Personal liability coverage is an important way to protect your assets. When you purchase a homeowners insurance policy or an automobile insurance policy, you are purchasing some basic liability coverage as part of that package. If you want additional liability coverage, you may choose to purchase a personal umbrella liability policy. Before buying any liability coverage, however, you should evaluate and compare the various products offered. Because your personal and financial obligations change, you will occasionally want to review your personal liability coverage to ensure that it adequately meets your needs. If it doesn’t, you may need to increase or replace your existing liability coverage.

Long-term care refers to the ongoing services and support needed by people who have chronic health conditions or disabilities. There are three levels of long-term care:

Answer:

As we get older and our health declines, the greater the chances are that we will require home care, nursing home care or other assisted-living arrangements. This care is quite expensive, and Medicare, HMOs and Medigap don’t pay for it. You might want to look into purchasing long-term care insurance (LTCI) to protect your assets in case you need long-term care.

For seven straight years, large cap stocks have outperformed small-caps – and 2023 was a blowout, as the large-cap Russell 1000 Index beat the small-cap Russell 2000 Index by 9.60%.

But the trend goes even further – nine of the last ten years, even 14 of the last 19 calendar years have ended in favor of large-cap stocks. The last sustained run of small-cap dominance was 1999-2004, when the Internet was still relatively new, the dot-com bubble was breaking, and the Dallas Cowboys had only recently won the Super Bowl.

Small-cap stocks staged a rebound in the fourth quarter to end 2023 on a high note. Does the recovery portend a small-cap renaissance in 2024 and beyond?

For seven straight years, large cap stocks have outperformed small-caps – and 2023 was a blowout, as the large-cap Russell 1000 Index beat the small-cap Russell 2000 Index by 9.60%.

But the trend goes even further – nine of the last ten years, even 14 of the last 19 calendar years have ended in favor of large-cap stocks. The last sustained run of small-cap dominance was 1999-2004, when the Internet was still relatively new, the dot-com bubble was breaking, and the Dallas Cowboys had only recently won the Super Bowl.

Small-cap stocks staged a rebound in the fourth quarter to end 2023 on a high note. Does the recovery portend a small-cap renaissance in 2024 and beyond?

Key person disability insurance can protect your business in the event that a key employee becomes disabled, and as a result, the business suffers a financial loss. A key person disability policy will pay short-term benefits to the business until the key employee recovers from their disability, or until they can be replaced.

Even if you plan on waiting until full retirement age or later to receive Social Security retirement benefits, consider signing up for Medicare. If you’re 65 or older and aren’t yet receiving Social Security benefits, you won’t be automatically enrolled in Medicare Parts A and B.

You have a limited opportunity to change your mind after you’ve applied for benefits.

If your pension is from a job where you paid Social Security taxes, then it won’t affect your Social Security benefit. However, if your pension is from a job where you did not pay Social Security taxes (such as certain government jobs), two special provisions may apply.

An estate plan is a map that explains how you want your personal and financial affairs to be handled in the event of your incapacity or death. Due to its importance and because circumstances change over time, you should periodically review your estate plan and update it as needed.

With the news full of reports about Social Security’s uncertain future, you might wonder whether you will ever benefit from the Social Security taxes you pay. Although this popular social insurance program faces financial challenges, and some reform is certainly likely, Social Security is not only likely to be there for you in the future, it’s there for you right now.

Income shifting (also known as income splitting) may be defined as dividing income in a way that lowers overall taxes. Typically, income is shifted from higher-bracket taxpayers to lower ones. Income shifting can be a valuable tool for self-employed persons.

A trust is a legal entity that you can set up and use to hold property for the benefit of one or more individuals (the trust beneficiaries). Every trust has one or more trustees charged with the responsibility of (1) managing the trust property and (2) distributing trust income and/or principal to the trust beneficiaries according to the terms of the trust agreement. (A trustee can be an individual or an institution, such as a bank.) Many different types of trusts can be used to achieve a variety of objectives.

