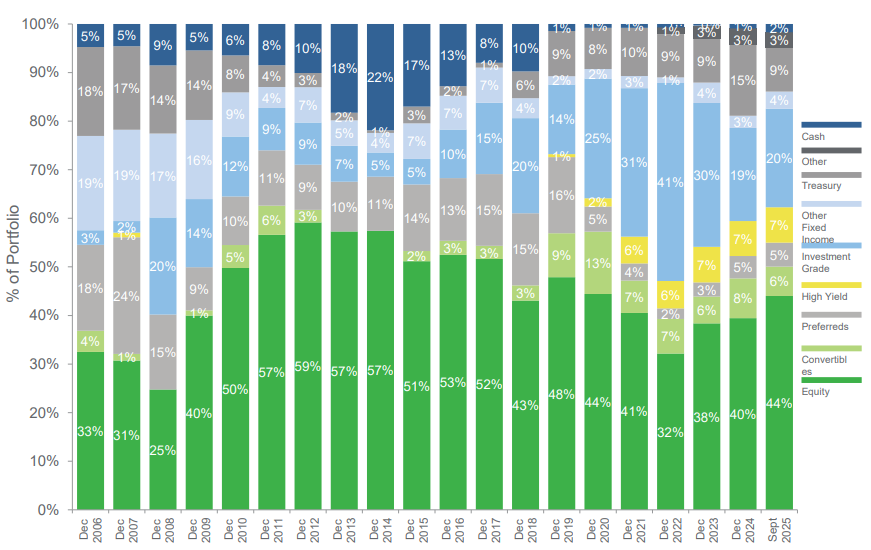

As of Sept. 30, 2025. Please note that each column may not add to 100% due to rounding. Allocations provided are based on a representative account that does not have any client-imposed restrictions. The representative account was selected by the firm because it was deemed to best represent this investment approach.

The Westwood Alternative Income strategy is a market neutral strategy that’s positioned to take advantage of both yiel...

Bottom-up Multi-Asset investing can bring something very powerful and unique to a portfolio in the current environment

...

For purposes of compliance with the GIPS® standards, the firm (“Westwood” or the “Firm”) is defined as the assets of Westwood Management Corp. (“WMC”), Westwood Advisors, L.L.C and Salient Advisors, L.P. WMC provides investment advisory services, primarily managing equity, fixed income, real estate and MLP portfolios, and Westwood Advisors provides investment advisory services, primarily to individual clients and entities as part of Westwood’s Wealth Management division. On February 1, 2018, Westwood redefined the Firm by adding the assets of Westwood Advisors so that all SEC registered investment advisers under WHG would be included in the Firm definition. On October 1, 2020, Westwood redefined the firm to exclude the Westwood International Advisors Inc (“WIA”) as this division ceased operation. Westwood Holdings Group Inc. the parent company of WMC and WA, acquired the asset management business of Salient Partners, L.P. Policies for valuing investments, calculating performance, and preparing GIPS reports are available upon request, as is a complete list and description of the Firm’s composites, pooled fund descriptions and a list of broad distribution pooled funds, by contacting [email protected].

Westwood Management Corp. claims compliance with the Global Investment Performance Standards (GIPS®). Unless otherwise stated, performance shown is in U.S. Dollars.

The Income Opportunity Composite is compared to a four-part custom benchmark(1) (25% S&P 500, 25% NAREIT, 25% 10-Yr Treasury, 25% 3-Month T-Bill) and a two-part custom benchmark(2) (40% S&P 500, 60% Bloomberg Barclays US Aggregate Bond Index), which are rebalanced monthly. The S&P 500 index covers 500 companies of the U.S. markets, is capitalization weighted, and includes a representative sample of leading companies in leading industries. The NAREIT Equity Index is an index of all tax-qualified equity REITs listed on the NYSE, AMEX, and NASDAQ that have 75% or more of their gross invested book assets invested directly or indirectly in the equity ownership of real estate. Investments cannot be made directly into the NAREIT Equity Index. The Bloomberg Barclays US Aggregate Bond Index is a broad-based benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market that includes treasuries, government-related and corporate securities, MBS, ABS and CMBS securities. On 10/1/2019, the two-part custom benchmark replaced the Libor+3% benchmark. The change was made to provide investors a more transparent and readily understood benchmark that is more reflective of the mix of assets that a conservative investor would own. The comparative benchmark returns include reinvestment of income but do not include transaction costs or management fees.