Income tax basis can be an important factor in deciding whether to make gifts during your lifetime or transfer property at your death. This is because the income tax basis for the person receiving the property depends on whether the transfer is by gift or at death. This, in turn, affects the amount of taxable gain subject to income tax when the person sells the property.

Taxes can take a big bite out of your total investment returns, so it’s encouraging to know that your employer-sponsored retirement savings plan may offer a variety of tax benefits. Depending on the type of plan your employer offers, you may be able to benefit from current tax savings; tax deferral on any investment returns you earn on the road to retirement; and possibly even tax-free income in retirement.

Even if you’ve always handled your family’s finances, you may be overwhelmed by the number of financial matters you have to settle in the weeks or months following your spouse’s death. While you can put off some of these tasks, others require immediate attention. If you’re uncertain where to start, begin by organizing. You’ll have to find the records and paperwork you need to apply for benefits, set up systems to organize those records and other information you receive, and determine your short-term need for income. Afterwards, you’ll be ready to start settling your financial affairs with the help of personal and professional advisors.

A withdrawal from an IRA is generally referred to as a distribution. Ideally, you would have complete control over the timing of distributions from your traditional IRAs. Then you could leave your funds in your traditional IRAs for as long as you wished, and withdraw the funds only if you really needed them. This would enable you to maximize the funds’ tax-deferred growth in the IRA, and minimize your annual income tax liability. Unfortunately, it doesn’t work this way. Eventually, you must take what are known as required minimum distributions from your traditional IRAs.

If you participate in a 401(k), employee stock ownership plan, or other qualified retirement plan that lets you invest in your employer’s stock, you need to know about net unrealized appreciation — a simple tax-deferral opportunity with an unfortunately complicated name.

The $1.7 trillion appropriations bill passed by Congress at the end of last year included some notable provisions affecting workplace retirement plans and IRAs. Dubbed the SECURE 2.0 Act of 2022, the new legislation builds on the sweeping Setting Every Community Up for Retirement Enhancement Act that was passed in 2019.

Generally, the term “rollover IRA” refers to an IRA that you establish to receive funds from an employer retirement plan like a 401(k). A rollover IRA is also sometimes referred to as a “conduit IRA.”

A traditional IRA is a personal savings plan that offers tax benefits to encourage retirement savings. In 2023, you can contribute up to $6,500 per year (additional “catch-up” contributions are allowed if you are age 50 or older). You and your spouse together may contribute double the annual limit, even if your spouse has little or no compensation. Contributions may be fully or partially tax deductible, depending on certain factors. Investment earnings in a traditional IRA grow tax deferred, but distributions will be subject to federal and possibly state income tax (excluding the portion that represents nondeductible contributions).

Anyone can convert a traditional IRA to a Roth IRA. There are no income limits or restrictions based on your tax filing status. You generally have to include the amount you convert in your gross income for the year of conversion, but any nondeductible contributions you’ve made to your traditional IRA won’t be taxed when you convert.

Retirement plans offer a number of benefits. A typical plan provides participating employees the opportunity to systematically save for retirement. From the employer’s point of view, having a retirement plan can maximize the business’s profitability by helping to attract and retain quality employees, and by boosting employee productivity. In addition, in the case of qualified plans and some nonqualified plans, retirement plans can provide significant tax advantages for both employer and employees.

Are health insurance premiums taking too big of a bite out of your budget? Do you wish you had better control over how you spend your health care dollars? If so, you may be interested in an alternative to traditional health insurance called a health savings account (HSA).

Happy Thanksgiving!

Please note: Due to the Thanksgiving holiday, there will be no Basis Points next week – we’ll be back the following week!

A durable power of attorney for health care (DPAHC), also known as a health care proxy, health care power of attorney or appointment of a health care agent, is your written appointment of a representative to make medical decisions on your behalf if you become unable to make or communicate a responsible decision for yourself. It allows you to exercise control over your health care through this representative, who will have the authority to make most medical care decisions for you. You may want to appoint such a representative to act on your behalf. If you don’t, medical professionals will generally be compelled to do everything possible to save and sustain your life. A DPAHC can resolve conflicts over your medical treatment and help ensure that your choices regarding medical treatment are respected.

Life insurance death proceeds paid to a valid ILIT may escape estate taxation in your estate, as long as the trust owns the policy and you haven’t retained any incidents of ownership in the policy, such as the right to change the beneficiary. Typically, the terms of the ILIT provide that the insurance proceeds be distributed from the trust to your beneficiaries in accordance with your wishes, which are spelled out in the trust document.

The federal government follows a complex transfer tax system. Transfer taxes come in three separate forms: gift tax, estate tax and generation-skipping transfer (GST) tax. The purpose of the GST tax is to ensure a transfer tax is imposed at each generation’s level. The GST tax acts as a supplemental tax by applying it in addition to either the estate tax or the gift tax.

A trust is created when you (the grantor) transfer property to a trustee for the benefit of a third person (the beneficiary). An estate is the assets and liabilities left by a person at death. Both a trust and an estate are separate, legal, taxpaying entities, just like any individual. Income earned by the trust or estate property (e.g., rents collected from real estate) is income earned by the trust or estate.

A charitable trust is a trust established for the dual purpose of donating to charity and providing for a noncharitable beneficiary (such as your children). When a charitable trust is used, the gift to charity is also referred to as a split-interest gift because the gift is split between a charitable beneficiary and a noncharitable beneficiary.

A family limited partnership (FLP) is a partnership created and governed by state law and generally comprises two or more family members. As a limited partnership, there are two classes of ownership: the general partner(s) and the limited partner(s). The general partner(s) has control over the day-to-day operations of the business and is personally responsible for the debts that the partnership incurs. The limited partner(s) is not involved in the operation of the business. Also, the liability of the limited partner(s) for partnership debts is limited to the amount of capital contributed.

Living trusts enable you to control the distribution of your estate, and certain trusts may enable you to reduce or avoid many of the taxes and fees that will be imposed upon your death.

A donor-advised fund (DAF) offers an easy way for a donor to make significant charitable gifts over a long period. A DAF is similar to a private foundation but requires less money, time, legal assistance, and administration to establish and maintain. A DAF also enjoys greater tax advantages than a private foundation.

You can use a variety of strategies to pay off debt, many of which can cut not only the amount of time it will take to pay off the debt but also the total interest paid. But like many people, you may be torn between paying off debt and the need to save for retirement. Both are important; both can help give you a more comfortable financial future. If you’re not sure you can afford to tackle both at the same time, which should you choose?

Whether you’re seeking to manage your own assets, control how your assets are distributed after your death, or plan for incapacity, trusts can help you accomplish your estate planning goals. Their power is in their versatility — many types of trusts exist, each designed for a specific purpose. Although trust law is complex and establishing a trust requires the services of an experienced attorney, mastering the basics isn’t hard.

If you have a lot of debt, you’re not alone. Today, more and more Americans are burdened with credit card and loan payments. So, whether you are trying to improve your money management, having difficulty making ends meet, want to lower your monthly loan payments or just can’t seem to keep up with all of your credit card bills, you may be looking for a way to make debt repayment easier. Debt consolidation may be the answer.

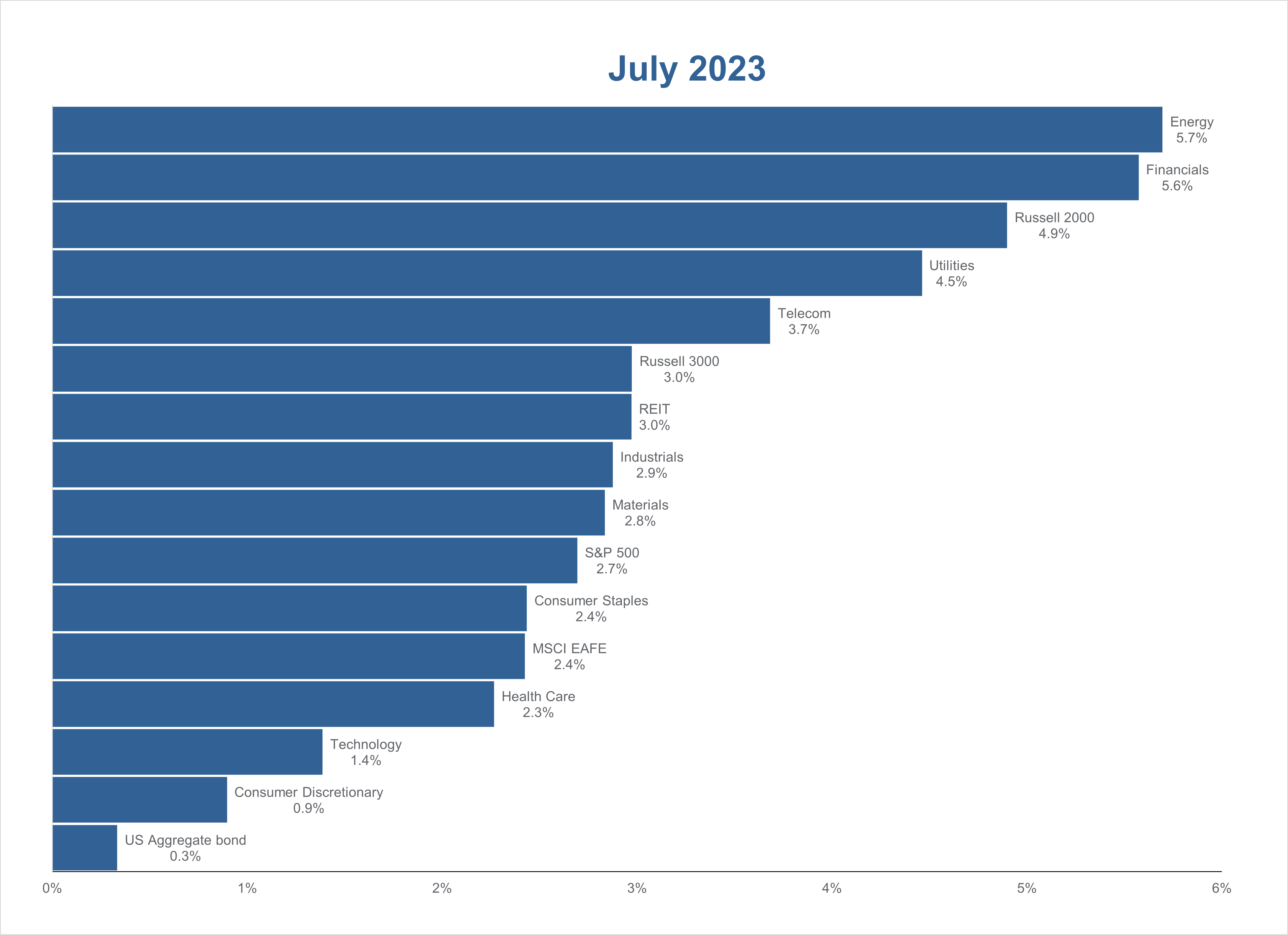

As expected, the Federal Reserve (Fed) decided to increase Fed Fund rates by 25 bps to 5.25-5.5%. This will bring the rate to the highest level in more than 22 years. Chairman Powell also left the door open for further rate hikes and said that they would continue to be data dependent. He said that the committee welcomed the better-than-expected inflation data in June but indicated the group still believes that there is still a long way to get to Fed’s target of 2% inflation.

U.S. Gross Domestic Product (GDP) data was released this week. The U.S. economy picked up last quarter and remained well clear of a recession despite the Fed pushing rates higher. During the second quarter, U.S. GDP grew at 2.4% picking up slightly from the first quarter GDP of 2%, driven by strength in business investments and consumer spending. Economists were expecting a growth of 1.8%.

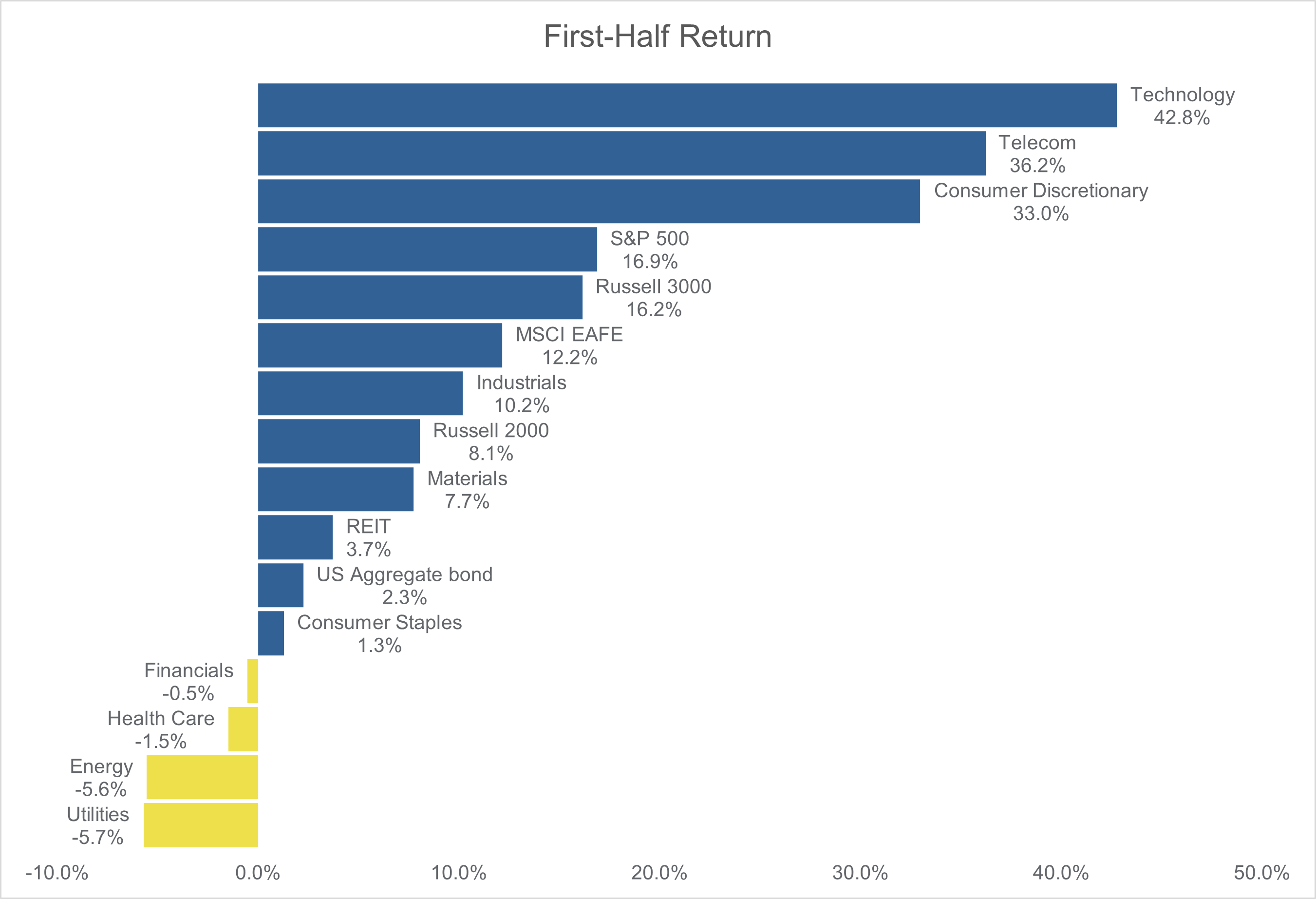

Equity markets have rallied this year with the S&P 500 index up 20.6%, the tech-heavy Nasdaq returning 37% and Dow Jones Industrial Average (DJIA) adding 8.5% to returns. The first half of the year was dominated by technology stocks. We started the year with fears of recession and investors flying to safety by investing in big technology companies like Microsoft, Apple and Alphabet. These companies tend to be recession-resistant given their strong balance sheets and cash positions. The tech stocks got a further boost in the second quarter on Artificial Intelligence (AI) boom after Nvidia, a leader in AI chips, reported a spectacular quarter and raised its guidance. In fact, the tech rally had been so strong in the first five months of the year that while the S&P 500 index returned almost 10%, the equal-weighted SPW index declined 0.7%. During the first half, the top seven stocks (Apple, Microsoft, Nvidia, Amazon, Meta, Tesla and Alphabet) contributed to 73% of the total S&P 500 index return.

Usually when the markets are this narrow, one of two themes play out:

1) the market is about to correct; or

2) the market is about to broaden out and allow for greater participation.

We believe that market breadth widening is a likely scenario this time. Inflation has continued to ease and we are likely very close to peak rates. At the same time, the U.S. economy has remained resilient as evidenced by today’s GDP data and strong labor market. At this point, the likelihood of a soft landing, where inflation slows down without the U.S. economy going into a recession, is becoming more likely. Even if we enter a recession next year as indicated by the deeply inverted yield curve and weaker PMI readings, this provides a good setup for cyclical and value-oriented stocks near term. Since the end of June, we have begun to see signs of market breadth widening as shown in the chart below. Cyclical sectors like Financials and Energy, as well as Small Cap stocks are beginning to outperform. The DJIA, which tends to be value oriented also logged in its 13th consecutive green day on July 26, 2023 – the longest winning streak since 1987.

Select Equity is a diversified portfolio and invests in both growth and value-oriented stocks. It is designed with risk management at its core. We utilize risk metrices (such as maximum sector limits of 16% and industry limits of 6%), primarily invest in high-quality companies with improving cash flows and stable balance sheets, constructing a portfolio of stocks which have low correlations with each other. All these factors help reduce portfolio volatility and provide good downside protection. We believe that we are very well positioned to benefit not only from market breadth widening but also from any potential uncertainty rising from disappointing economic data.

Please feel free to reach out to your Private Wealth Advisor if you have any questions.

Owning a home outright is a dream that many Americans share. Having a mortgage can be a huge burden, and paying it off may be the first item on your financial to-do list. But competing with the desire to own your home free and clear is your need to invest for retirement, your child’s college education, or some other goal. Putting extra cash toward one of these goals may mean sacrificing another. So how do you choose?

Massive computer hacks and data breaches are now common occurrences — an unfortunate consequence of living in a digital world. Once identity thieves have your information, they can use it to gain access to your bank and credit-card accounts, make unauthorized transactions in your name, and subsequently ruin your credit.

Many parents pay for college with a combination of savings, current income, and financial aid. By learning the basics of financial aid, you’ll be able to understand how the aid process works and compare the aid awards your child receives.

If you’ve lost your job, or are changing jobs, you may be wondering what to do with your 401(k) plan account. It’s important to understand your options.

Even before your children can count, they already know something about money: it’s what you have to give the ice cream man to get a cone, or put in the slot to ride the rocket ship at the grocery store. So, as soon as your children begin to handle money, start teaching them how to handle it wisely.

Many students take out federal and/or private student loans to pay for college or graduate school. This article focuses on federal student loans, highlighting current interest rates, borrowing limits and repayment options. Private loans are typically more costly and provide fewer consumer protections and repayment options than federal student loans.

You’re beginning to accumulate substantial wealth, but you worry about protecting it from future potential creditors. Whether your concern is for your personal assets or your business, various tools exist to keep your property safe from tax collectors, accident victims, health care providers, credit card issuers, business creditors and creditors of others.

To insulate your property from such claims, you’ll have to evaluate each tool in terms of your own situation. You may decide that insurance and a Declaration of Homestead may be sufficient protection for your home because your exposure to a claim is low. For high exposure, you may want to create a business entity or an offshore trust to shield your assets. Remember, no asset protection tool is guaranteed to work, and you may have to adjust your asset protection strategies as your situation or the laws change.

In tax lingo, your principal residence is the place where you legally reside. It’s typically the place where you spend most of your time, but several other factors are also relevant in determining your principal residence. Many of the tax benefits associated with home ownership apply mainly to your principal residence — different rules apply to second homes and investment properties. Here’s what you need to know to make owning a home really pay off at tax time.

Where do mortgage rates go from here?

Uber speeds up

More not-so-rosy jobs data